Movies About Financial Trading

Here is the list of some of the most interesting movies about trading:

- Dumb money

- Dirty Money

- Too Big to Fail

- Margin Call

- Big Short

- Madoff (ABC)

- Black Wednesday

Now, let us discuss the summaries and lessons which can be derived from each of those in more detail.

Dumb money

2023 comedy drama “Dumb money” examines one of the most peculiar stock price movements from 2020’s covid-19 pandemic. Thousands of strangers had been persuaded to purchase GameStop equities by a financial analyst and YouTuber named Keith Gill. Despite the company on the verge of bankruptcy and investment corporations shorting its shares. The film gives out the expression that the working class is against the wealthy capitalists. The term dumb money is used by corporate investors and wealthy investors to mock individual investors who have no clue about where they are putting their own money. The film Dumb money presents an event from 2020 when this very opinion was subverted and the so-called dumb ones had overturned the corporations’ fortune. The film begins with scenes of this very heightened situation where founders and investors in hedge fund company Melvin Capital are in utter shock as they face great financial losses. The people at Melvin Capital have recently been short-selling the stock of GameStop, a physical store-chain across the USA selling video games and products related to gaming. The active short selling involves borrowing shares of the company at a higher price and selling them off at the same price with the prediction the share prices will fall. In 2020 GameStop was indeed experiencing financial losses due to the pandemic and the lockdowns that followed. The company has also been struggling as a result of gamers shifting preferences which now favor purchasing and downloading digital video games. It was perhaps not surprising that the company’s shares were declining but Melvin Capital’s interest in the company and short selling had made matters worse. Keith Gill, a regular guy, made the decision to step up and take the responsibility. A financial analyst by profession, Keith was also highly active on YouTube and Reddit, through which he started to inform people about this short selling situation. Having had a strong emotional connection with the GameStop ever since his childhood, Keith wanted to save the business from bankruptcy. After investing all his money into buying shares of the company, Keith asked everyone on the internet to do the same.

Keith Gill’s story in the film begins with an informal meeting with his good friend Briggsy who happens to be a wall street investor. It is to this friend that Keith first tells about his investment in GameStop, which seems like a decision based on emotions rather than any sensible financial decision. When Keith tells Briggsy about the investment, the waitress at the place hears and decides to invest in GameStop too.

Keith’s original goal wasn’t to make a fortune out of the investment. His aim was to help the relatively modest company and to fight the big businesses that were trying to bankrupt GameStop. After putting in his money to buy GameStop shares, Keith posted videos about it on his YouTube channel and also wrote about it on the Reddit forum named WallStreetBets. In fact this very forum was and still is about people wanting to take on big investment firms from Wall Street and disrupt their corrupt intentions. A group of made-up characters are featured in “Dump money”, and they are shown to join the movement after learning about Keith’s online activity.

Overall, the movie is a great watch and shows how online influencers can actually have a huge impact on financial markets.

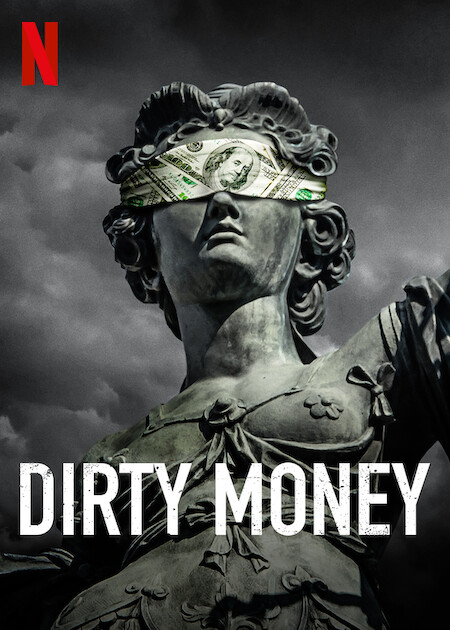

Dirty Money

Dirty Money is a Netflix original documentary that exposes the greed, corruption, and crime through the global economy. The first season premiered on Jan 26, 2018. And the second one was released on Mar 11, 2020. Each season consists of 6 episodes and each episode has its own theme. Every episode delves into a distinct scandal, meticulously unraveling the intricacies of financial crimes, unethical practices, and the profound repercussions on both individuals and society at large.

