Some of the Best Stock Trading Apps for Beginners Listed

Let’s now go through each of the apps listed above and see what makes them so unique and popular with most stock traders in the world.

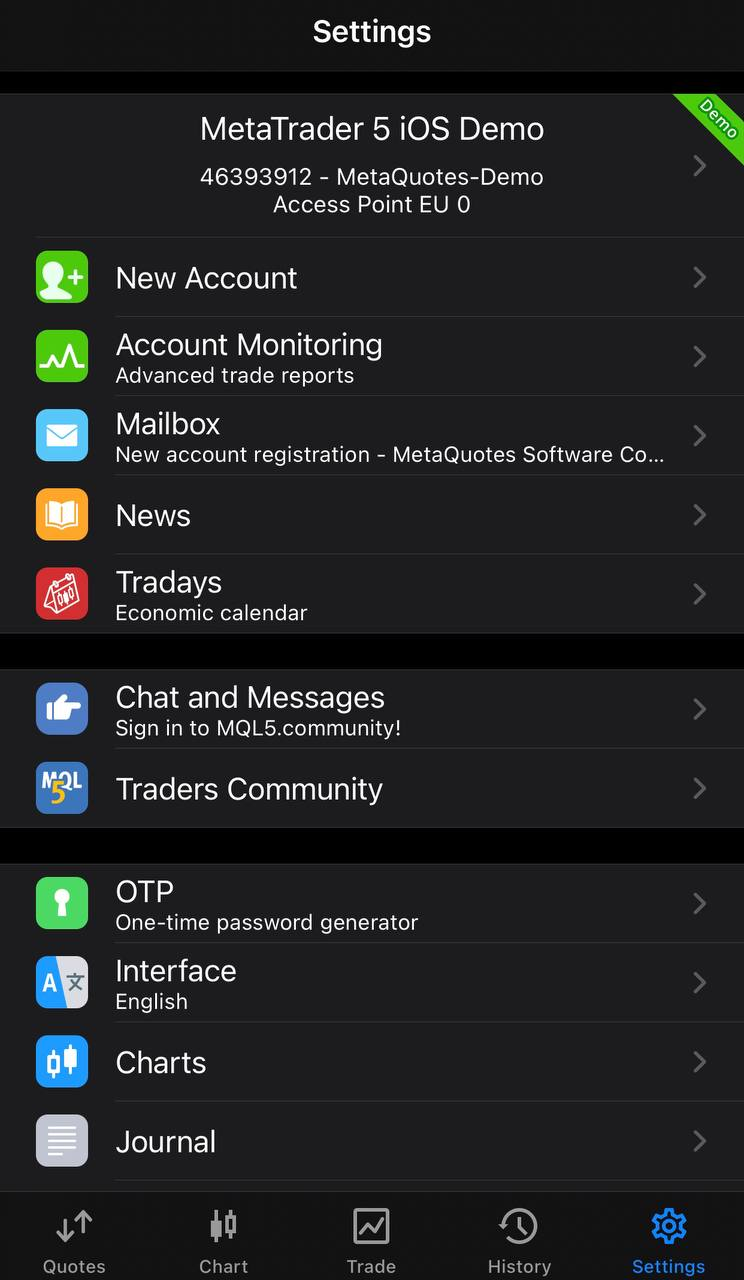

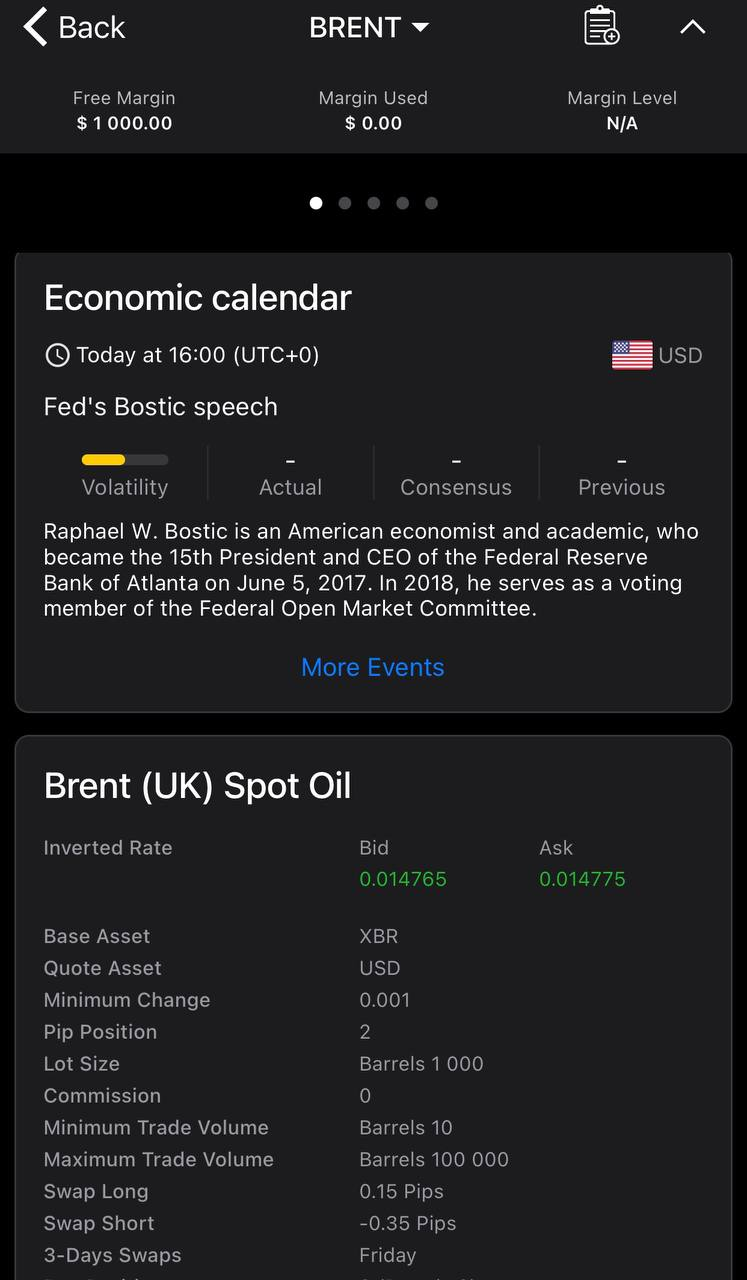

MT5

MetaTrader 5 which is a

stock trading mobile app is available in laptop, web, and smartphone models. The app edition includes advanced resources for in-depth market research, algorithmic trading apps using trading bots or experts, who are providing traders with advice and copy trading.

The MetaTrader 5 platform operates with the MQL5 programming language, which is used for automatic trading software on your device and executes trading processes for you. It can monitor currencies and other assets, including stocks and shares for 24 hours a day, copy offers, produce and submit files, interpret reports, and even include a specialized personalized graphical design.

Since the platform includes an entire production framework for applications and optimizing your own EA, you can automate your efficient investment strategy. Likewise, you can choose a number of ready-to-use EAs from the

stock trading mobile application that is accessible to import from Code Base or that you can buy or rent from “MetaTrader Market,” the biggest store of worthy trading software. By using consulting services, you can also demand custom programs through talented programmers. The copy trading function gives you an opportunity to access the active trader signals, allowing you to automatically execute all exchanges on your account. There are hundreds of free and paying signals enabled for both demos and live accounts.

The MetaTrader 5 application delivers the conventional netting mechanism both for forex markets and the stock market. It supports two marketplace orders, six pending orders, and two stop orders and allows four operation modes: immediate, demand, market, and trade execution.

The

trading stock mobile app allows you to access up to 100 currency or asset graphs at once, and the 21 timeframes make for a systematic and thorough analysis of even small price fluctuations. It also includes 80 technical indicators and 44 quantitative elements, such as Gann, Fibonacci instruments, geometric forms, and different networks.

