Identifying Top MT4 Expert Advisors

When it comes to

Expert Advisors in the MetaTrader 4 platform, there are dozens of different options available for traders. Consequently, this might be confusing for market participants and they might have a difficult time choosing the effective MT4 EA. Fortunately, there are some ways that can possibly make this selection process easier and potentially more accurate as well. Here is the list of some of those:

- Traders can read and analyze the descriptions of each of EA. This essentially shows the indicators which artificial intelligence uses for identifying signals and for making the trading decisions.

- Market participants can check the star ratings for each expert advisor. This rating is based on the trader reviews and can be informative about the usefulness of each EA.

- Traders can utilize the backtesting tool at MetaTrader 4 platforms. This features dozens of currency pairs, as well as different time frames.

- Forex traders can test the effectiveness of each expert advisor on the demo account. This will allow them to measure their performance in the live trading environment.

Let us now go through how a trader can get a free MT4 expert advisors download. We will also discuss those 4 methods of testing EAs in more detail

How Traders Can Download MT4 Free Expert Advisors?

At this stage, many market participants might wonder how one can get access to MT4 EA free of charge. Well, the process is quite simple. Below the trading chart, the MetaTrader 4 platform features the section, which is called the ‘terminal’.

Now if for some reason, the platform misses this section, traders can easily activate this by clicking on ‘view’ in the menu and then selecting the ‘terminal’ from the list below. Once it is activated, it should look like this:

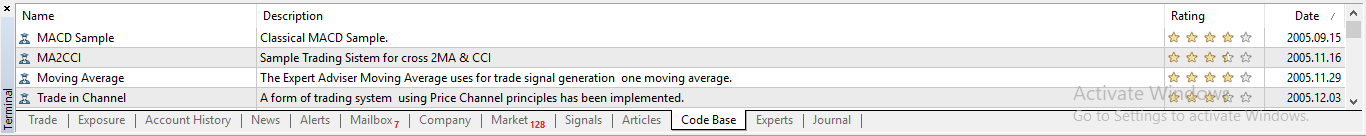

As we can see here the ‘terminal’ has several pages below to choose from. This includes items such as trade, exposure, trading journal, articles, and other items. Here trader needs to select the ‘Code Base’ window.

This will display a large list of expert advisors, the market participants can choose from. The first item on the list shows the name of EA. In the majority of cases, this describes the name of the indicator or method, used by artificial intelligence. The second column shows the description, which gives more details about the individual expert advisors.

In some cases, the description might be too large to be fully displayed. However, in such cases, traders can just point their mouse at this section and it will simply display the full text.

This is followed by the star rating column. Here the market participants can check the evaluation of each EA by other traders. 4 or 5 star rating is usually a sign that the given expert advisor was tested by some traders and won their approval.

One thing to note here is that, if the individual EA has a zero star rating, it does not always necessarily mean that it is totally useless. In some cases, the expert advisor might be too new to have any ratings whatsoever and after some days or weeks, it can receive favorable reviews.

Finally, we have a ‘date’ column. As the name suggests, this shows the date when this particular expert advisor was uploaded on the platform and became available to the public. Some traders prefer older EAs, the ones which have been tested for several years. However, at the same time, some market participants are more looking for newly created expert advisors. So it all depends on personal preferences.

Once traders find the EA, which they are interested in, they can open the additional menu by right clicking on the items. Here the market participants can click ‘view’. This will open up a new page, which will show more details about the exact methodology and technical indicators, used by this particular EA.

Alternatively, traders can click on the ‘download’ option, after right clicking on the item for MT4 EA download. Once this process is complete, the new expert advisor will appear in the ‘navigation’ page under ‘expert advisors’ and then ‘downloads’ section.

The actual number of the downloaded trading advisors is not limited by the MetaTrader 4 platform. Consequently, traders can download several EAs and then test each of them in order to identify the best possible option.

Once the new expert advisor appears in the navigation section, the traders can right click it for several additional options. Firstly, they can choose the ‘attach to the chart’ option. So at this point, the EA will be attached to the one particular chart and can start analyzing it.

Alternatively, they can click the ‘modify’ option. This allows the market participants to modify the settings of indicators, the EA uses for posting trading signals as well as for making the trading decisions. Finally, if the traders find one particular expert advisor ineffective for their trading strategy, they can just click the ‘delete’ option and remove it from the navigation bar.

So as we can see here, selecting and downloading the new expert advisors is a very straightforward task. What is not so simple, is choosing the proper expert advisor, something we will discuss in greater detail below.

Backtesting Best Free MT4 Expert Advisors

As mentioned before one of the ways traders can evaluate expert advisors is to read their methodology and check their star ratings. However, for many traders, it might not be enough to identify the best free MT4 EA.

In order to address this concern, traders do have another option, called backtesting. This essentially involves testing how a particular expert advisor would have performed with the past trades.