Viewers have the opportunity to learn about new details about VW's corporate deceit, how HSBC has laundered hundreds of millions of dollars for Mexican drug cartels and more. The documentary is well received by the viewers and has become quite popular.

The series is produced by Alex Gibney, a renowned figure in the realm of investigative documentaries. If you enjoy investigative documentaries in the financial sector, then “Dirty Money” could be an engaging and informative series for you.

Too Big to Fail

‘Too Big to Fail’ is one of the movies about financial markets. It focuses on the events prior to and the beginning of the 2008 Financial Crisis. It begins as the CEO of the ‘Lehman Brothers’, Richard Fuld, struggles to address the decline of the company share prices. Overleveraging and large exposure to the housing market led to investors losing confidence in this investment bank and started selling its shares, hence the decline in the stock price.

Despite those enormous challenges, Fuld did have several opportunities to stabilize the situation and rescue the company from bankruptcy. However, in the process, he made several significant strategic errors, which eventually turned out to seal the fate of the firm.

Firstly, he rejected the investment offer from Warren Buffet. According to the terms and conditions, the billionaire investor was ready to invest several billions of dollars by buying its stake for $40 per share. In return, Buffet asked for a dividend of 9% per annum.

Now, the CEO of Lehman Brothers rejected this offer, because as he mentioned, during February 2008, the stock price of his company was at $66, therefore, for him the selling price of $40 was too low. He also did not want to pay millions of dollars in dividends.

This turned out to be a major strategic blunder, but this was not the only missed opportunity. There were negotiations with Korean investors. Those talks were going quite successfully, with the delegation already starting to write a letter of intent. According to the agreed terms, the toxic real estate assets would be spun off into another bank, while the Korean investors will purchase the rest of the company.

At this point, Fuld joined the discussion and told his Korean counterpart to take a look at the real estate, since he did not want them to leave money on the table. It is not surprising that the negotiations failed as a result. Later, one of the treasury officials suggested to Fuld to sell company stock for $5 or lower per share, but the CEO of the Lehman Brothers has firmly rejected this advice.

In the meantime, the US treasury secretary, Henry Paulson, worked to address the threats of some investment banks being on the verge of bankruptcy. He gathered the representatives of major US banks in order for them to come up with a private solution for Lehman Brothers. They eventually failed to do so, but those meetings were not entirely fruitless. In fact, the Bank of America eventually agreed to be bought by the Merrill Lynch investment bank.

During the same period, as the last-ditch attempt to agree a deal with Barclays failed, Lehman Brothers went bankrupt. The US treasury secretary stood very firm on his position, that there was no public money to rescue the investment bank. As he mentioned ‘If we keep covering their losses, they will never learn anything’.

As panic selling started to dominate the market, Henry Paulson and the chairmen of the New York Fed and the future treasury secretary Timothy Geithner, worked with the remaining investment banks to avoid the repetition of the same scenario as happened with the Lehman Brothers.

The devastating effect of the financial crisis forced Henry Paulson to become more flexible with his bailout principles and went to congress to authorize an $800 billion troubled asset relief program, also known as the TARP.

One of the former employees of Paulson advised the US treasury secretary to nationalize some banks as a temporary measure to inject the necessary capital in those firms, to ensure their survival. This led to skepticism and opposition from the US treasury staff. However, as the alternative plans turned out to be unworkable or too slow, the Paulson eventually consented to this plan.

This capital injection involved 7 major US banks. According to the terms of the agreement, the US government would become a shareholder of those financial institutions. In return, they would inject billions of dollars into those firms, essentially as a loan. The banks then have to pay 5% interest on those loans to the US government and 9% interest after that.

However, in order to avoid the interest expense and buy back shares from the government, the banks had an option to replay their TARP money at some point in the future. The film ends as the treasury secretary and the Chairman of the US Federal Reserve, Ben Bernanke expresses the hopes that the banks will use the TARP money to lend them to their customers.

Now, it goes without saying that everything might not have happened in the way, shown in this film. However, the filmmakers always try to make the storyline more dramatic and therefore, more interesting to the audience. This is why ‘Too Big to Fail’ is one of the best stock trading movies available.

There are also indeed several lessons to be derived from this film. Firstly, from the example of the CEO of Lehman Brothers in the movie, we can see that making decisions based on pride and emotions can easily lead to some serious strategic mistakes, the cost of which can be considerable. Also, this shows that sometimes it is much better to accept a smaller loss than to risk losing everything.