MetaTrader 5 includes and allows traders to access fundamental research, which tracks a range of economic and market metrics. The application features news updates from foreign media sources as well as an economic calendar. MetaTrader's mobile trading app is available on your smartphone or tablet running Android or iOS. The mobile edition includes the full range of trading functions, as well as the ability to track payment status and browse trading history.

MetaTrader 5 - one of the

best apps to trade stocks is a simple platform to use. It has a basic and user-friendly design that makes it easy to navigate all orders from the start page, with the most commonly used functions accessible on the toolbar. The Market Watch provides stock market quotes as well as quotes for other tools, and the Navigator provides AI-based trading tools and management of fundamental and technical analysis.

Opening a demo account is also reasonably straightforward, requiring only the selection of a trading server and the entry of registration information.

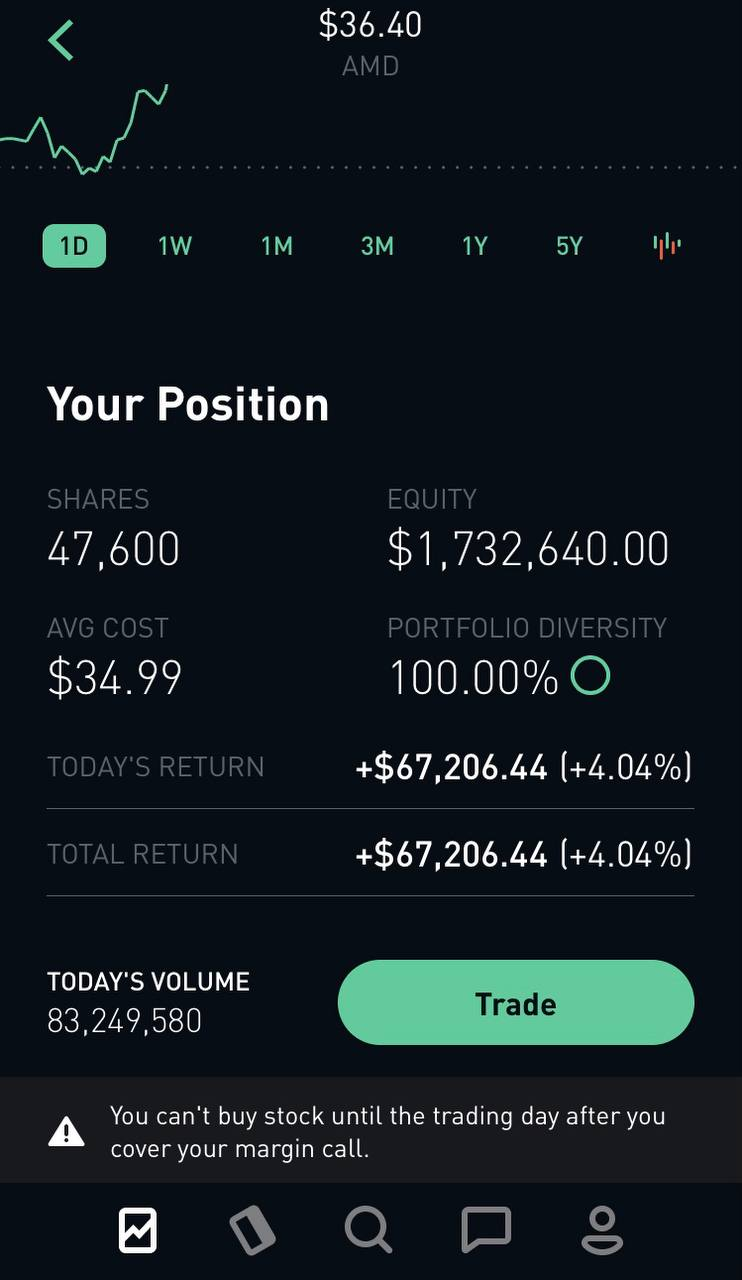

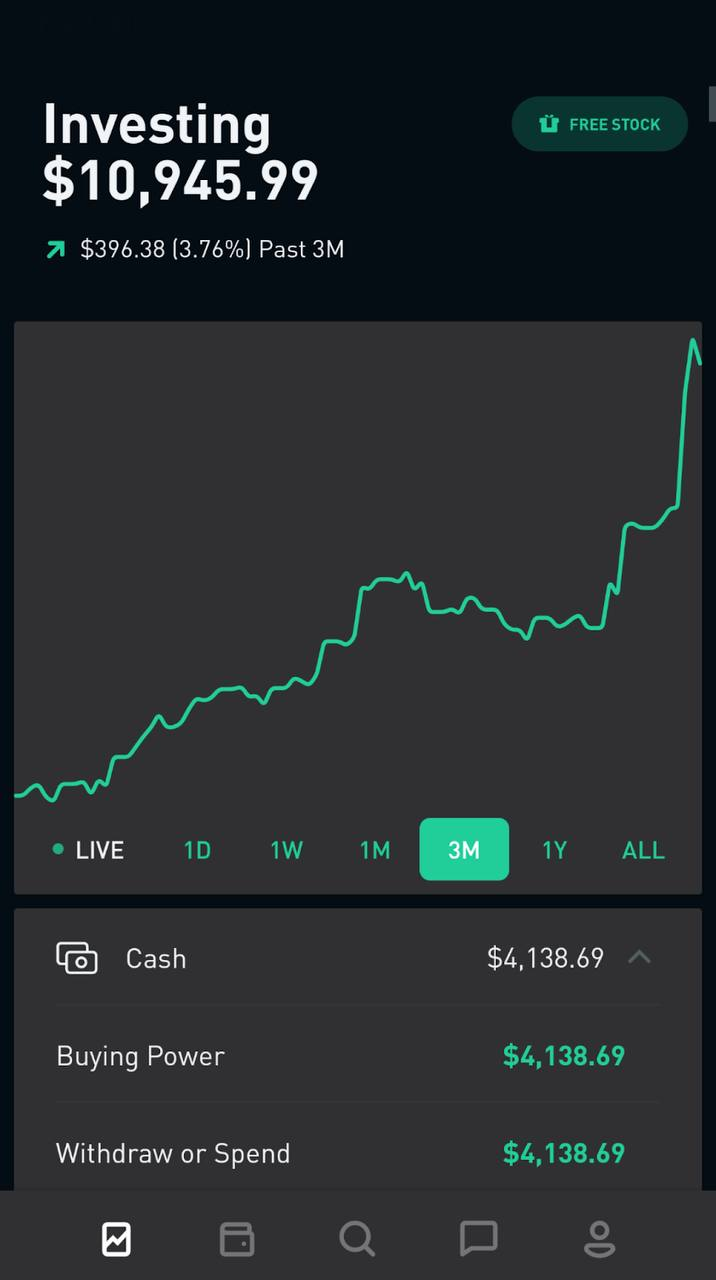

RobinHood

Robinhood's dedication to offering 100% payment-free stock, futures, ETF trades is impressive, and the savings for regular traders are substantial. This is particularly important for options traders, as Robinhood is one of the few brokers and owns the

stock trading practice app that does not charge a per-contract fee. Even multiple major brokerages now deliver free trades, so it's a good idea to compare those features when choosing a brokerage.

Robinhood also appears to be committed to keeping many consumer costs to a minimum. The Clearing by Robinhood facility enables the organization to use its own classification scheme, which lowers some of the platform's account fees.

The $75 outgoing account transfer fee is one of the most significant fees charged by Robinhood, but it is not uncommon amongst brokers. (An account transfer is anytime you wish to move your assets to a different broker; there is no charge for trading your investments and getting the money transferred to your bank through ACH.)

Robinhood

stock trading mobile application has also launched fractional securities. That means you are able to pay as little as $1 for a fraction of a share, even though the entire price of that share is in the hundreds of dollars. This function provides the flexibility to diversify your portfolio — you can purchase much more stocks even though you don't have a lot of capital to spend.

