Forex No Loss Trading Strategy

As mentioned before, there are some strategies which in general might have lower risk attached to them, compared to the others. Here is the list of some of those:

- Carry Trading - Essentially involving buying a higher-yielding currency against the lower-yielding one.

- Forex Correlation Hedging Strategy - Utilizes highly positively or negatively correlated currency pairs and commodities for hedging purposes.

- Trend Trading Techniques - Makes use of candlestick charts, simple moving averages, and other indicators for the purpose of trend determination.

Despite the perceptions mentioned above, believing that those techniques can be used as a no loss FX trading strategies can be very misleading. We will go through some of the risks attached to each of those methods.

Risks of carry trading

The Carry trading strategy involves buying the high-yielding currency against the low-yielding currency and benefiting from interest earnings as long as the position remains open. For example, from 2001 to 2008 one of the favorite trades among market participants was buying the AUD/JPY pair.

The reasons for this were twofold: Firstly, in 2001 the Bank of Japan has kept the interest rates to 0% and kept them at this level for more than 5 years. Later as the economy improved the BOJ consented to 2 rate hikes, however, they never went beyond 0.50%. So as we can see during this period the Japanese Yen was a very attractive funding currency.

On the other hand, the Australian Dollar was one of the highest yielding major currencies. At the end of 2001, the key Australian interest rate was 4.25%. During the following years, the Reserve Bank of Australia steadily increased rates, until reaching 7.25% by 2008. Consequently, the Australian dollar was one of the favorite currencies to carry traders.

This is not surprising since traders could have earned from 4.25% to 6.75% annual return for holding long AUD/JPY positions. This might not sound that impressive, but if a trader used 1:10 leverage, that would translate into returns ranging from 42.5% to 67.5% per year.

This method worked well for 7 years and many market participants have earned some decent payouts by using this strategy. However, as the 2008 great recession entered the picture, the Reserve Bank of Australia cut rates repeatedly. Nowadays, partially because of the COVID-19 outbreak, AUD only yields 0.25%. Depending on the circumstance, at some point in the future, the RBA might start raising rates again, but for now, the Australian dollar is not a very attractive option for carry trading.

So as we can see from the above example, the interest rate risk is always present in the carry trades. However, another important factor is the exchange rate. There is no guarantee that the higher-yielding currency will always hold its ground against the lower-yielding currency.

Returning to the AUD/JPY example, during the summer of 2008, the pair was trading well above the 105 level. Surprisingly enough, by the end of the year, the Australian dollar collapsed below the 60 mark. Clearly, Trades who got caught in this move could have suffered severe losses.

Therefore, we can conclude that the carry trade can not be considered as zero loss Forex trading since it carries both interest rate and exchange rate risks.

Imperfections of Forex correlation hedging strategies

It is well known that some securities are highly correlated with each other, meaning that they tend to move in the same direction. There are also negatively correlated currencies, which typically move in opposite directions. Some professional Forex traders utilize this factor for hedging purposes, by opening a long position on one currency pair and shorting the other one. The logic here is that losses in one case will be offset by another.

For example, Australia is one of the largest producers of precious metals in the world. Consequently, higher gold prices can certainly benefit the local economy. As a result, the Australian dollar and the gold price have a positive correlation and quite often move in the same direction. So a trader can open a long AUD/USD position and short Gold at the same time as a part of a viable hedging strategy.

Now, this approach worked well in some cases in the past, but how would this method perform in 2019 and 2020?

To answer this question, let us take a look at this daily AUD/USD chart:

Even without any thorough analysis, we can conclude that the last 15 months the Australian dollar was in the slow but steady downward trend. There were some pullbacks, the latest one being in March 2020, however, so far the overall direction of the AUD/USD pair remains intact. During this period the Australian dollar fell from 0.72 to 0.64 level against the US dollar and so far there are no clear signs of reversal.

