Measuring the trend momentum - The RSI 101

One of the main characteristics of the trend, apart from its upward or downward direction, is its

momentum - or the magnitude of the price changes that occurred recently. There are many technical indicators that help traders measure the momentum of the trend and the Relative Strength Indicator (RSI) is one of them.

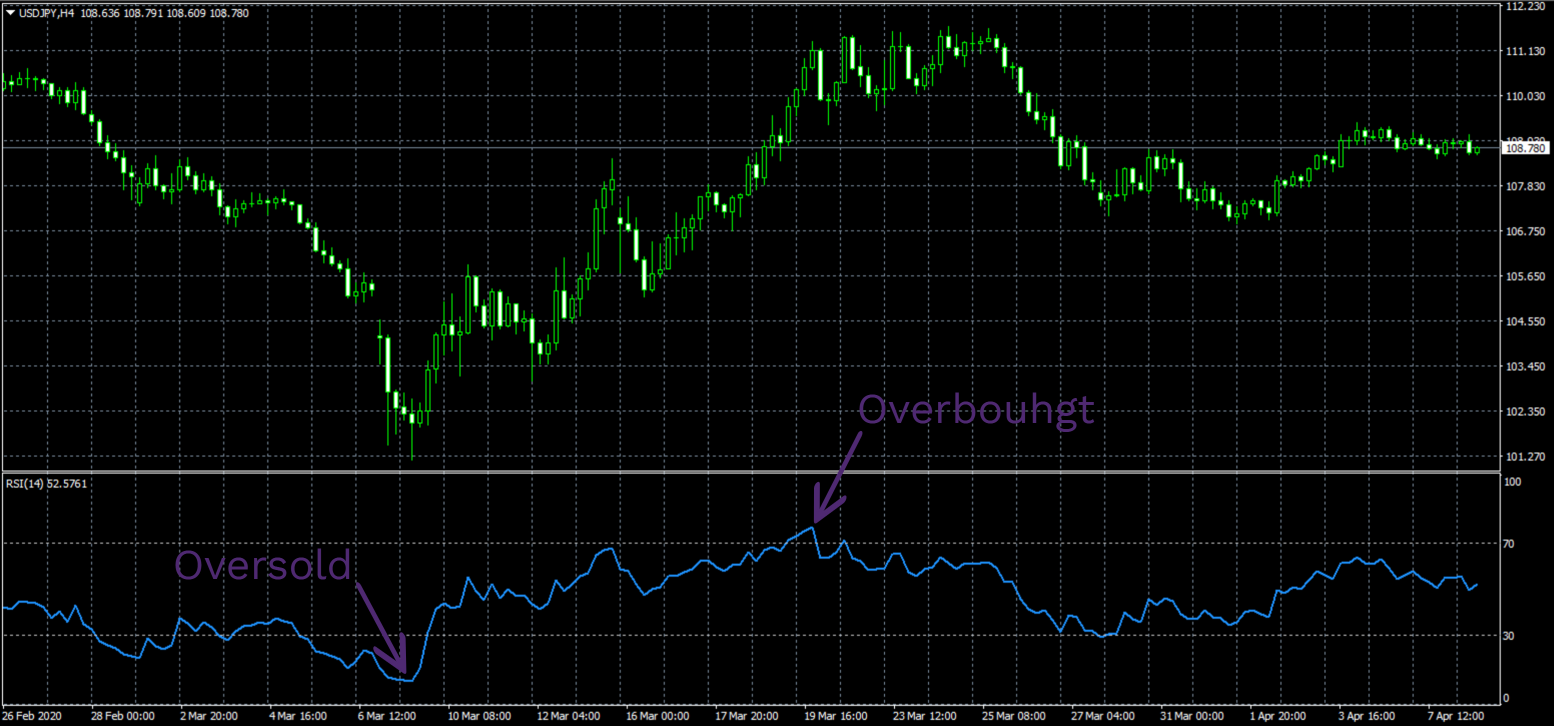

By using the RSI indicator Forex traders can determine if the market is over-trending. It is an oscillator, which means the RSI line graph is constantly moving between the two extreme points from 0 to 100, and depending on the value of the RSI, the market will be overbought or oversold.

Overbought and oversold markets

There are several ways of determining market momentum. The most popular one traders use is the RSI scores of 70 and 30:

- If the line graph goes above 70 in the chart, it means that the market is overbought

- If the line graph goes below 30, it shows that the market is oversold

According to the theory, when the market has been in an overbought/oversold condition for a long period of time, it tends to retract. Therefore, if we had an overbought market for a while, the price of an asset may start declining soon. Conversely, if the market has been oversold for a while, the price may start increasing.

There is another, more extreme scoring of the RSI indicator meaning the traders use not 70 and 30, but 80 and 20 as the extreme points. This method, according to those who use it, is more accurate for getting the signal and making more effective trading decisions.

The formula for RSI

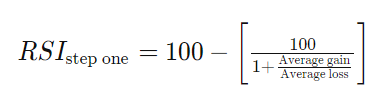

In order to calculate the actual value of the RSI graph, the indicator usually depends on the data from the previous 14 days of price movements. The formula consists of two parts, where the first part is calculated the following way:

RSI (step one) = 100 - [100/(1 + Average gain/Average loss)]

In this formula, the average gain represents the average percentage gain of the asset price during the recent 14 days, while the average loss shows the average decline of the price in the same period. Now, while the average loss will be represented as a negative value, to calculate the RSI indicator Forex traders have to use the positive value of it. So, instead of, say, -1% change, the formula will use a 1% change.

The second part of the RSI formula looks like this:

RSI (step two) = 100 - [100/(1 + {previous average gain*13 + current gain}/{previous average loss*13 + current loss})]

While the first part of the formula gives us a more sensitive RSI score, this second formula will make the results smoother, which means the score will only reach 0 or 100 values if the trend is in a strong upward or downward direction. Otherwise, small price increases and the number of days with such results will incrementally increase the RSI line, whereas the price declines, and the number of days with such results will slowly decrease the RSI line.

Once the actual RSI score is calculated, then traders can make a decision as to which trading position to take. The way they usually do that goes like this: if the RSI score gets closer or crosses above 70 on the scale, it means that the market has been overbought for the previous 14 days and it may be a good idea to sell an asset as its price may start declining.

In the opposite scenario, if the RSI score gets closer or crosses below 30, the indicator may give out the buy signal because the market has been in an oversold condition for a while and the price may start increasing soon.

To make the positions a bit safer, traders can use a

stop-loss order just above the recent high - if they are selling an asset, or just below the recent low - if they are buying an asset. This way, the platform will automatically close the trade if it starts to generate losses.

Some drawbacks of the Forex RSI explained

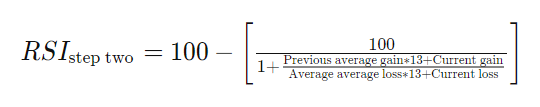

Now, while there are many advantages with the Relative Strength Index Forex traders can utilize, there are still some disadvantages that we need to discuss. For example, even though the second RSI formula we mentioned earlier smoothens the overall results, the drastic price changes can still cause the indicator to spike up or down, giving out false overbought or oversold signals.

Another flaw of the RSI indicator is that the overbought/oversold conditions can last quite a while before the price starts to actually retract. For this reason, traders tend to use it alongside other indicators like MACD (Moving Average Convergence/Divergence). In a combination, the RSI will show whether the market is oversold/overbought while the MACD will detect the divergence from the current price, giving out the signal to buy or sell an asset.