All users should do is establish a calendar (once a week, biweekly, monthly basis, etc.) and a dollar sum, and Robinhood will spend the amount you specify when you choose. While this is not an unusual characteristic of traders, using it in conjunction with fractional shares is a distinct advantage. When you buy by the shares (rather than by the cash amount) for repeated investments, you will eventually end up with uninvested cash, but Robinhood has solved this dilemma.

If you're used to using mobile and want to get part of the

stock trading on the cash app community the sign-up and account payment process would be fast and easy. Anything occurs inside the app in a short amount of time, with only just a few simple questions gathering your confidential information, Social Security number, and method of financing your account. According to the firm, authorized users are informed in less than an hour and can then perform bank transactions. Robinhood uses direct authentication for several financial firms and banks and as the services are provided quite rapidly, it allows customers to save their time.

Via Robinhood's platform, the firm has taken strides to expand the resources and analysis offered to people, including expert ratings, rankings of top movers, performance calendars, and access to earnings calls. Candlestick charts can be accessed on a smartphone, and the

trading stock mobile app shows data from other Robinhood users to create its own universe of data. For example, traders can filter the software's 100 most common assets by different metrics such as analyst scores, what is increasing (or falling) over a given timeframe, market cap, and value.

J.P. Morgan Chase WMA

JP Morgan Chase, the bank titan with over $2.6 trillion in reserves, now provides self-directed investment services, including the purchase and sale of stocks, ETFs, futures, mutual funds, and shares.

J.P. Morgan Self-Directed is ideal for existing Chase Bank Account holders looking for a straightforward way to purchase and sell stocks. The advantages of having several accounts are many, like instant transactions, universal access, and $0 trades.

The

stock market app for iOS and Android has a feature of Self-Directed Investment, which educates first-time traders about the pitfalls of advanced investment strategies such as options trading, and it also has regulations in place to discourage stakeholders from being in over their heads. This entails a stringent permitting process, only selling level 1 and level 2 choices tactics, and immediately removing trading options on the expiration day. They also prohibit the selling of highly risky assets, such as leveraged ETFs and penny stocks.

Self-Directed Investment has no account cap, so you can start investing with any amount of capital you have saved. You will spend as little as $1 in no-load mutual funds with no trading costs, according to J.P. Morgan.

Each Self-Directed Investing feature is eligible on the Chase smartphone app - which is the

stock exchange app for iOS and Android and where members can analyze, sell, and handle savings. Even if you are not a current Chase bank member, you can open a Self-Directed Investing profile.

For certain retail traders, the idea of constructing a whole portfolio from the start may be enough to put investors off spending their funds in investments entirely. The Self-Directed Investing Portfolio Builder technique makes the method less complicated and more straightforward.

To use the Portfolio Builder function, you must first complete a questionnaire that decides how your investments should be divided based on your tolerance for risk and aims. You will also use equity distribution as a framework when searching for, comparing, and selecting investments. While Self-Directed Investing accounts enable the traders to select and sell other investment forms, such as shares and mutual funds, the Portfolio Builder method gives you an opportunity to choose and trade only ETFs and shares.

Stock exchange app Android and iOS provides customers with all needed basic charts for analysis. It is available to ordinary shareholders, including customization options of the time period, bar form, occurrence indicators (e.g., profits or dividend income), and a decent 20 customizable tools. Share and index similarities are also possible.

The price, regular update, and a micro chart of retracement results are all shown on watch lists. Yes, there are actual quotations, but they're still not online, which is common across the J.P. Morgan Self-Directed platform.

Looking carefully at Portfolio Builder, it is only open to investors with at least $5,000 in investable funds. Unlike standard automated advisors, who essentially filter you into one of many clearly defined portfolios, Portfolio Builder as well needs you to choose the exact stocks before allowing you to change the metrics for each stock. Overall, having considerable insight into what goes into the portfolios and how each investment is measured is not optimal for ordinary investors.