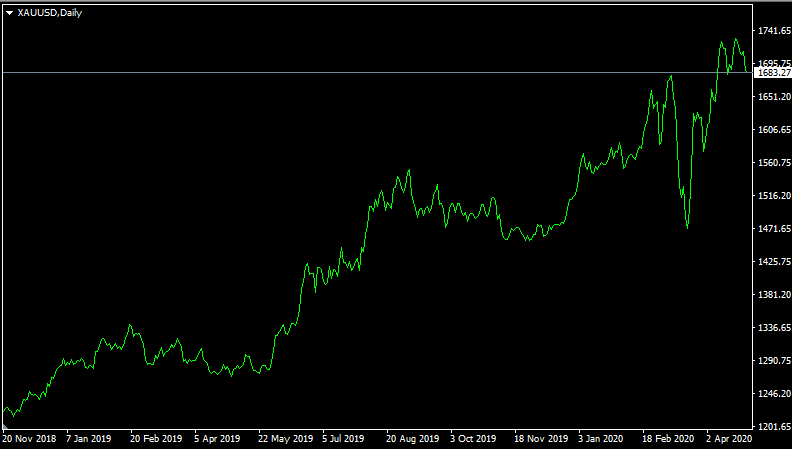

So what is the reason for this tendency? Was the Gold price also falling and consequently hurting the Australian economy? To be sure, let us take a look at the daily Gold price chart:

Here we have a surprise, the Gold had a quite impressive run during the last 15 months, rising from $1,215 to $1,695 during this period. This development logically speaking should have benefited the Australian economy and most likely it did, however, AUD still fell significantly against the American dollar.

There can be several reasons to explain this, one of them being the fact that during this period the Reserve Bank of Australia has cut rates repeatedly, reducing it from 1.75% to 0.25%. As we can see this policy led to a divergence between AUD/USD and Gold prices.

So as we can see the correlation hedging method can not be treated as Forex no-loss strategy since in some cases it can fail and traders can lose money as well.

Problems with trend trading methods

Moving on to another popular trading strategy, it has to be mentioned that trend identification techniques are becoming more popular than before. There are dozens of methods for this, however, one of the simplest options is the use of

candlestick charts and moving averages. This type of analysis can be helpful to traders and give them opportunities for earning some decent payouts.

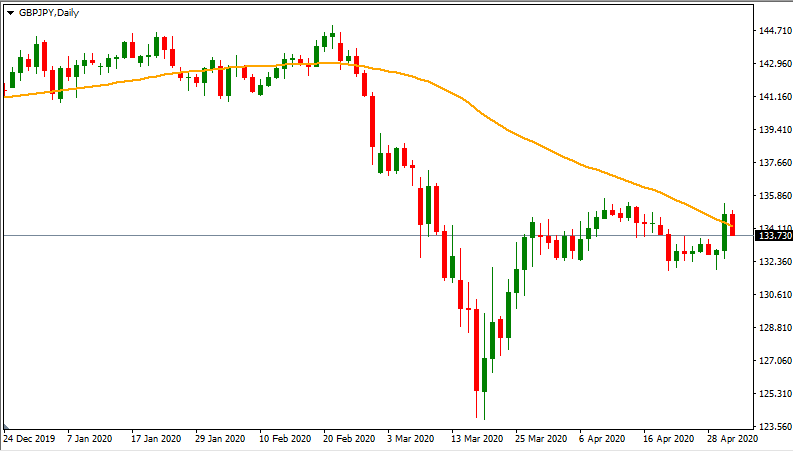

However, despite all of its advantages, the trend trading is not a no loss strategy for Forex traders. To illustrate this, let us take a look at this daily GBP/JPY chart:

As we can see from the above, the GBP/JPY pair was in the consolidation phase for at least 3 months. During late February, the Pound began to fall, firstly breaking below the 50-day simple moving average and then going from 144 mark to all the way down to 124 level.

So if somebody conducted a technical analysis at this point, everything pointed at the resumption of a downtrend: we had a very long red candle, followed by two shooting stars and also the Pound was trading well below the 50-day SMA. Consequently, it seemed like the most sensible thing to do was to open a short GBP/JPY position. Instead, we see that the pair has since recovered and now tries to consolidate near 134 handles.

As we can see from this example, the trend analysis can not be used as a no-loss strategy to trade Forex. The price action is not only dependent on purely technical indicators, but sometimes it is also influenced by fundamental elements as well.