Precious metals advanced on Tuesday as the greenback continued to decline, with silver trading more than 1% stronger during the US session, defending the 22 USD threshold.

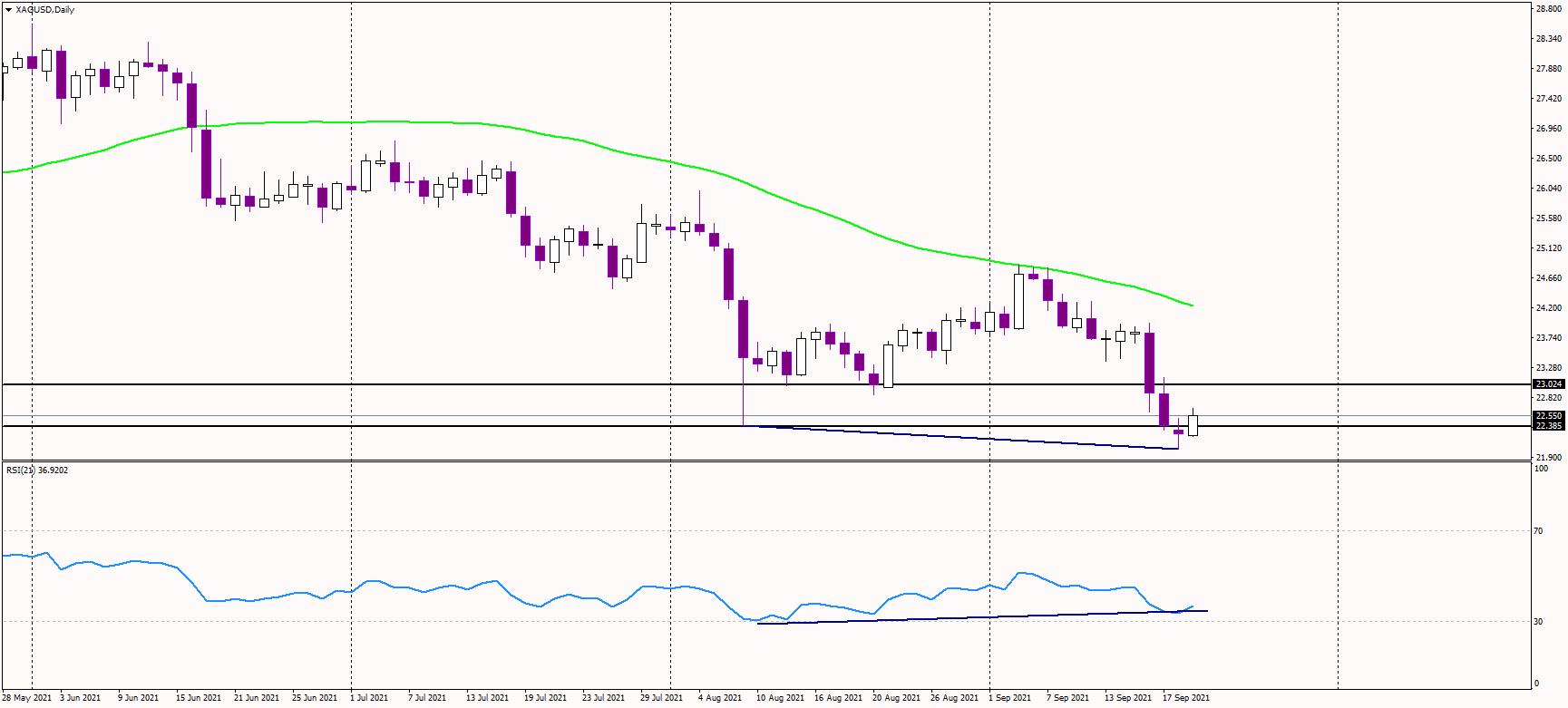

On Monday. silver declined below July’s lows, wiping all the stop-losses below this critical support. However, the bearish pressure has eased immediately, and it looks like a short-term bullish momentum is forming.

That is a well-known reversal formation, known as a bearish trap or a false breakdown. The focus of this formation is to cause maximum pain for most of the traders, ie. Tagging stop-losses of long positions and squeezing new short positions opened on the breakdown.

If silver closes the day above July's lows, i.e., above 22.35 USD, the reversal formation could become valid, targeting previous lows in the 23 USD area.

Additionally, short-term timeframes seem way oversold after the previous wave of selling, and the bearish momentum appears exhausted.

Lastly, there is a bullish divergence between the RSI indicator and the price, supporting the bullish bounce, at least from the short-term perspective, cause longer time frames still look bearish.

On the other hand, should silver starts dropping again, the support now stands at yesterday's lows near 22 USD, and if taken out, the next medium-term target will be at the psychological 20 USD level.