The bullion dropped one percent on Wednesday, erasing Tuesday's gainsFed'st was trading near 21.50 USD - the same price since the middle of May.

It looks like investors cant make up their minds - w "ether to buy the metal amid soaring inflation or whether to sell it because of rising (real) yields and the strengthening US dollar.

Powell's testimony eyed

According to JPMorgan, the market "will look for any insight into how the Fed views various data input to gauge the Fed's reaction function. Further, are there any insights into what would move the Fed back to 25bps hike cadence or even a pause?"

Furthermore, DB analysts predict Powell would stick to the talking points he made during his post-meeting news conference last week when he indicated they would probably choose between 50bps and 75bps at the July meeting.

Fed funds futures presently suggest that another 75bps increase is more plausible, with +71.8bps currently priced in, as of before the hearing.

Sideways consolidation

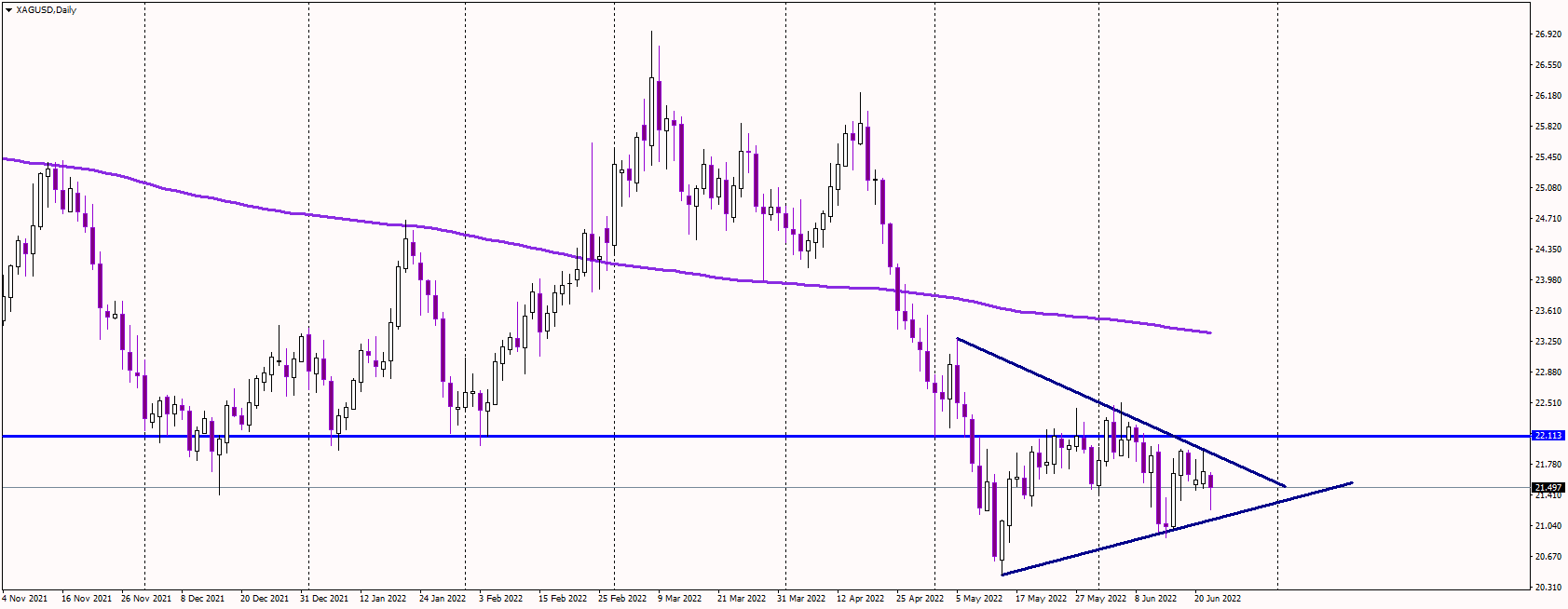

The metal has been consolidating since the April/May sharp decline has ended, but the overall trend does not look that good.

The current triangle pattern might only be a consolidation formation, likely leading to further losses.

If we see a break to the downside below 21 USD, silver could quickly decline to the current cycle lows at 20.50 USD.

Alternatively, a bullish breakout above 21.80 USD might send the metal toward the 22.50 USD resistance.

We need to see the price move either below 20.50 USD or above 22.50 USD for some medium-term momentum.