Quotes for ETFs and mutual funds, on the other hand, do better as a result of the addition of simple Morningstar results. Morningstar data is also used in the screening, which is a good bonus. Casual stakeholders, including bonds, will be completely comfortable; although, analysis stutters behind big players by a significant amount. Schwab, for example, contains the complete Morningstar PDF article with far more design elements to help to discover key points.

The weekly business review papers are also produced by J. P. Morgan's research assistants. Given that J.P. Morgan Financial Services oversees more than $1.7 trillion in assets. Overall, while Schwab's Insights pieces and Fidelity's Viewpoints business analyses are far more fleshed out, research articles are descriptive and helpful.

Chase makes it easy to handle the J.P. Morgan Self-Directed account for the daily Chase smartphone app, which is available for both Apple iOS and Android. You will access and track any of your Chase accounts, either banking and trading after you've signed in. While the app provides traders with sophisticated charting, online watch lists, and warnings, it also offers a bug-free, clean experience for daily stockholders.

Chase offers a supportive training opportunity in the areas of general investment and financial planning. The navigation is flawless, and a solid basis for growth has been created.

cTrader

cTrader is an online exchange application that is used by a variety of brokers. The main idea of the platform is that the trader is able to open an account with a brokerage and then install cTrader through them. Usually, cTrader is accessible as a browser application, an online trading tool, and a smartphone application.

cTrader is a unique forum in that it is generally user-friendly while still being synonymous with ECN brokerage and having strong specialized trading capabilities including automatic trading and assistance for news trading. As a result, it is seen as a forum that allows investors from novice to advanced to technically use.

Moreover, in practice, cTrader may be best viewed as a forum that more experienced traders also might want to try, especially those who generally are getting used to executing their own trades but may want to have this option combined with the ability to allow AI trade on their behalf, on their network. Previously, algorithmic trading was on a different site, but it is now completely incorporated into the main platform and smartphone users are eligible, as well, to get benefits through the use of AI-based trading.

The first theoretical benefit is for traders who use valuation thresholds. Investing on value levels is a type of technical analysis in which the investor searches for meaningful value levels and forecasts potentials based on past performance. It may be used in conjunction with other analytical techniques such as candlestick charts and pattern recognition. The aim is to connect a meaning analysis rather than using fundamentally 'free flowing' trends or other methods.

Whenever a trader sees that the activity is at a large figure and is figuring out the kind of trend a stock may display (which can be very common) when navigating its way high or low over large value levels, the trend that is appearing or shifting makes more sense.

In addition, this type of analysis is based on support and opposition, as well as rises and drops in movement and liquidity.

Price is presented clearly in cTrader. Using the candlestick graphic price form, the value scope per candle will be shown. The graph is easily understandable, and it can be black and white. This will help the trader in gaining a perspective about what is occurring by creating a sense of dynamic value change pointed out on the chart. Timespan analysis is necessary for this, and cTrader excels at it, offering an incredibly broad variety of options.

The less a trader knows the graph, the further dependent they are on methods that can lead to black-box interpretation, such as tracking a metric, even though they recognize what the measurement is doing. Basically put, cTrader aids map-based methods by bringing the graphic into clear perspective as it is used by investors attempting to make sense of it. By giving emphasis on the graph, the investor will locate stocks, position demands, find a time frame, indications, and graphic artifacts.

Another possible advantage is the network's ability to trade news, especially chart-based news trading. The functionality that may be useful for charting research also may be useful for news investors, who may need fairly reliable results of value shifts. At its root, news trading can be about trading on ups and downs of value, as can be seen in the graph at particular moments. So, how could a trader know which data is already being published, what will be released, and what influence it will have on the segment?

There are plenty of methods of trading news, including betting on movement before the announcement, taking a place during the slow period before the report, and trading after the update. Trade after the announcement can involve buying and selling in the following days, when the possible consequences of the news report can be felt immediately, and when the consequences sustain in the marketplace and shift in response to new views of the news. The appeal of the time of the announcement is that it can be the purest type of reaction the marketplace will offer, and any subsequent consequences will be integrated into the market's structure.

