The bullion remains resilient, considering the recent rise in yields and the USD. Additionally, silver is down 3% on the week, but gold managed to erase yesterday's small losses in today's rally.

At the time of writing, gold was up 0.8%, trading near 1,740 USD, while silver advanced more than 1%, changing hands near 21.80 USD.

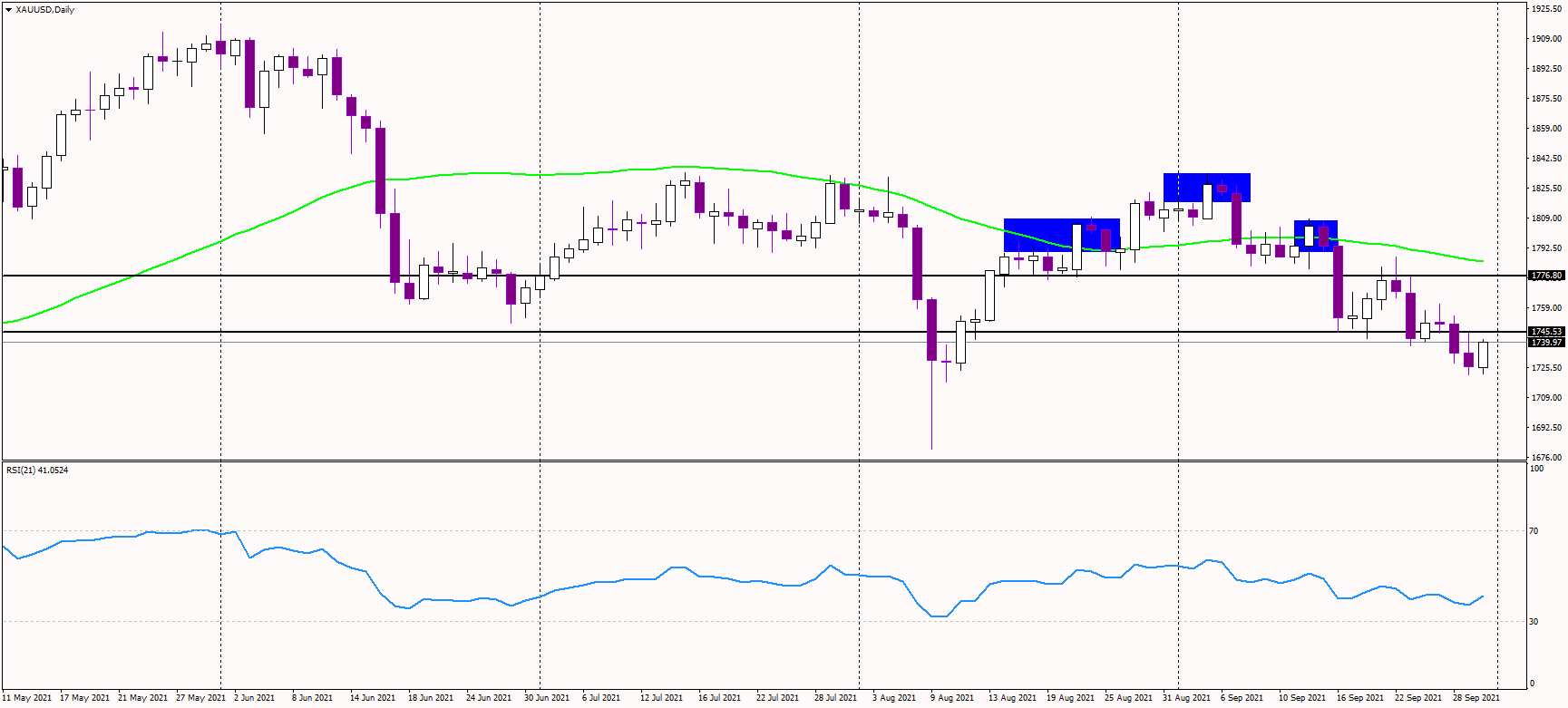

If gold manages to rise above 1,745 USD, the short-term trend will likely change to bullish, despite many bearish fundamental reasons. That is because the recent head and shoulders pattern was completed, and it is no longer valid.

The primary resistance for gold is now at 1,775 USD, where previous lows are converged with prior highs. Another selling area is again near 1,835 USD, and the metal must climb above it to switch the medium-term outlook to bullish again. Unfortunately, that looks rather improbable right now.

On the other side, the support is at this week's lows near 1,723 USD, and if not held, further losses toward 1,717 USD could occur.

Considering the USD strength, rising US yields, and the recent Fed's shift to hawkish, we think that precious metals could remain pressured.