Weekly Market Commentary | 04.09 – 10.09

04 September 2023

Curious to know what’s happening on the markets this week? Take a quick tour of the latest news, economic updates, and trading setups that will keep you up-to-date and in the know.

Monday

- Switzerland's GDP: Expected to slow down, coming in at 0.1%, as opposed to the previous 0.3%.

- Bank Holiday: Markets in Canada and the U.S. will be closed.

- ECB President Lagarde: Scheduled to address the public.

Tuesday

- China's Caixin Services PMI: Slight decline anticipated, with forecasts at 53.6 against the previous 54.1.

- Australia's Cash Rate: Expected to remain steady at 4.10%, accompanied by the RBA Rate Statement.

Wednesday

- Australia's GDP: Numbers forecast to rise by 0.3% - a slight uptick compared to the last quarter's 0.2%.

- Bank of Canada Rate Statement and Overnight Rate: Both expected to remain at 5.00%.

- U.S. ISM Services PMI: A slight uptick expected, from 52.7 to 52.5.

Thursday

- RBA Governor Lowe: Public remarks scheduled.

- U.S. Unemployment Claims: Estimated to be slightly higher at 235K, as opposed to last week's 228K.

- Canada's Ivey PMI: Anticipated to rise to 49.2 from the previous 48.6.

- BOC Governor Macklem: Scheduled to give a speech.

Friday

- Canada's Employment Change: Expected to rebound with an estimated growth of 20.0K jobs.

- Canadian Unemployment Rate: Slight increase expected, from 5.5% to 5.6%.

Setups for This Week:

EURUSD

Primary View

- Euro-Dollar ended last week on a bearish note, further threatening the neckline of the apparent triple-top formation.

- The pair is currently trading below the neckline, signaling a negative sentiment in the market.

Alternative View

- A reversal back above the designated red line would serve as a bullish signal, indicating a potential long position.

S&P 500

Primary View

- The index closed last week with two consecutive daily shooting stars, highlighted in green.

- The sentiment remains bearish, as long as the price stays below the top of Friday's candlestick.

- There's a potential for the S&P 500 to continue its downward trajectory, forming the right shoulder of a larger head-and-shoulders pattern.

Alternative View

- A break above Friday's high would constitute a bullish buy signal, nullifying the negative sentiment.

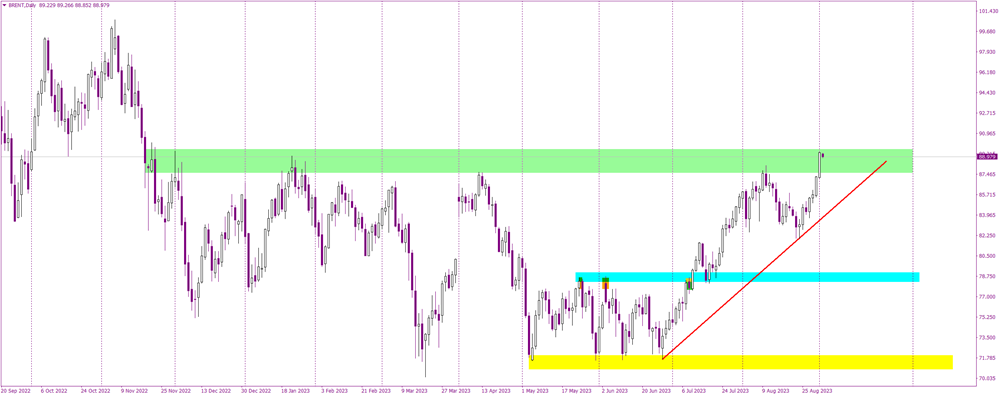

Brent Oil

Primary View

- Brent oil is currently at its highest levels since the start of the year.

- Strong performance at the end of August and the beginning of September suggests a bullish momentum.

- Daily close above the specified green area would confirm a solid buy signal.

Alternative View

- If the price bounces off the green resistance area and moves lower, this could signal a bearish correction.