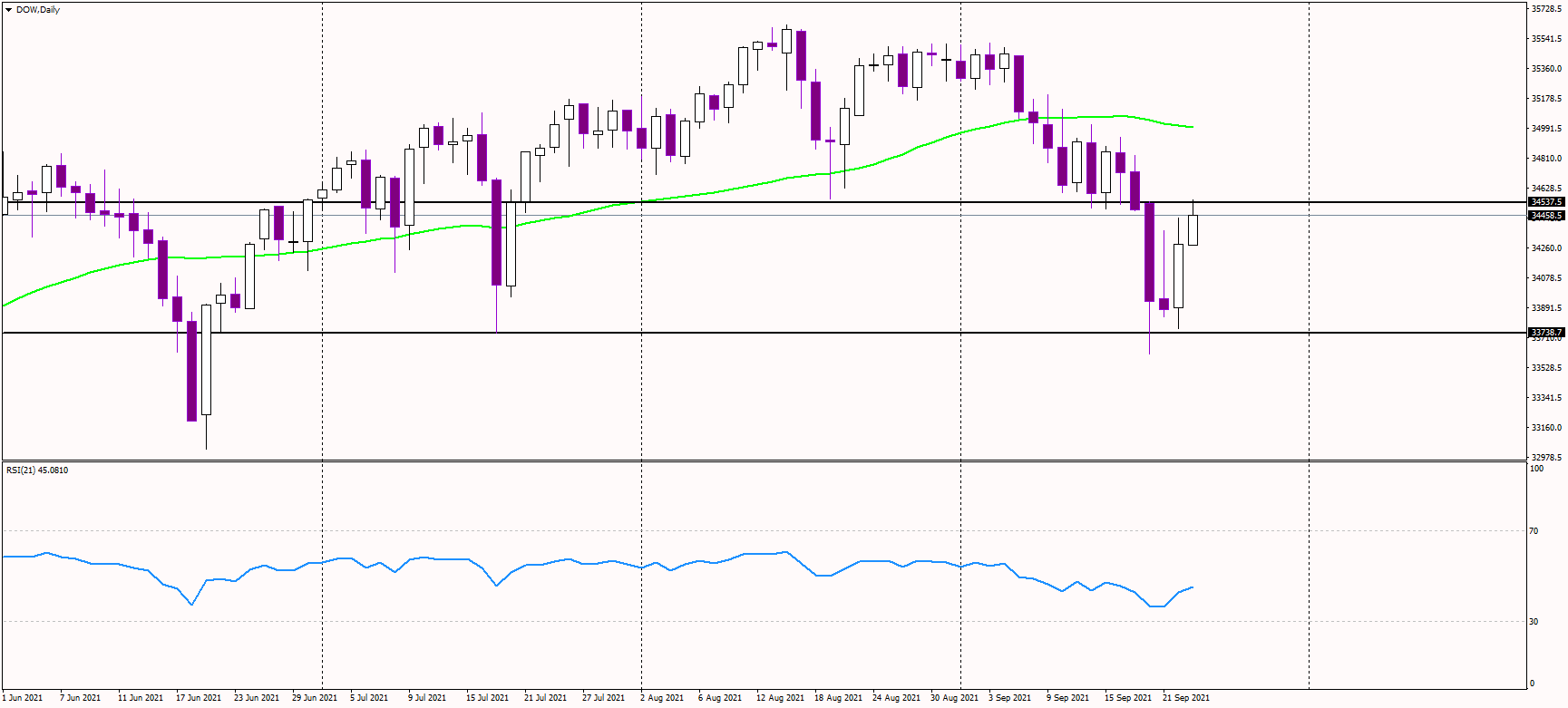

On Thursday, traders were in a bullish mood, and US equity indices rose notably, pushing the Dow Jones index above 34,500 USD, testing previous support, and now resistance.

During the recent correction phase, the Dow defended July's lows at 33.750 USD, which offered enough buying power to send the index higher. Thus, the medium-term bull market has been protected.

Should the index jump above the resistance zone of 34,500 - 34,600 USD, the next target for bulls could be at the 50-day moving average near 35,000 USD.

The long-term uptrend remains intact, but the index should soon create new all-time highs to confirm it.

Alternatively, if bearish sentiment returns and selling reappears, the support could be at today's lows at 34,250 USD, while the critical support to watch remains at 33,750 USD. If the index drops below it, there is a risk of a more significant correction.

Yesterday's FOMC decision sounded hawkish, but it looks like investors have ignored the hawkish tilt, and since the QE will be here for many more months, equities might continue higher during that time.