Forex Grid Trading Strategy Explained

As mentioned above, before a trader starts trading Forex with the grid strategy, it is essential to

analyze the charts. This is to determine whether the given currency pair is engaged in an uptrend, downtrend or just settled for some trading range.

Using a 50 day Simple Moving Average (SMA) can be very helpful. In fact, we can make several observations about this indicator:

- A consistently rising or falling SMA line can be an important sign for the formation of the trend.

- On the other hand, if the Simple Moving Average line is relatively flat, then this could signify that the pair might be confined for a trading range for some time.

- Consequently, each of those scenarios requires the adoption of different techniques. Therefore, there is no one best Forex grid strategy that can be used in all cases.

- Obviously traders can also use 5, 20 or even 200-day moving averages in conjunction with 50 SMA, for the purpose of getting more clarity.

So let us begin with the first scenario. Suppose the trader analyzes the charts of several currency pairs, Simple Moving Averages, other indicators and identifies a clear trend. What should be the next step?

In order to simplify the matters let us return to our previous example: suppose that the current market spot price of GBP/USD is 1.2475 and it is determined that most likely the pair is engaged in some kind of uptrend or downtrend.

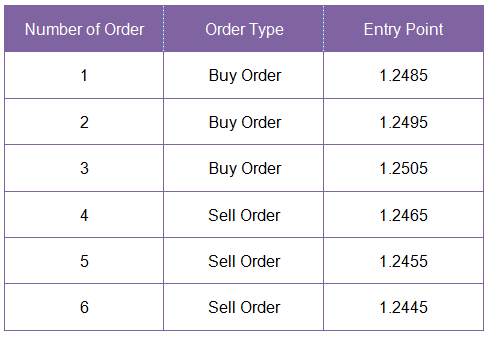

So if a trader uses the grid strategy to Trade Forex then, in this case, he or she can place the following orders:

As we can see from the table above, this includes 3 buy and 3 sell orders with 10 pip intervals. Therefore, if there is a strong uptrend and GBP/USD to 1.2525 level, then along the way those 3 buy orders will be triggered and traders will have 3 winning trades: the first one will gain 40 pips, the second = 30 pips and the third trade will earn payout worth of 20 pips. That's 90 pips worth of gains in total. Another good news with this scenario is that an individual does not have to worry about those 3 sell orders since in this case they will not be triggered.

So what happens if the market goes in the opposite direction? Let us suppose that because of some bad news for the British economy or some other reason Pound declines and GBP/USD falls to 1.2400. In this case, 3 sell orders will be triggered. The first trade will gain 65 pips, with second and third gaining 55 and 45 pips respectively. All buy orders remain intact and the trader archives a payout worth 165 pips.

Finally, it might be useful to mention here that the actual number of buy and sell orders, as well as intervals between them, are entirely dependent upon the trader’s preferences. For example, some market participants might feel more comfortable using 5 or 6 sets of orders with 20 pip distance between them or any other variation.

Using the grid strategy against the trend

Now let us move on to the second scenario. Suppose that trader analyzes the GBP/USD charts, moving averages, other metrics and comes up with a conclusion, that the pair is consolidating and is mostly confined to the 1.2400 to 1.2500 range.

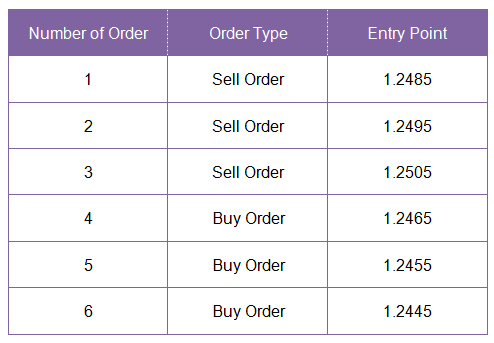

So how would Forex trades, using the grid trading strategy, deal with this situation? Well, clearly in this case orders have to be arranged differently:

As we can see from the table above, here buy orders are placed below the market sport price and sell orders above that level. The basic idea here is to benefit from volatile market conditions. Let us consider an example where the Pound collapses to $1.2415 and then rises to $1.2505.

Firstly as the pair falls to 1.2465 level, the first order will be triggered and the trader will open a long GBP/USD position. The same will happen with the remaining two orders, as the price declines further. However, once the tide turns and the pair goes all way up to 1.2505 sale orders get activated and each position can be closed with 40 pip gain.

So to sum up, all of those 6 orders will be triggered and in the end, the traders could potentially end up with 120 pips of the worth of gains.

Some experienced professional traders even use two sets of grids together, it is called a Forex dual grid strategy.

Stop Loss orders

As we have seen from the examples above, there are many scenarios where a trader can achieve significant payouts using Forex grid strategies. However, defining the Forex grid trading strategy as some infallible fail-proof method can be very misleading. It is essential to point out that those techniques do not guarantee a 100% success rate. In fact, there can be several cases when things might go wrong.

Returning to our example from the first chart, it might happen that GBP/USD moves up to 1.2485, triggering the first buy order. However, instead of developing a trend, let us suppose that the pair falls back to 1.2475. Here it is essential for a trader to have some stop loss level in mind to limit losses, otherwise, this trade can easily turn into a bottomless hole and lead to serious losses.

There are also similar examples when it comes to the second chart as well. It might happen that GBP/USD falls to 1.2400, triggering all 3 buy orders. However, instead of sticking to the range trading, Pound can break down and fall to $1.2300 and even lower. So if a trader does not have a Stop Loss order in place or alternatively does not close the trade manually, then losses can add up and eventually all of those 3 positions could be wiped out.

Therefore, just like with any other trading strategies, a trader must be able to cut his or her losses if things do not turn out the way it was planned.

Avoiding trading commissions

The Grid trading strategy might be very helpful for Forex traders, however, there are some other factors to keep in mind. It might be worthwhile to point out that this style of trading involves opening and closing several positions within a rather short timeframe. Therefore, if a trader uses a trading account that has commissions for opening each position, those expenses can quickly add up and take out a considerable portion of the potential payout amount.

There are some accounts, where traders are charged from $5 to $10 for an opening position for 1 lot, meaning 100,000 units of currency. One upside with those brokers is that the spreads with currencies can be much lower, compared to other ones. So potentially they might be very useful for long term trading. However, for the grid strategy, this might not be the best option.

Returning to our previous examples, if traders are charged $30 to $60 for executing those trades, then this can potentially offset most of their gains. Therefore, if a trader is considering using grid strategies, then it is essential to find brokers with no commissions.

Luckily, there is no shortage of companies who offer their Forex services with those terms. For example, both of

Axiory’s standard and Max accounts have no fixed commissions.