Also, this film shows that due to deals and acquisitions during the 2008 Financial Crisis, the size of several US banks and insurance companies became so large that they effectively became too big to fail. This is because the collapse and bankruptcy of any of them will most likely have a domino effect on the rest of the sector and can eventually bring down the entire US economy.

This creates a situation where, even if the CEOs and managers of those financial institutions take some serious risks and things go seriously wrong, they know that the government will be forced to intervene in order to keep them afloat and prevent the systematic collapse of the economy. The financial sector is filled with different types of risks, risks and rewards are an important part of investing and financial trading, they are like Yin and Yang.

Therefore, this film suggests that despite the fact that the 2008 Great Recession is now over, some of the underlying issues with the banking industry have not yet been resolved.

Margin Call

The ‘Margin Call’ is yet another one of the movies about trading, and it has some direct references to the trading term,

margin call. It shows the story of one unnamed investment bank during the 2008 financial crisis. Two of the employees of the firm discovered that the company was holding a large amount of toxic assets and the value of those investments was highly likely to drop dramatically in the foreseeable future.

After a round of discussions and analysis, the Chief Financial Officer of the firm decides to one day hold a fire sale of all those assets in order to preserve the solvency of the company. The obvious problem here was that the employees of the firm have spent years building up relationships and trust with the representatives of other investment banks.

Consequently, if they dumped all of those toxic assets into the market, that would effectively destroy their personal reputation in the industry, and most likely they would not be able to work at the same position ever again.

In compensation for this loss, the CEO of the firm set some percentage targets to achieve for employees during their fire sale and told them that each employee who reached those goals would get a $1 million bonus in a single day.

This daring operation eventually turned out to be a success. However, the price of this result was the fact that the CEO had to ruthlessly fire dozens of employees who participated in the fire sale since it was clear that nobody would do business with them in this line of work.

This movie also has some lessons for the audience. Firstly, it shows that despite a large amount of potential earnings in the industry, the people could easily lose their jobs in investment banking due to high competitiveness and sometimes even the ruthless nature of the business.

It also shows that the reputation of the individual, especially in business, is much more valuable than having millions of dollars. Obviously, one can have both, by years of consistent effort. However, if one sells his reputation for any price, it might market an end to his or her career

Big Short

The big short is one of the movies about traders. It covers the story of 3 different groups of traders, who decided to take a short position with the mortgage-backed securities. At first, the movie shows that such an instrument did not exist, however, due to a request from their client, the major banks decided to create such a tool to allow for such a trade.

The film shows that the majority of the investment bankers firstly laughed at the idea of shorting MBAs, but they still helped their clients, since they would receive insurance premiums, as long as the collapse in the housing market did not happen.

It is not surprising that many clients of those 3 hedge funds, who took this short position, were very uncomfortable with their managers paying insurance premiums for those trades.

The movie also depicts the reckless nature of lending by some mortgage companies. Some people get 5 mortgages simultaneously, while others receive those loans even though they have no jobs or any type of income. For those 3 hedge funds, it was inevitable that the entire market would collapse, something which seemed unbelievable for other investors and traders.

Eventually, those daring steps paid off, with those hedge funds making huge profits, with one of them making a 489% return on the initial investment.

There are several lessons to be derived from this movie. The main idea here is traders and investors to trust their analysis rather than just simply following the lead of the market and public perception. The film also shows that sometimes contrarian trades can be proven to be very profitable.

Madoff (ABC)

The ‘Madoff’ is one of the must watch trading movies. It represents a two episode series, showing the events inside the Bernard Madoff scandal. One interesting aspect of the film is that it includes the comments of the actor, playing as Madoff. He engages the audience and explains the details of how he managed to recruit rich clients and dodge the regulators.

Another interesting thing in the film is that it shows the changing balance of the Madoffs accounts as the clients deposit or withdraw the money. This allows viewers to measure how close Madoff was from bankruptcy at different points of time in the film.

The movie shows how the main character of the film manages to convince billionaires not just in the US, but also in Europe and other regions of the world to deposit billions of dollars into his fund. As a result, he can afford luxury homes, cars and all other items money can buy.

