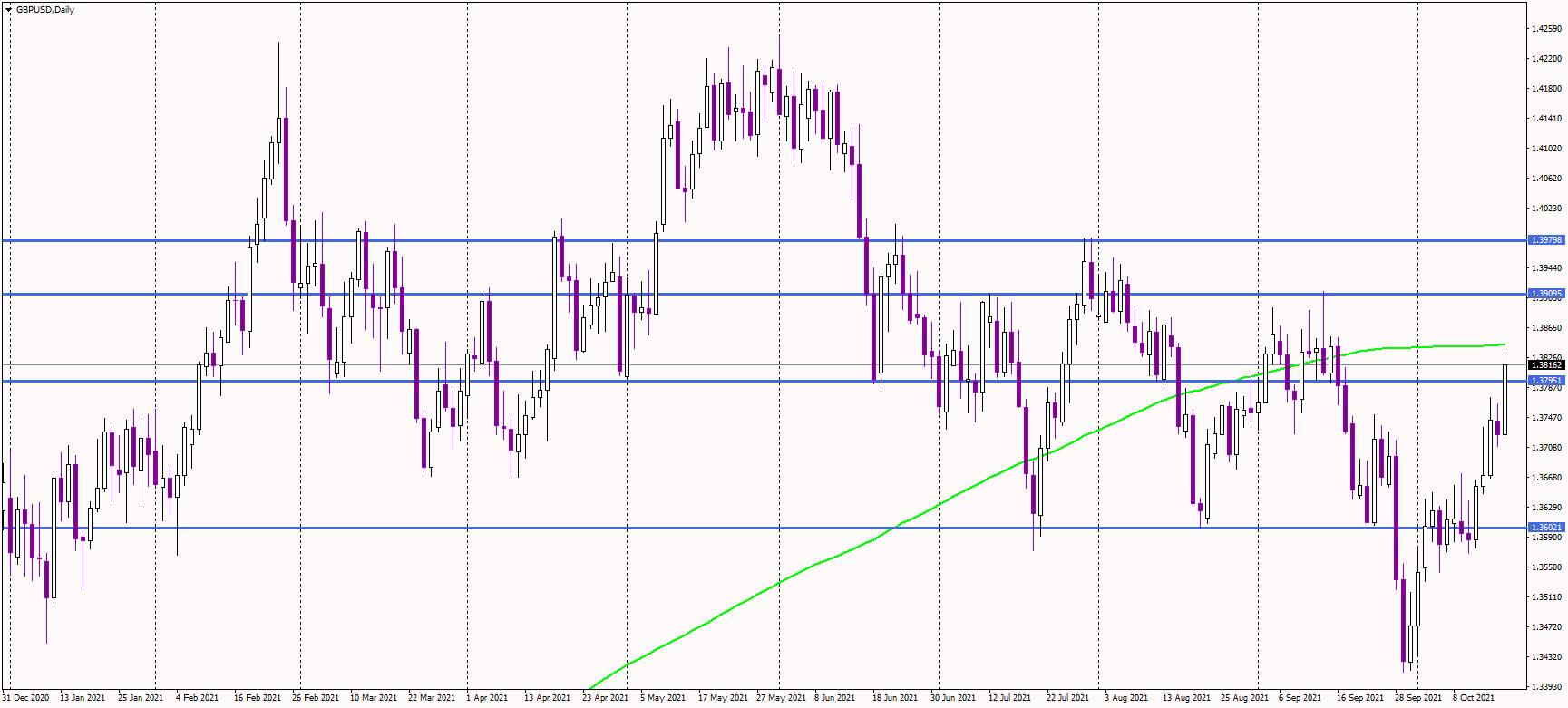

The GBPUSD pair rose sharply Tuesday, adding nearly 1% during the US session and jumping above the strong resistance of previous lows at 1.38.

As long as the Pound trades above 1.36, the medium-term outlook seems bullish. At the same time, staying above 1.38 should lead to a bullish bias from the short-term perspective.

The next upside target in the current bullish wave is at the 200-day moving average at around 1.3850. Should sterling jump above it, we could see another leg higher toward 1.39, or possibly a retest of the psychological resistance at 1.40.

Alternatively, a failure to stay above 1.38 could lead to a decline toward 1.37, with the following demand zone at the mentioned 1.36 level.

It looks like the dollar might be heading for a more significant correction as traders are selling it, despite a sharp rise in short-term US yields. Therefore, the greenback became less attractive, despite a fundamental advantage.

If that trend persists, sterling might push above the 1.40 level, while the EURUSD pair could return to 1.18.

GBPUSD daily chart, 3:30 PM CET