Strategies for Long Term Forex Trading

When it comes to long term trading, there are a couple of important strategies:

- Utilizing 200 Day moving Average

- Reducing or avoiding rollover charges

- Conducting extensive fundamental analysis such as comparing relative real interest rates, analyzing trade balance, etc.

- Using Purchasing Power Parity (PPP) indicator

200 Day Moving Average

One example of long term Forex trading strategy is using 200-day Simple Moving Averages (SMA). This indicator is calculated by the average closing price of the last 200 trading days. It is mostly used for determining the long term market trends. In general, when the currency pair remains above the 200-day SMA, it is considered to be in the uptrend. Conversely, if the price of the security stays below this indicator, then it is deemed to be in the downtrend.

In the long term, FX trading strategy the 200-day Simple Moving Average can also serve another purpose: during the uptrend, it turns into a significant support level and in times of downtrend it becomes a major resistance point.

200 day SMA is frequently used in conjunction with other indicators like 50-day SMA. When one line crosses the other, it is usually considered as a sign of trend change.

So essentially this long term strategy for Forex trading works like this: Traders can look for currency pairs where, according to moving average indicators, there is a clear trend and open positions to capitalize on that. It's important to note that moving averages are best for trading trends, and they fail to provide reliable signals when markets are ranging.

Reducing or Avoiding Rollover Charges

Because of the borrowing costs and interest rate differentials, brokers charge clients

rollover fees for holding most of the Forex positions open overnight. There are some trades where the broker pays the client a small interest as well. This mostly depends on the central bank rates.

For example, let us suppose that a trader is analyzing the EUR/RUB pair and is looking to open a position. As of April 2020, the European Central Bank still keeps its key interest at 0%, when the Bank of Russia is holding on to 6%. So since at the moment, Russia has a higher-yielding currency, therefore for holding a $100,000 short position overnight on EUR/RUB, a broker might pay a client $5.

If a trader analyzes the latest charts and concludes that the Ruble might appreciate against the Euro, then there are no problems with holding on to short EUR/RUB positions for a larger time frame. In fact, at this rate, traders can earn $150 per month for doing so.

But what happens in the opposite scenario? What if the Euro is in an uptrend against the Russian Currency? Because of unfavorable interest rate differentials, a broker might charge a client $25 for holding a long $100,000 EUR/RUB position overnight. Now, this amount might not be a life-changing sum. However, when it comes to long term strategy for Forex, it is helpful to keep in mind that those expenses will eventually add up to more significant amounts. At this rate, in three months rollover charges can reach $2,250.

Therefore, traders might identify good trends for long term trading, however high rollover charges can significantly reduce his or her potential payouts. So how can we deal with this issue?

The first obvious solution to this problem is to shop around. There are many Forex brokers with more competitive rates and consequently lower rollover charges, so potentially traders can save hundreds of dollars on their long term positions. Some of them even offer rollover free accounts, in exchange for a small flat fee or larger spreads. So there are several options to reduce those types of expenses.

Relative Real Interest Rates

The real interest rate essentially measures how well will deposits maintain their purchasing power in a given currency. For example, nowadays, the Federal Funds Rate is set within 0 to 0.25% range. At the same time, the latest US

Consumer Price Index (CPI) indicates 1.5%.

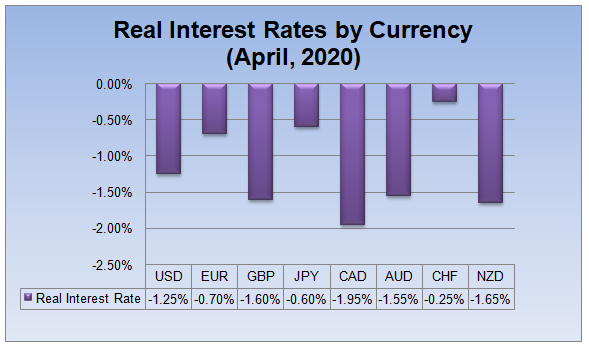

So let us suppose that a customer opens a $1,000 deposit or CD for one year, which pays 0.25%. After 12 months he or she will earn $2.5 in nominal terms, but if the inflation rate stays at the same level, the deposit will lose 1.25% of its purchasing power, calculated by 0.25% minus 1.5%. Consequently, we can conclude that the real interest rate of USD is -1.25%.

