US Dollar continues to maintain its momentum that started in June of 2021 ahead of Fed meeting.

The 21-day SMA that had previously offered some resistance today showed least resistance and DXY easily moved up through it, making remarkable gains. US Core PCE Price Index and steady prints of Fed’s preferred inflation gauge helped DXY in maintaining this good run. Thus, the previous lows of 93.278 may be considered as a potential support level whereas the recent high of 94.561 may be considered as a potential resistance level.

This modest performance of the greenback prevented any significant uptrend in gold prices. Traders’ fear that Fed may be forced to resort to aggressive policies to curb the high inflation also weighed heavily on Gold prices.

With European Central Bank (ECB) not being successful at hiding its hawkish intentions, the market is now keenly observing Fed Reserve hoping to see some tapering hints.

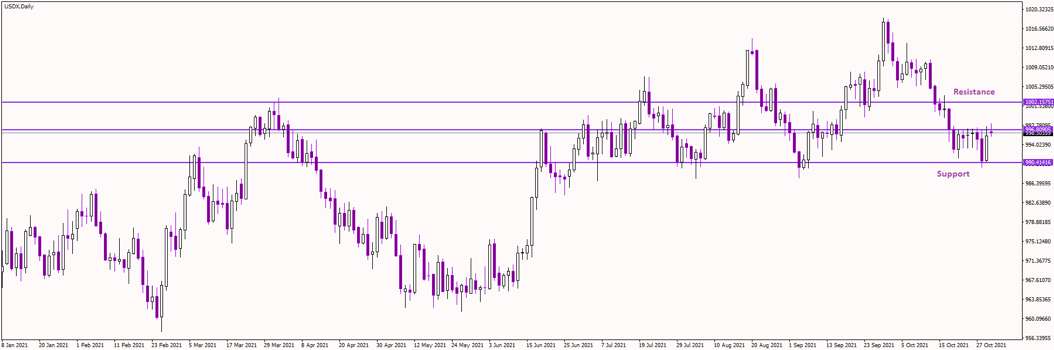

As can be observed from the above USD chart index, the next resistance would be 1002.1575. However, if the trend goes down, then the support level would be 990.4141.