Best and Worst Days to Trade Forex

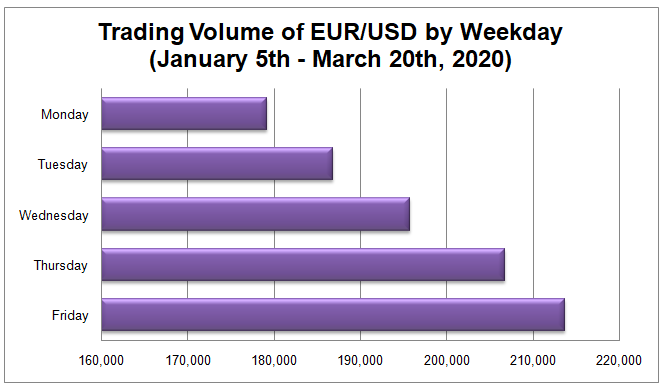

There are some eventful times when Mondays have higher volumes, however, on average the number of trading contracts is lower, compared to other days. For example, during the period between January, 5th to March, 20th, 2000, the average volume on the first day of the week was 17% less, compared to Friday.

So how can we explain this? Are Mondays the worst days for Forex trading? Well, there are several observations we can make:

- Mondays have the lowest volume so momentum is weaker

- During the following business days, the number of trading contract increases

- Fridays have the highest volume so momentum is stronger

In the early morning, the volatility is low, there are very few economic data releases, therefore many Asian and European traders are hesitant to enter the trades before the directions of the market could become clearer.

There are hardly any economic numbers released on weekends, however, some important political events can still take place. Since the market is closed by that time, it is impossible to see how the Forex market is responding to those developments.

Obviously, the trader’s response to those events will start manifesting itself from Monday. In times of relatively low volume, this can lead to very unpredictable moves.

This is why so many experienced traders do not usually place as many trades on Monday, as on other days. This does not mean that that will always be the case. If there is some major announcement or unexpected news, the market is not going to wait for another day. Sometimes Monday traders can be more crowded.

Trying to Identify the Trend

Under normal circumstances, for most traders identifying trading opportunities becomes easier. There are 24 hours of recent market performance to analyze, some trends and biases become clearer and the volume is higher.

It is also notable that quite often on this day Eurozone inflation date is announced. Sometimes it is about individual member states, but also frequently it can be about the entire Currency Block.

Now, why is this important? The ECB has only one mandate, the main aim being to keep inflation lower, but close to 2%. Unlike the Federal Reserve, it has no target for unemployment.

Therefore, Eurozone inflation data can be helpful, when working with EUR based pairs. If the HICP (Harmonized Index for Consumer prices) is falling below 1.5% or 1%, then this might lead to further easing from ECB and consequently put pressure on a single currency.

Carry Trade Effect

This is the day when the influence of the

carry trades comes into the play. Obviously, not all central Banks set the same rate, some of them have higher-yielding currencies.

From 2001 to the 2008 financial crisis this strategy has proven very profitable. During most of this period, the Bank of Japan kept rates near 0.1%, when at the same time the Reserve Bank of Australia, kept the cash rate between 4.25% to 7.25% range.

Subsequently, those traders who placed long positions on AUD/JPY profited from those differentials and earned interest on daily bases.

Now, earning a 4% to 7% return on investment is helpful, it is like having a high yielding savings account. However, from a trading perspective, that may not seem that impressive.

However, we need to keep in mind that this is a leveraged investment. Suppose a trader has placed $10,000 on his Forex account. Even if he or she uses 1:20 leverage, that $100,000 AUD/JPY position could earn him $27.41 a day, which is $834 per month. Clearly, carry trades do have some risk, especially in times of crisis, but some traders still use it.

What does this have to do with Wednesdays? Well, the income from interest rate differentials is calculated for every single business day. However, on Wednesdays, the triple rollover is given, in order to account for Saturday and Sunday.

So returning to our earlier example the trader would earn $82.23 for holding a long AUD/JPY position, than the usual $27.41.

The net effect of this factor is that traders who opened such positions where they profit from interest rate differentials might prefer to hold on to them, to earn extra income.

The opposite is also true if the same trader had a short AUD/JPY position by that time, he would be charged with $82.23. So as we can see there is very little incentive to hold on to that.

This factor makes Wednesday trades slightly more predictable and might be helpful to many traders. That is why some people consider this the best day to trade Forex, or at least one of them.

It is also worth keeping in mind that most of the time the US Federal Reserve announces it’s monetary policy meeting outcomes on Wednesdays. With expected policy and rate changes, that can make the market more volatile.

Central Bank Announcements

Thursdays can be important for EUR and GBP pairs. ECB and Bank of England hold their governing council meetings on Thursdays. This can make EUR/JPY, GBP/USD, GBP/JPY, and other pairs much more volatile.

When it comes to placing trades after the central bank announcements, it is worth keeping in mind, that the market always tries to guess the outcome beforehand.

There is one strange phenomenon, which confuses many traders. Conventional wisdom tells us that when the Central Bank cuts its key interest rate or announces QE, then the currency it issues might fall.

However, we have seen many examples, when ECB was widely expected to reduce rate, but when the announcement was made, instead of collapse, Euro stayed stable or even appreciated

This shows us that the interest rate cut was already priced in beforehand, so the actual decision did not make as much difference.

Closing the Trades

As we have seen on average EUR/USD trades reach the highest volume by Friday, so there should be a number of good trading opportunities.

However, it is also useful to consider that many traders, because of approaching weekends, try to close their positions. So under this scenario, profit-taking can become a major factor.

Therefore, trading on Friday can become riskier. The trader might correctly identify the trend on Tuesday and open several positions. However, during the last business day of the week, the market turns to the profit-taking mode, this can lead to reversals.

All of those reasons above might suggest that this is not the best time to trade Forex.

Non-Farm Payroll (NFP) number, one of the most essential measures of employment in the US is usually released on Fridays. As the name suggests, this indicator excludes the entire agricultural sector, which is more seasonal, than the other parts of the economy. This announcement also encourages greater volatility, especially in USD based currency pairs.

Finally, finding the best days and times to trade Forex is most important for short term day traders. Let us not forget that there are many long term traders and investors. So if there is some serious undervalued opportunity in the markets, then the choice of the weekday to execute the trade, might not be as important as in the previous case.