Weekly Market Commentary | 11.09 – 17.09

11 September 2023

Curious to know what’s happening on the markets this week? Take a quick tour of the latest news, economic updates, and trading setups that will keep you up-to-date and in the know.

Monday

- Keep an eye out for China's New Loans data. With the anticipated number at a whopping 1275B, it's a sizable jump from the previous 346B. Lending behavior could indicate the health of the nation's economy.

Tuesday

- For our UK traders, the Claimant Count Change is projected at 17.1K - a noticeable decrease from the previous 29.0K. Coupled with the Average Earnings Index holding steady at 8.2%, Britain's job market warrants a close watch.

- At midday, turn your attention to the German ZEW Economic Sentiment. With forecasts hinting at a dip to -15.0 from the prior -12.3, Europe's economic powerhouse may be showing signs of concern.

Wednesday

- UK's GDP m/m figures are on the horizon. After a 0.5% increase last period, a downturn of -0.2% is now projected.

- Stateside, the CPI data will be in focus. Monthly Core CPI and CPI are forecast at 0.2% and 0.6% respectively. Annually, the CPI is expected to hit 3.6% - a subtle rise from 3.2%.

Thursday

- Aussie traders will be eyeing the Employment Change and Unemployment Rate. With job numbers expected to rise by 25.9K after a prior decrease of 14.6K and unemployment holding steady at 3.7%, the Australian job market seems resilient.

- The Eurozone takes center stage in the afternoon. The Main Refinancing Rate is projected to remain unchanged at 4.25%. The Monetary Policy Statement, however, will surely provide insights into the ECB's current stance and future monetary plans.

- Across the Atlantic, a slew of US data is expected to drop. We're watching the Core PPI m/m projected at 0.2%, slightly lower from the previous 0.3%. Core Retail Sales m/m, expected at 0.4%, reveals a possible slowdown from the prior 1.0%. With PPI m/m expected at 0.4% and Retail Sales m/m at 0.2%, the US retail and production landscapes present a mixed bag. What’s more, Unemployment Claims are pegged at 225K - a slight rise from 216K.

- Rounding up the afternoon, the ECB Press Conference will likely dominate the Euro trading, as traders and investors parse every word for hints of future policy moves.

Friday

- Starting off with China's data reveals, the Industrial Production y/y is expected at 3.9%, while Retail Sales y/y is forecast at a promising 3.0%. Both indicators are up from their previous figures, suggesting potential bullish momentum for the Asian giant.

- In the US, the Empire State Manufacturing Index is projected to come in at -9.5, an improvement from the alarming -19.0 from the previous period. The Industrial Production m/m is forecast at 0.2%, revealing a slowdown from the prior 1.0%. As the day progresses, traders will also watch for the Prelim UoM Consumer Sentiment, expected to dip slightly to 69.2 from 69.5.

Setups for This Week:

USDJPY

Primary View:

- The week commences with a bearish correction.

- It seems that the price is gravitating towards the horizontal support on 144.7.

- The pair remains ensconced within the channel-up formation delineated by red lines.

- If the green support is breached, the price may venture towards the lower boundary of the channel-up formation. A bearish stance is thus expected for the week.

Alternative View:

- A rebound from the green support line can catalyze a buy signal, targeting the upper echelon of the channel-up formation.

Dow Jones

Primary View:

Dow Jones

Primary View:

- The previous week culminated with the price rebounding off the long-term uptrend line highlighted in blue; an essential bastion for Dow Jones.

- As long as we remain above this demarcation, optimism prevails.

- It's anticipated that the black downtrend line will be tested this week.

Alternative View:

- Should the price shatter the blue uptrend line, it will unfurl a long-term sell signal.

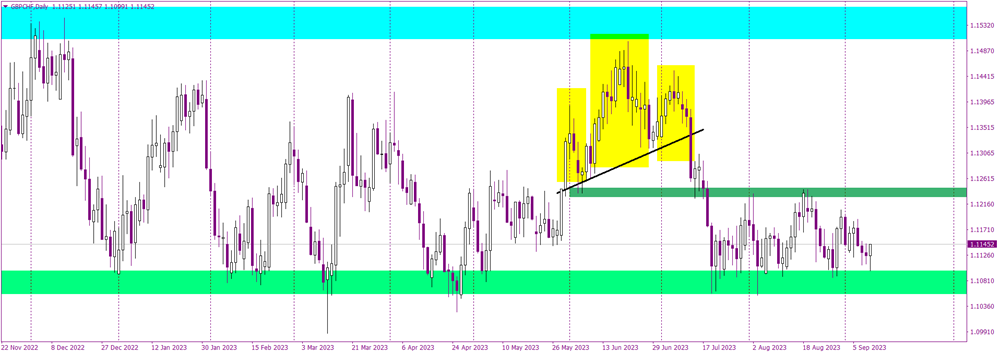

GBPCHF

Primary View:

GBPCHF

Primary View:

- The pair is ensnared in a sideways motion, both in the long haul and the immediate future. The latter commenced in mid-July.

- Presently, the price is rebounding off horizontal support pegged at 1.11. As long as it remains north of this level, buying with an aim for 1.124 seems feasible.

Alternative View:

- A descent below the 1.11 support would unfurl a robust sell signal.