The WTI oil benchmark was flat on Monday and was trading at around 69.30 USD during the US session as the latest rally might be running out of steam.

Oil staged an impressive comeback from August lows and managed to gain more than 10% in three weeks. Therefore, the short-term situation now appears overbought.

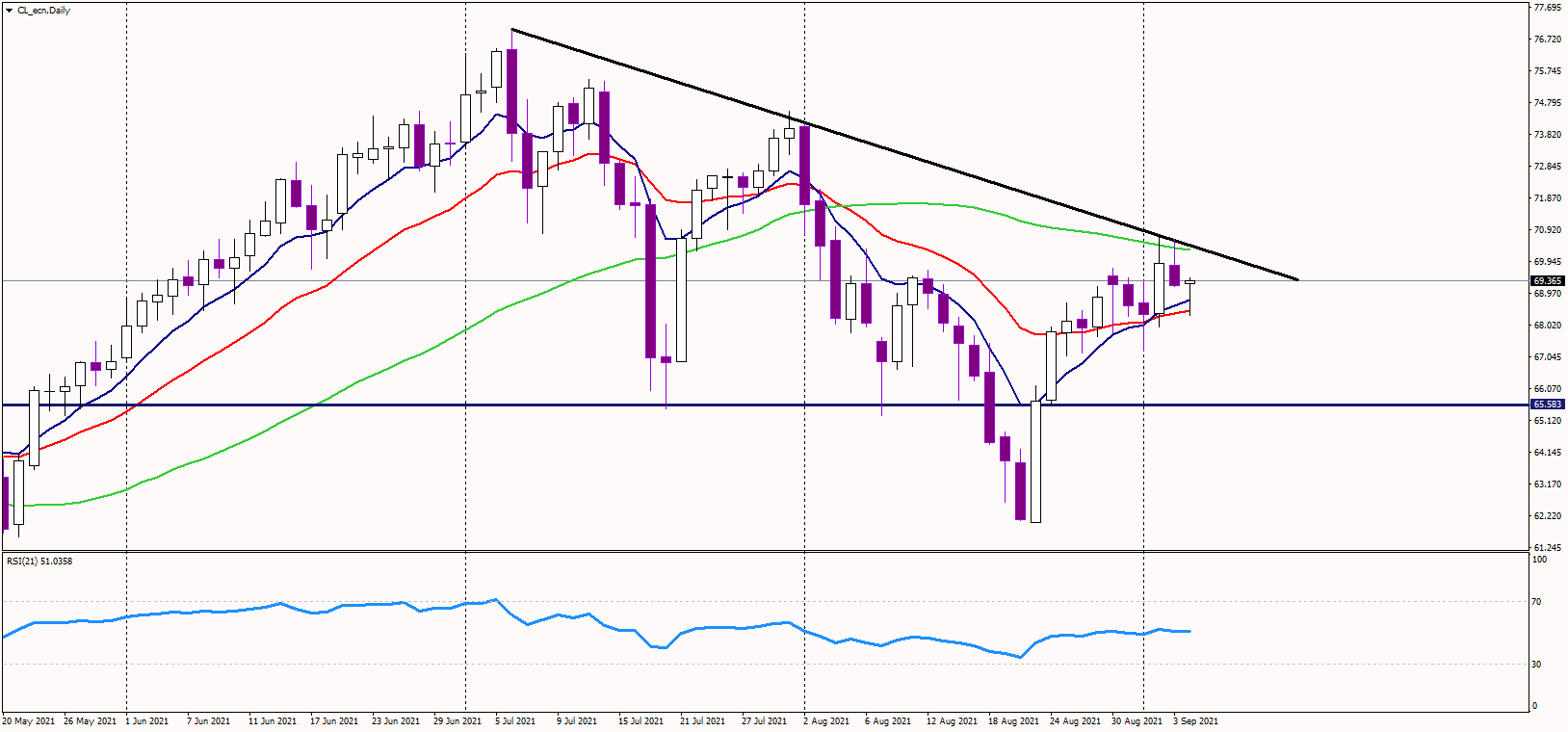

Additionally, the 70 USD could be the critical resistance as the medium-term downtrend line is converged with the 50-day moving average and the psychological resistance of a round number.

Oil needs to jump above that selling area and close above 70 USD on a daily basis to change the medium-term trend to bullish. Until then, traders could use the current overbought conditions for profit-taking or shorting the commodity.

Alternatively, should bears take charge, the support is near today's lows of 68 USD, and if not held, the black gold could decline back to the 65.30 USD zone, where the major support is located.

Should the USD continue to weaken, it will most likely be bullish for oil and other commodities. However, the 70 USD resistance needs to be cleared out first.