Best Forex volume indicators – how do they work?

Although there are quite a few volume indicator types, they all follow the same principle. Which is looking at the general amount of financial instruments being traded on the market for a predetermined period of time. Forex volume indicators display changes in trading activity relative to previous periods. As already mentioned, Forex market is decentralized and counting exact number of total contracts traded at given period is impossible.

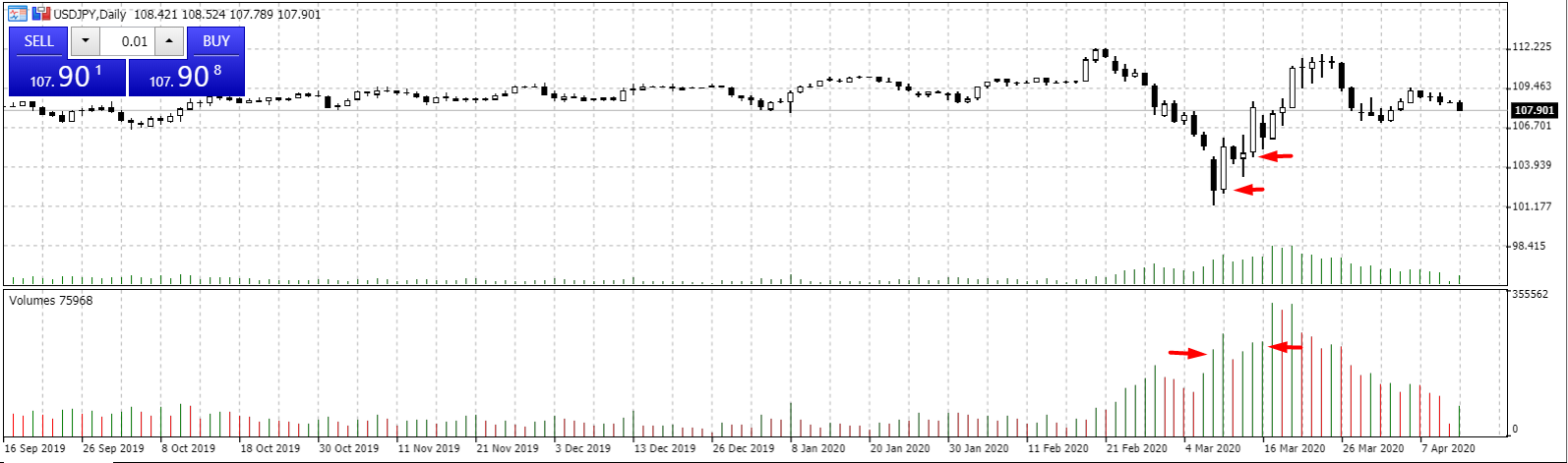

The volume information is visualized on the chart and provided for traders. Let’s take the USD/JPY chart as an example with the volume indicator already activated. Volumes is one of the simplest and the best volume indicators for traders today.

As you can see in the lowest part of the chart, there are green and red lines below the

candles. These are the visual representations of volume in the market at that specific moment.

The big green line means that bulls are pushing hard and vice versa. If volume increases wildly and price remains more or less in the same place, it means that the level is holding up the price effectively.

Some traders go long when Green line increases on the volume indicator and go short when red line becomes massive.

There is a thing called “median volume” that needs to be determined before traders can place a trade after looking at the volume chart.

Let’s take the USD/JPY currency pair again and see how these “median volumes” can be found.

As you can see on the chart, highlighted with red arrows, there are two almost identical volume points where the price managed to spike considerably well. When hovering the mouse over these volume indicators, we see that it’s somewhere between 210,000 and 220,000. What this means is that the median volume is 210,000. If there ever is another volume amount above 210,000 in the future, and it indicates a “green line”, then it could be a good indicator that going long at that moment is a good idea.

If the volume based indicator MT4 is showing a red line on the same volume amount or more, then going short could be a good decision.

The concept is exactly the same with cTrader as well and looks something like this.

Where to find best volume indicators for traders

The volume indicator is a technical indicator for MT4, MT5, cTrader and various other trading software. Usually, these platforms have the indicator pre-installed, so there’s no need to download anything.

For example, with MT4, you can simply go to Insert > Indicators > Volumes > Volumes and voila, you will see the red and green lines at the bottom of your chart. This is the exact same case with cTrader as well.

However, unlike the volume profile indicator for cTrader, MT4 has the option to add additional volume indicators to its portfolio. These indicators can be found on the MetaQuotes marketplace.

Keep in mind that most indicators you find on the marketplace may be free, but the most useful and feature-rich ones tend to require some sort of payment. However, most of these paid indicators are designed for seasoned veterans of Forex trading, so you may not require it for the foreseeable future if you’re a beginner. The default volume indicator is more than enough for that.

Mistakes to avoid when using the volume indicator

The first mistake with the volume indicator, much like any other indicator, is using it exclusively. What this means is that you don’t use other indicators on top of the volume indicator. There are no top volume indicators for FX traders that can give you a 100% guarantee that your next trade will be successful, which is why it’s important to use other tools too.

The second mistake is that you don’t find the median volume first before placing a trade according to the volume. Sure, it may look like the volume for the day is extremely high, but is it high according to this week’s total volume? Many traders like to

keep their positions open for a few days, so it’s essential to look at the bigger picture too.

How to use volume in trading?

There are various ways that you can use information about volume to your advantage. Forex trading volume indicator keeps you informed about the rise of interest around a given instrument. In Forex, prices move from significant levels to significant levels. Breaching support and resistance or other significant areas require energy. For instance, when you are trading a pattern, the rise in volume around pattern completion is a great thing. It means that traders are starting to get involved. As a result, probability of pattern predicting the price increases. Similarly, when you see a low volume, it might indicate that there's no or very little interest and the pattern might not be worth entering.

Volume can predict trend continuations and reversals. As mentioned before, if a strong trend slows down and volume decreases, it might be an indication of running out of energy and reversal might happen. The best volume indicator for Forex doesn't have to be complex. Simple volumes indicator is all that traders need in most cases. It's important to learn how to interpret the information that comes from volume indicators. Increase in trading volume can result in breakouts, sharp price movements and trend continuations