But how about those central banks which have even lower interest rates? For example, the Swiss National Bank holds rates at -0.75%, yet the Swiss Franc held its ground quite well against the US dollar, in fact, compared to a year ago, it has appreciated by approximately 5%.

Well, nominal interest rates are only one part of the equation. The latest Swiss Consumer Price Index came out at -0.5%. So the real interest rate for CHF stands at -0.25%. Consequently, one possible reason for the Franc’s strength is that the real interest rates in Switzerland are 1% higher than in America.

When it comes to long term strategies for trading FX, it might be helpful to keep in mind that Central Banks can not enforce negative nominal interest rates. The fact that SNB reduced rates to -0.75% does not necessarily mean that all savers and investors will be happy to pay interest for the privilege of holding Francs in their accounts. Some clients might choose to take out cash and keep it in a safe or on current accounts. So for those people, the real interest rate for CHF would be 0.5% since Franc is gaining buying power due to 0.5% deflation.

As we can see from the chart above, all major currencies are experiencing the negative real interest rates. One reason for this is that as a response to the COVID-19 pandemic, central banks across the world have anticipated an upcoming economic downturn and reduced their interest rates considerably.

However, this does not affect all currencies to the same degree. For example, real interest rates in the case of CHF, JPY, and EUR are still notably higher than in the case of their peers. This is especially true when it comes to GBP, CAD, and NZD. If their negative real interest rates remain at such a level, this can eventually lead to their depreciation.

The basic idea of this method is to calculate the real interest rates of different currencies and open long term positions for the ones which have higher real interest rates.

Purchasing Power Parities

One of the most famous long term strategies to trade Forex is utilizing Purchasing Power Parities (PPP) and comparing this indicator to the current market exchange rates. PPP is essentially defined as the exchange rate at which the average price of goods and services will be equalized between the two countries.

So if one country has consistently lower inflation rates than other nations, then over time its exports will become cheaper and attractive for foreign importers. To access those goods and services, the foreigners need to buy the local currency, so this creates a natural demand for it.

Therefore, the currencies which trade below PPP levels are considered as ‘undervalued’ and ones which trade above PPP are deemed as ‘overvalued’.

The Purchasing Power Parity is measured by OECD using large statistical data on the prices of goods and services in different nations. PPP is also the main idea behind the Economist’s Big Mac Index, which tracks the average price of this iconic burger in dozens of countries. Essentially BMI includes the price of bread, beef, cheese, vegetables, as well as transportation, labor, and rent costs. Obviously, it is not as comprehensive as OECD figures, but it is at least easy to digest and therefore more helpful for making quick calculations.

How can PPP strategies be used to trade FX for the long term? Basically, the trader is focused on identifying the most undervalued currencies and places trades in accordance with their potential for appreciation.

Role of Fundamental analysis in Forex long term trading strategy

Long term forex investing is typically based on the economic outlook of the countries where the currency is dominant. For instance, the strengths of European economies can increase the value of Euro in relation to other currencies. How can we measure the strength of European countries? We can take a look at manufacturing, trade deficits, job creation and employment, Consumer Price Index and interest rate decisions.

Keep in mind that one of the strongest metrics of how currency will change is interest rates. High interest rates mean that regular people will avoid taking loans from banks, which will result in reduced money in people's pockets. As a result, the value of currency will increase. When forex long term trading, it's critical to note that interest rates have various effects on the economy. High interest rates are good for a currency strength short term but bad for long term. Increased rates limit money in circulation, which makes currency artificially stronger. However, in the long term, less money means less profit for companies and less sold goods. When income and spending decreases, recession begins, and the economy gets damaged. Ultimately, recession can cause weakening of a currency. Central banks know this very well and avoid hiking rates unless they have to The main job of central banks is to keep inflation in a healthy, predetermined range.