The Australian Dollar back-pedalled the gains that it made on Wednesday capitalizing on the upbeat mood resulting from the dovish comments of Fed Chair.

The AUD/USD pair managed to hold its position above 0.7450 on Wednesday. The slip that was witnessed in US Dollar following Federal Reserve Chair Jerome Powell’s comments on interest rate hike after tapering purchases helped the pair to hold on to this level. Fed failed to offer any clues to expected rate hike in mid 2022.

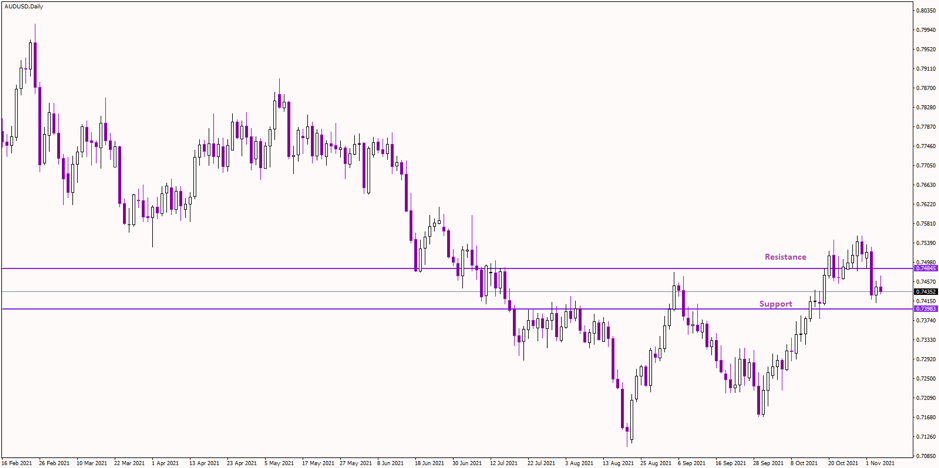

However, today, having failed to find any acceptance above 0.7450, AUD/USD is reversing the rebound that it witnessed on Wednesday.

Even though Australian Trade Balance showed a surplus, its retail sales figures fell by 4.4 percent on third quarter against the expected percentage. Now the AUD bulls have a Herculean task ahead to take the currency back on the highs.

Now the pair continues to challenge the 21-DMA at 0.7441. If this trend continues, then we can expect a further decline towards the 50-DMA at 0.7365.

The following chart shows this steep fall. If the bears continue to flex their muscles, then the next support level would be 0.73983.

Traders are now keenly looking forward to Australian Reserve Bank’s monetary policies and US nonfarm pay rolls that are to be released tomorrow.