The film also shows the structure of Madoff's company. Barnard has his sons in the trading department, who execute trades in order to make a profit for the firm, just like with any other investment banks.

However, this is just a facade, to cover up the rest of the business. This is exactly where the infamous room 17 comes into play. This is where the real business is done. This is where the CFO of the company resides and oversees the operations of receiving and sending out money to clients’ funds..

In fact, the level of organization in room 17 is quite impressive. In fact, Madoff here had an employee, whose sole job was to know the changing balance of the fund at all times. It is also worth mentioning that the CEO of the firm used the staff in room 17 to forge some documentation, with the employees putting cups of hot coffee on the papers in order to make them look old.

Despite a number of inspections and interviews with the US Securities and Exchange Commission, Madoff managed to deflect any type of suspicion from those public officials. So this allowed him to defraud more of his clients without any disturbance.

However, there was one man, Henry Markoupulos, who analyzed Madoff's company in detail and eventually determined that he was dealing with a giant Ponzi scheme. He did try to raise the alarm with regulators and some journalists, but with little results. Yet, he did become popular after this scheme was exposed.

The basic scheme of Bernard Madoff's company was to offer its clients a stable 10-12% per annum return on investment, regardless of the circumstances in the economy. It is not surprising that this degree of stability was very attractive to many investors. So this is why so many wealthy clients flocked to his fund.

Now the problem here was that Madoff did not invest in the stocks, bonds, or real estate market in order to earn some return for investors. Instead, he put those funds in 2% savings accounts with banks. Obviously, this was not enough to offset the costs of paying a 10% annual return to investors. Yet, as long as new wealthy individuals kept investing large sums of money in the fund, Madoff was able to sustain those operations.

The situation changed dramatically after the collapse of the housing market and the beginning of the 2008 Financial Crisis. Major clients of the firm started pulling out their money, with the balance of the fund shrinking considerably. At first, Madoff managed to stabilize the situation by asking some of his older clients for more money. He even accepted the deposit of his own secretary, when she received her inheritance.

However, those measures only delayed the inevitable. As the balance of the fund fell below $1 billion, Madoff realized that it was all over. He told his wife and two sons that his business was a Ponzi scheme. His sons disowned him and denounced him to the FBI. As a result, Madoff was arrested and the scheme was exposed.

The reactions of Madoff's clients to those events were different. Some of them did manage to get out of the fund before the scheme was exposed, while others started demonstrating and one of them even ended his life with a suicide.

Bernard was eventually sentenced to 150 years in prison, which realistically speaking was the effective equivalent of life imprisonment. Interestingly, as Madoff entered the jail he was cheered by fellow inmates, as a hero who robbed the rich people.

This series once more reminds us that as the old saying goes ‘if it seems too good to be true, it probably is.’ It also shows the importance of diversification in investing and trading, not putting all eggs in the same basket.

Also, the movie teaches us to do thorough due diligence, before making any trades or investment decisions, especially when it comes to the large sums of money. Finally, the film teaches the regulators and ordinary people to take whistleblowers more seriously, even in times when the investment being a Ponzi scheme seems unlikely.

Black Wednesday

The “Black Wednesday'' is one of the movies about Forex trading. As the name suggests, It covers the events leading up to and during the so-called ‘Black Wednesday’ in the United Kingdom back in 1992.

In 1990 the UK government decided to join the European Exchange Rate Mechanism (ERM). According to the rules, the exchange rates of different European

currencies were pegged to the German Mark, which in turn was pegged to the ERM monetary unit. This was all meant to prepare the European countries for adopting the single currency, as it eventually happened in 1999 when the ERM monetary unit became the Euro.

Now, according to the rules of the European Exchange Rate Mechanism, the British pound would be pegged to the German mark. As the film shows, the German Bundesbank requested a negotiation with the British government regarding the exchange rate at which the pound will be pegged to mark.

However, despite those requests, the UK government decided for a pegged rate for GBP/DEM at 2.95, without consulting the Bundesbank. The German policymakers thought that the rate was too high and the British government might have a difficult time maintaining it in the long term. However, the new policy and the exchange rate was already announced by UK policymakers, so both sides now could only hope for the best.

As the film shows this was the first major mistake by the British government and it is just one link in the chain of events which led to the ‘Black Wednesday’. However, choosing too high an exchange rate was not the only reason which led to the pound crashing out of ERM.