The basic observation that the marketplace should not be doing as is predicted at any period is reflected in news trading. Nevertheless, the possibility of a valid response, as the possibility of obvious trends in regular market dynamics, might be what defines a marketplace. cTrader's transparency and specificity can aid in at least reflecting what the price is doing.

The 3 important sectors of this system are represented by three buttons on the platform's left-hand side. The first is Trade, which provides basic trading, the second is Automate, which focuses on trading, which is executed through automatization, and the third is Analyze, which displays information such as results and account balance.

cTrader is an electronic trading site and application that attempts to simplify a diverse collection of tools and techniques by their introduction. It may assist the investor in clarifying (and developing) their own trading strategy, rather than being dictated by the platform. The software may be simple enough for a newcomer to use, but an investor just setting out may choose a system that is optimized for beginners. Professional traders, on the other hand, may consider this platform quite useful and sophisticated. cTrader can be provided alongside other trading channels and brokerages for multiple platforms.

TradingView

TradingView is a defense consulting company that does not engage in exchange. It also does, though, collaborate with a small proportion of broker companies. Furthermore, these related firms provide trading directly from the TradingView application. While TradingView's basic services are free, the most effective resources include a monthly charge.

TradingView's app focuses on charting, analysis, and networking. The platform is very stable and user-friendly.

TradingView does not specialize in direct dealing, but it does collaborate with a few brokerage firms to offer this vital service. TradingView is also API app compliant.

To position a trade with the help of the TradingView application, you should first open an account with a suitable broker. An, it should be said, that TradeStation has the most exchangeable properties.

If you want to day trade on TradeStation, keep in mind that you will need to keep $25,000 in account equity. In addition, you will receive:

TradingView has three paying options to choose from.

The Pro package removes the advertisements that run on TradingView's online charts from time to time. It now includes improved databases and the ability to plot up to 5 metrics on a single map. For the Pro package, you are allowed to even display two graphs on a single screen at the same time.

The Pro+ plan raises the number of technical researches shown on a map from 5 to 10. A single format can display up to four maps, and graphic data can be exported.

TradingView has some global market information, but there are some services lacking, including those for paying subscribers. However, traders will find an economic calendar, global indices, futures market stats, and, most importantly, bond market specifics on TradingView.

One of the platform's strong points is its economic calendar. Present, future, and previous data will all be viewed in the app. Perhaps most importantly, there is a multinational focus. A broad range of regions can be chosen.

TradingView does a bit more in terms of finding trading ideas on individual properties. At the top part of the applications, an Ideas window shows trade ideas in both document and video formats. There are views expressed by TradingView members. The reviews are organized into divisions following the basic trade policy. Three different screeners for stocks and currencies, are available, each with its own wide range of search parameters.

The outputs of a screener can be quickly filtered by any search element. When you click on a ticker icon, you'll get a profile.

Other users' asset accounts include a plethora of news stories and posts (similar to tweets). However, there is a lack of basic material, such as SEC disclosures or stock releases. At TradingView, the focus is on technological activities and what other users are saying.

TradingView is a discussion group about trading stocks and other assets. One of the online networking functionality is the opportunity to track and contact several investors. Posts can be liked, commented on, shared, and saved for later.

On the TradingView application, there is an open meeting room where investors can communicate with one another. Chat groups can be created by Pro+ and Premium users. It is easy to get access to a particular room and build room alerts.

On the Mobile application, which is compatible with both iOS and Android users, customers can find additional things and functions, including, trending ideas from other users and customers, also, traders can find here both vertical and horizontal charts, that are promising investor a unique experience and shows the trends and tendencies that are taking place in the stock market. Through the use of charts, investors can take screenshots and save layouts, which are quite useful for determining the decisions about stock trading. TradingView has excellent data analysis and charting as well as more advanced studies than is available elsewhere.