Bears and bulls power indicator explained

Every financial market from FX, stocks,

commodities, indices, etc. is different from one another. But they all share lots of commonalities. The bull bear power indicator is useful for trading any market. The indicator is using the Exponential Moving Average, which means that this is a lagging indicator. In Forex, you will come across leading and lagging indicator types. Leading indicators signal upcoming trend reversals or new trend formations. Lagging indicators, such as the bulls bears indicator, improve visualization and the information becomes easily digestible for traders.

The bear bull indicator shows whether buyers or sellers have the initiative. The indicator receives its values based on previous candle, for instance, if the current candle closes higher than the previous one, we'll get an increase in the bull's indicator and vice versa. The indicator is coupled with the Exponential Moving Average EMA. Keep in mind that the EMA works best in trending markets, but fails to produce reliable signals in choppy and ranging market conditions.

Bulls are interested in buying an asset, and as any regular buyer, they want to get the product/service as cheaply as possible. Bears are interested in selling an asset, and they want to do that as extensively as possible. It's important to determine significant levels where you can enter the trade with the best price possible. When using the bull bear power indicator, patience and waiting for trading signals in a trending environment is critical.

The indicator was created by a Russian-America professional trader, Dr. Alexander Elder, that's how the bulls bears indicator received its name – the Elder-Ray.

The second name “Ray” hints to the indicator’s ability to see through the surface of the market prices, just like an X-ray does. Using it, traders can detect the potential strength of an uptrend/downtrend and make trading decisions accordingly.

The Elder-Ray indicator incorporates bulls and bears power oscillators to detect the trend – whether a price is in an uptrend or a downtrend. On top of that, this indicator also uses the Exponential Moving Average (EMA) indicator, which is also a trend-detecting tool. These individual elements together give out various signals to the traders.

Bulls power derives from the subtraction of an exponential moving average (usually, the time frame is 13 days) from a high price of an asset. Bear power derives from the subtraction of the EMA from a low price of an asset. Then, the two powers are put as histograms in the

bar chart.

Then, a 13-day EMA is taken as a baseline that is going to measure the strength of the bulls and bears powers. By interpreting the individual movements of the 13-day EMA and bulls and bears power histograms, the Elder-Ray indicator gives out signals as to when to buy or sell an asset.

Now, let’s talk about how traders actually interpret the movements of Bulls and Bears signals. In a combination of a 13-day EMA, the Elder-Ray indicator gives out a signal to buy an asset when the following conditions are met:

- The EMA is in an uptrend (increasing)

- The Bears Power is negative but is increasing as well

These two trends show that: a) The average price has been increasing for the past 13 days, and b) The sellers’ (Bears) position is at its lowest point and is starting to increase. Therefore, it is the best time for a trader to buy an asset.

Conversely, the Elder-Ray indicator gives out a signal to sell an asset when the following conditions are met:

- The EMA is in a downtrend (decreasing)

- The Bulls Power is positive but is decreasing as well

What these two trends show is that: a) The average price of the asset has been going down for the past 13 days, and b) The buyers’ (Bulls) position is at its weakest point but is slowly gaining strength. Therefore, this is the best time to buy an asset.

These two main conditions are absolutely essential to the detection of a trend and for the Elder-Ray indicator to be precise in its signals.

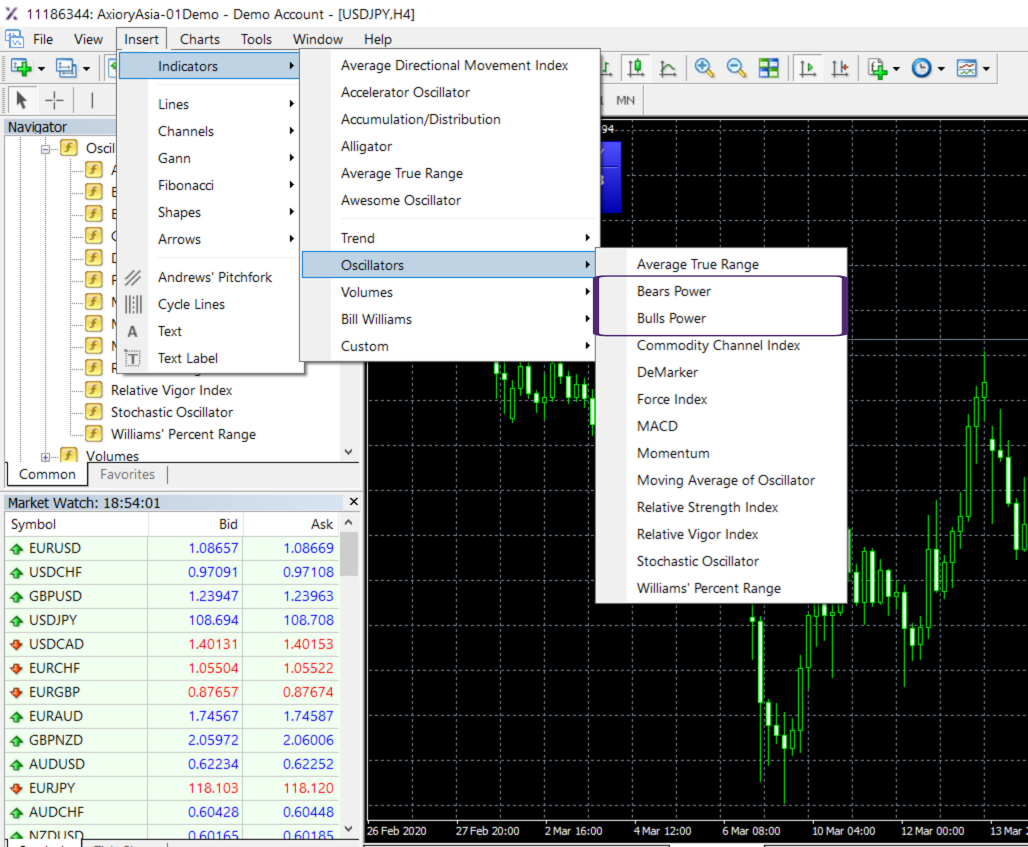

The buyers and sellers strength indicator in MT4

When it comes to using the Bulls Bears power indicator, MT4 is one of the simplest pieces of software for it. They are available to the platform as a default, therefore, adding them to a chart is quite simple.

All traders have to do is click the “Insert” menu in the top-right corner, go to the “Indicators”, choose “Oscillators,” and then put both “Bull Power” and “Bear Power” in the chart. While these indicators can be put individually, it is much more effective to use them together, as was the original intention of Dr. Elder.

And, alongside those two indicators, it’s also important to plot the 13-day Exponential Moving Average on the chart. This way, the Elder-Ray index will work at its best and the signals will be more accurate.