The second link in the chain was the decision of the Bundesbank to raise the interest rates in order to combat the rising rate of inflation, which occurred after the reunification of Germany.

Now, it goes without saying that this move made the German Mark more attractive for investors and traders. Consequently, in order to stop the GBP/DEM exchange rate from falling, the UK government had to match those interest rate increases by the German Bundesbank.

The problem was that by that time, the United Kingdom already had relatively high interest rates, leading to bankruptcies of several major businesses and the decline in the housing market. Therefore, it was likely that any further increase in the rate would make the economic conditions even worse. In fact, one of the former UK treasury secretaries even went as far as to call the ERM, the Eternal Recession Mechanism.

Facing those problems, the UK government had decided to keep rates unchanged. This decision made a lot of sense from an economic point of view, but it did make the pound more susceptible to devaluation.

What makes the ‘Black Wednesday’ one of the best forex trading movies is that it includes the interviews of the former cabinet members of the UK government, as well as policymakers from Bundesbank and George Soros, the hedge fund manager who profited from this event.

So as George Soros mentioned in his interview for this film, he identified that the overvaluation of the pound represented a great undervalued opportunity. In fact, the GBP/DEM exchange rate was already on a slide. However, the European Exchange Rate Mechanism did allow for a 6% fluctuation in rates. This means that the lower bound for GBP/DEM rate was near 2.77.

Faced with these pressures, the British and Italian governments asked the Bundesbank several times to cut their interest rates. The German policymakers initially resisted those calls. However, later, they offered those governments a deal. They promised to cut their rates by 0.25%, in exchange for both the UK and Italy revising the exchange rate pegs downward. Yet, eventually, for whatever reason, the deal was rejected.

The ‘Black Wednesday’ is indeed one of the most informative Forex movies for beginners because it explains quite well how interest rates affect the Foreign exchange market. Official interviews in this film argue that the revision of the exchange rate was a necessary step to keep those two countries in the ERM.

The fact of the matter is that this organized devaluation would have relieved a downward pressure on the British pound, making it much easier to keep the British currency pegged to the German mark.

This third major mistake made the collapse of the pound’s exchange rate against the German mark inevitable. As George Soros’ Quantum Fund took a $10 billion short position on the pound, the British currency began to drop significantly.

The Bank of England responded with massive interventions in the Forex market, spending billions of pounds in the process. In addition to that, the UK government has authorized several emergency interest rate hikes, raising rates all the way up to 15%. However, all those measures had very little effect on the exchange rates, as the waves of selling kept hitting the market. As George Soros himself mentioned in the film, those rate hikes were simply an act of desperation.

As the later official figures show, during that day in a massive loss to the British taxpayer, the Bank of England had lost £3.3 billion. After several cabinet meetings, the UK government had eventually decided to give up and leave the European Exchange Rate Mechanism. At the same time, George Soros managed to earn in excess of $1 billion in profits. This is why many people know Soros as the man who broke the Bank of England.

Despite these losses, some British officials felt relieved by the collapse of ERM in the UK. This allowed the British policymakers much greater flexibility to respond to challenges of the UK economy. In fact, some British officials even called the ‘Black Wednesday’, a ‘Golden Wednesday’. According to their opinion, this event gave the British economy an opportunity to expand.

Interestingly enough, during the subsequent years, the average inflation rates in the UK came down significantly. So this was at least one benefit of the country being part of the European Exchange Rate Mechanism for those years.

This film teaches us several valuable lessons. Firstly, it demonstrates a real-life example that fundamental analysis does matter a lot in Forex trading. The currencies might stay overvalued or undervalued for months or even in some cases years, but eventually, the market tends to address those pricing inefficiencies. Consequently, sometimes there is a lot of money to be earned by identifying and exploiting those opportunities.

In addition to that, this film demonstrates that maintaining the fixed exchange rate regime can be a very challenging task for governments. It limits the ability of policymakers to respond to the economic challenges in a timely and adequate manner.

Finally, this film shows that real interest rates are very often more important than nominal interest rates. The reason for this is the fact that at that time, nominal rates were very similar in Germany and the UK. However, the average inflation rates in Germany were lower than in Britain, something which gave the decisive advantage to the German Mark. So in many respects, it is not surprising that ‘Black Wednesday’ can be the best Forex movie for some traders.