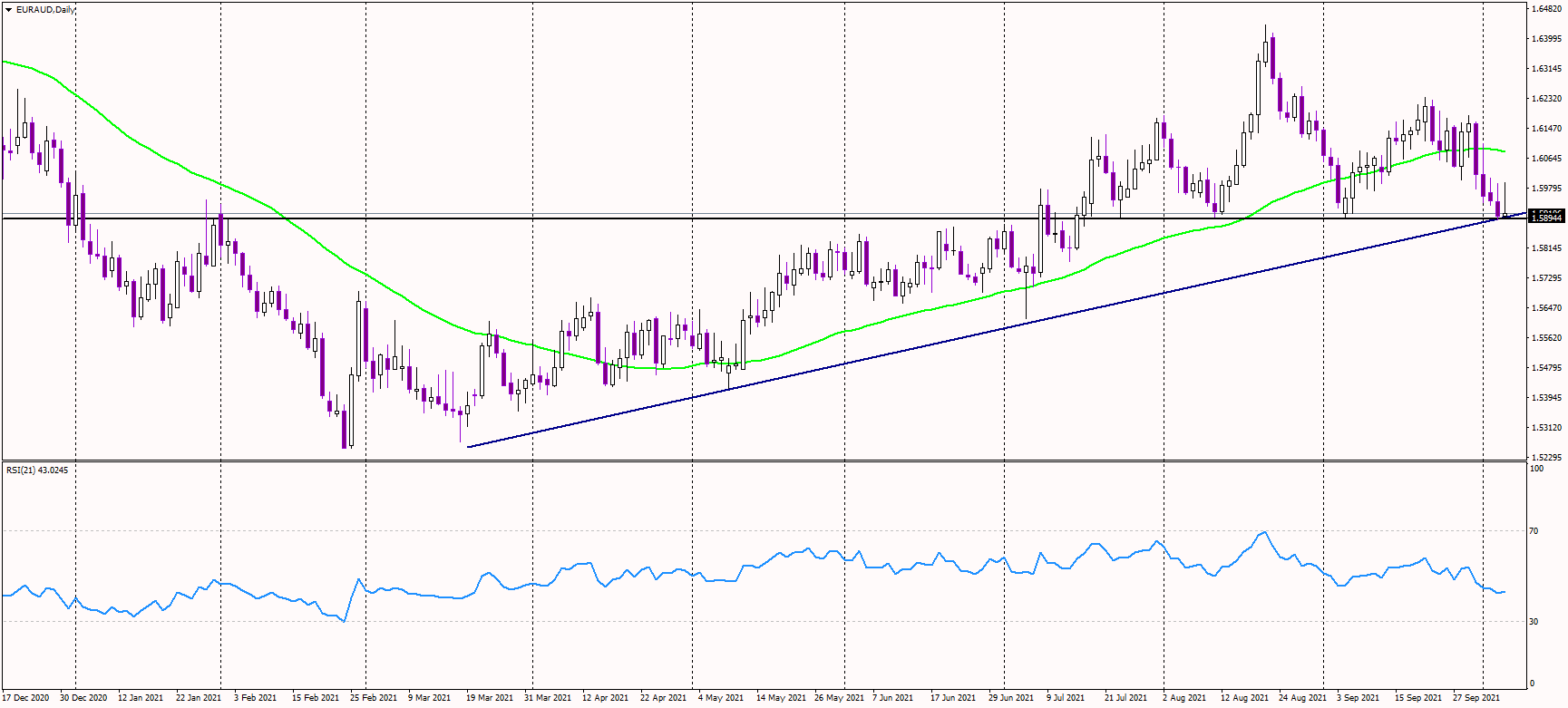

The euro continues to underperform under major currencies, leading to a decline in the EURAUD cross. On Wednesday, it was flat but testing a major long-term uptrend line.

The support of this bullish trend line currently stands near 1.59. Bulls need to defend it for the euro to stay in an uptrend. Failure to protect it could lead to a more substantial decline.

Additionally, the 1.59 level is also the horizontal support of the previous double bottom pattern, possibly creating a triple bottom formation if the support will hold. That could be a strong bullish signal.

However, the current bearish momentum appears strong, and it looks like the horizontal support and the uptrend line will be broken to the downside. Should that happen, more enormous stop losses of long positions could be hit, possibly sending the euro toward 1.58 in the initial reaction.

Alternatively, the resistance appears to be at the 50-day moving average, currently some pips above the psychological level of 1.60.

Since stocks are sliding now, one would think that the EURAUD cross will move to the upside, as it usually does in the risk-off periods. But it seems that this time it is the other way around.