In order to get started with this process, traders need to click the ‘view’ on the MetaTrader 4 platform and then choose the ‘strategy tester’. After doing this the market participants will see the following menu appear below the currency pair chart:

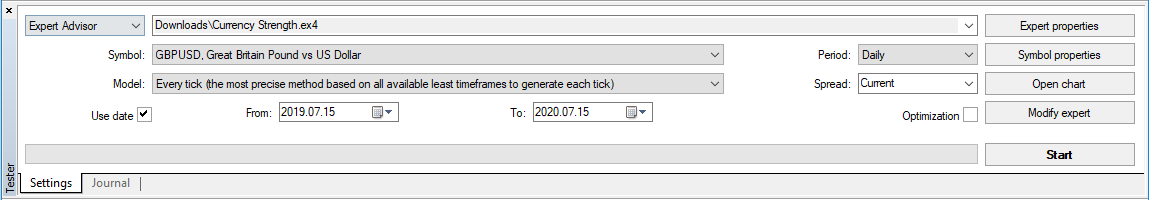

As we can see here there are several items on this image. Firstly, on the top left side of the corner, traders need to choose an expert advisor. Then on the right side of this option, they get to specify the EA they will be using, in our example that is ‘Currency Strength’. Below this, they have to choose the specific currency pair, with which they will conduct the test.

This is followed by the choice of model. There are essentially 3 options here, one being the fastest method, while the other one allows for the most thorough testing, examining every tick, however, obviously, it requires more time to process. The third option represents something in between those two extremes.

In addition to selecting those options, traders also get to set the period which will be covered by the experiment, the timeframe, and spreads. Once everything is ready, the market participants can click to the ‘start’ button, on the right side of the screen and the computer will start conducting the backtest.

Now the time it takes to complete the test can vary from several seconds to even hours. This depends on the choice of model and the length of the period covered. It goes without saying that it will take much more time for the computer to analyze 20 years of data, compared to just 3 months.

If traders believe that the backtesting is taking too long, they always have the option of terminating the process and choose the faster option from the ‘model’ section. As the test is completed it will display the results, which should look like this:

If the results do not automatically appear at the end of the tests, traders can just click to the ‘results’ window on the lower part of the ‘terminal’ section and it will display this data.

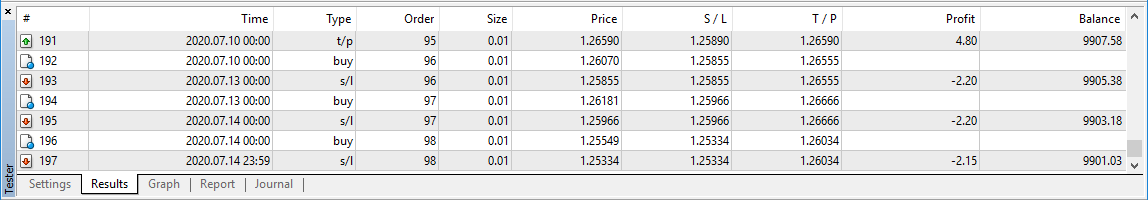

As we can see from the chart above, this shows several variables. Beginning from the left side of the image, the first column shows just the number of trades, 1 - represents the first position opened, 2 - the second, and so on. This means that the last entry in this section will also represent the total number of trades the expert advisor has executed for the chosen period.

The next column displays the exact timing of opening or closing positions, followed by the type of trade, buy or sell and the number of the order. The following section will show the size of the position in terms of standard lots. Here it is worth remembering that one standard lot equals the 100,000 units of the given currency.

The next column will show the actual exchange rate for opening the position, followed by the stop-loss and take profit orders. Next comes the gain or loss for that trade. Finally, the chart displays the changing balance of the trading account.

Analyzing MT4 EA Performance by Backtesting

At this stage, the obvious question remains: how can one evaluate the performance of the given expert advisor by the backtesting results? Well, the first item many traders would analyze is the balance of the trading account.

Actually, this can be an efficient way to identify and discard those expert advisors who show consistent overall losses. The fact of the matter is that if the size of the trading capital is lower than at the beginning of the experiment, it might be a sign that the trader is likely not dealing with MT4 best expert advisors.

However, here it is worth noting that when testing EAs conducting just one test with a single currency pair might produce the most accurate results. It might be a better idea to backtest the given expert advisor’s performance with at least 3 currency pairs and possibly even with different timeframes.

Here the market participants can take note of the trading balance by the end of each backtesting session. If the average resulting balance is still lower than the initial investment, then traders might consider modifying the parameters of EA or alternatively discard the current one and experiment with some other expert advisor.

When analyzing the performance of EAs, traders can also take a look at such items as the maximum gains and losses per trade, the size of positions, and the degree of fluctuation in the trading balance.

Testing Expert Advisors on Demo Accounts

It goes without saying that backtesting can be a very useful tool for many traders. However, the fact of the matter is that if an individual expert advisor has performed quite well in the past, this does not automatically guarantee that it will do so in the future.

Consequently, as a measure of precaution, traders can test EAs who have performed well in backtesting on the

demo accounts as well. This allows the market participants to track the performance of the artificial intelligence under live trading conditions, without taking any sort of financial risk.

In order to do this traders need to choose the EA from the navigation bar and drag it on the chart of the currency pair, they wish to experiment with. This will open up the menu, where they need to check the box for live trading.

After completing this step, traders need to go to ‘tools’ and then ‘options’ from the main menu. After clicking on the ‘expert advisors’ window, they have to select the ‘Allow automated trading’. The final step is to click on the ‘Enable AutoTrading’ bottom, or alternatively click Ctrl+E keys. The EA then will start opening and closing positions based on its set of entry, exit, and money management rules.

The main criteria here is very much similar to the backtesting. Traders can just observe the changes in the trading balance. If the given EA manages to increase the trader’s capital, then it might be considered for use in real trading accounts as well. Alternatively, if the expert advisor performs well in backtesting, but shows poor results on demo accounts, then it might not be the MT4 best EA choice for market participants.