Forex CCI Indicator Explained

Each month the Conference Board organizes a survey of 5,000 households and asks them for their opinions on five issues:

- Current business conditions

- Current employment conditions

- Business conditions for the next 6 months

- Employment conditions for the next 6 months

- Total family income for the next 6 months

All participants of this survey have only three options to respond to each question: ‘Positive’, ‘Negative’, or ‘Neutral’. The results from those households are summed up, calculating the relative value of positive and negative replies. Eventually, this is compared to the benchmark year of 1985, which always has a value of 100.

They have chosen this particular year because by that time the economic performance was moderate, close to long term average. Obviously, setting the benchmark during the Economic boom or low point of recession can produce very misleading results.

For example, by the end of March 2020, the CCI in the US stands at 120. This shows that the proportion of positive household responses was 20% higher than the benchmark year.

How does CCI affect the Economy?

As we can see from the above, 40% of the questions from this survey address the present economic conditions when the remaining 60% focuses on future expectations. So essentially, the Consumer Confidence Index is mostly a forward-looking indicator. In order to understand how consumer expectations affect the overall economy, let us take a look at the composition of the

Gross Domestic Product.

GDP consists of four elements:

- Consumption - Based on Household Spending

- Investment - Spending by Businesses

- Government Spending - Including Federal, State, and local authorities

- Net Exports - a balance between imports and exports

In the majority of countries, Consumption is the largest component. In the US, this makes up at least 2/3 of the entire GDP. Consequently, if consumers lose confidence in the economy, then they will spend less money.

So even if the US households across the country decide to cut their expenditures slightly, say by 3%, then this has the potential to reduce GDP by as much as 2%. If consumers get more cautious and slash spending by 9%, then this can have a -6% negative effect on economic growth.

The declining consumer confidence also can have a major influence on the other component of GDP: Investment. If the business leaders see the customers cutting back on their consumption and the sales of their companies stagnate, this can have major consequences. They might decide to reduce their advertising expenses, inventory purchases, and eventually even resort to laying off some employees.

Faced with falling consumer confidence the government might try to intervene and raise spending. In the short term, this might reduce the scale of the recession, however, this may not be a viable long term strategy. Essentially, without Economic growth, this will only make the budget deficit much bigger. As a result of the weak economy, the currency falls.

The opposite is true for the rising Consumer Confidence environment: feeling more confident about the economy, households spend more, businesses are more open to considering increasing advertising budget and inventory investments. The government can use this opportunity to improve its fiscal balance. All those factors can help the currency to appreciate.

The only potential downside of rising Consumer Confidence can be found in the category of net exports. The households might import more goods and services from abroad if they feel optimistic about the economy. For some countries, the net exports do not represent a large portion of GDP and therefore have a little significance. However, this is something to keep in mind when dealing with such export-oriented countries as China and Germany.

Considering those factors can be helpful when formulating the Forex CCI trading strategy. In general, a persistently falling Consumer confidence index can be a sign of an upcoming economic downturn.

Trading with CCI Forex indicator

So how would any CCI trading system operate? When analyzing the fundamentals of any Forex pair, it might be helpful to consider the latest consumer confidence indicators with both currencies. Most useful here is to look for the pairs with the diverging CCI picture.

If a given country faces a persistent decline in consumer confidence, then the local Central Bank might consider cutting the key interest rate and may even resort to other easing measures.

One way CCI is most useful is that it can point to the changing of economic conditions, before Gross Domestic Product, unemployment rate, and other indicators do. Central banks officially never aimed to maintain some particular level at the Consumer Confidence Index, yet they still take its major changes into account.

So essentially, traders could identify the currencies with rising consumer confidence and place their position in such a way to benefit from their appreciation.

The latest data of the Consumer Confidence Index is widely available online. Conference Board Website is one place where one can check and download the latest CCI indicators for Forex trading.

Reasons behind the high volatility of CCI

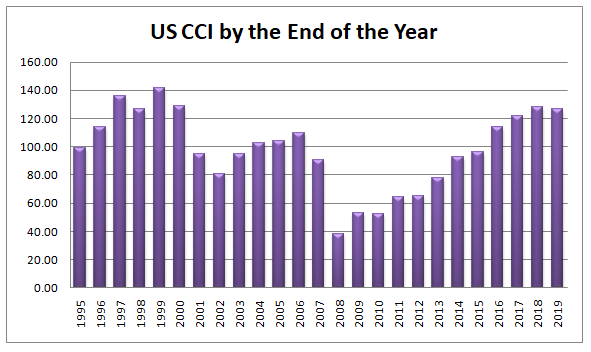

By its nature, the Consumer Confidence index is very volatile. This becomes more apparent if we take a look at the US historical data. Analyzing the past data is essential for any CCI Forex trading strategy.

As we can see from the chart above, by the end of 1995 the US Consumer Confidence Index stood near 100 level, almost the same as in the benchmark year of 1985. By 1999, it reached a high mark of 140. From the following year, the index started to decline, even before the start of the recession, falling to 80 by 2002.

After that, the index started to recover and in 2004-2006 managed to stay slightly above the benchmark level of 100.

As the subprime mortgage crisis entered the picture in 2007, CCI started to collapse, and within a year, it fell all the way down to 38.

Another cycle of recovery followed, with consumers slowly but steadily gaining confidence. From 2017 the index managed to rise above 120, the first time since 2000, and mostly managed to keep to that level. The latest report also shows 120, so at first glance, it might seem that the index experienced very little change.

However, it can be useful to point out that the latest CCI level is 12.6 points lower, compared to just a month ago. Even for such a volatile measure, like the Consumer Confidence Index, this is a very noticeable decline, for such a short period of time. This can be a testament to the fact that the recent Coronavirus concerns affect the economic perceptions and expectations of US households.

If this trend continues, it can easily turn into a self-fulfilling prophecy. This scenario can develop in four stages.

- Because of health and economic concerns, consumers lose confidence, reduce their spending, and expect a recession.

- Stock Market collapses, wiping out several years worth of gains.

- Faced with stagnating or falling volume of sales, businesses turn to cost-cutting and layoffs, further eroding consumer confidence.

- The latest GDP numbers confirm the beginning of the recession and expectations become a reality.

Both in the case of 2001 and 2008 recessions, the collapsing Consumer Confidence provided investors with an early warning sign of crisis. This demonstrates that in Forex, CCI can have a major predicting power for future economic activity and consumer behavior.