How Successful Traders Effectively Manage Fear and Greed

Most methods that you find with professional traders tend to be very personalized and adapted to their trading style. Because of this, it may be hard to find something that suits your style. However, there are still some methods that are universally applicable to whatever trading style you may have.

Please note that most of these are effective during the beginning phases of your trading career.

- Avoiding demo trading

- Using stop orders

- Goal setting

- Pre-trading ritual

But listing them in a neat bullet-point graph is not going to be enough information for most. Let’s get into a bit more detail as to why these points are essential to use when learning emotional control.

Avoiding demo trading

Avoiding

demo trading may help you control emotions while trading, but it is a significant hit to your ability to learn trading overall. A demo account is extremely useful for a beginner, especially if that beginner has very little capital to invest in the beginning and doesn’t want to “spend” it on experience.

However, no matter how many technical things a demo account may teach you, it will never teach you proper risk management. Why? Because even though you may be very careful with the virtual funds provided to you by the broker, it will never be the same as having your actual hard-earned funds on the line.

With virtual funds, there is no emotional connection, therefore no way to stop your emotions from making you place a risky trade. Furthermore, whenever you make a mistake on the demo account and place an unsuccessful trade, it doesn’t really teach much for the long term. Sure, you may remember to do better research in the future, but the emotion of not having lost anything will not stick to you in the long run.

Although it may sound unfair, it’s very hard to train your emotions without using them. This is the primary reason why Forex trading or trading, in general, is so risky and needs to be approached with extreme caution.

Using stop orders

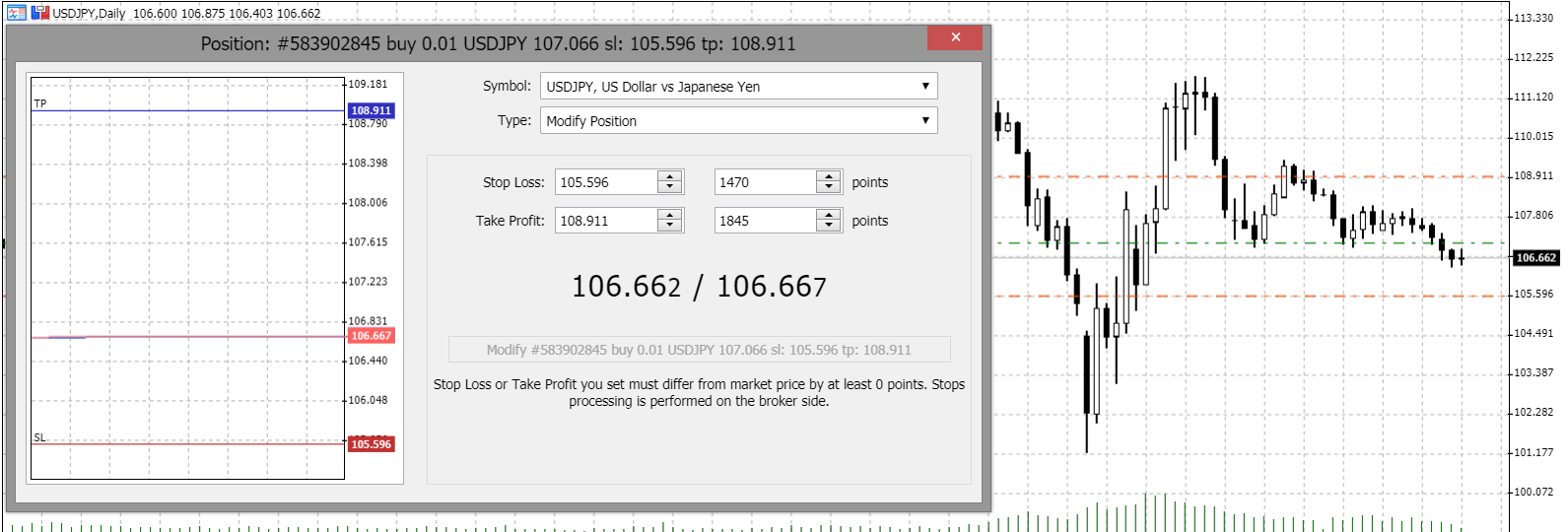

Stop orders are very unique tools that have been designed to help both the busy trader as well as the emotional trader. But its biggest advantage is that it helps you take control of your greed when trading, or more specifically removes greed from the equation completely.

Essentially what these orders do is help you set a specific price point of a financial instrument and register it on the software as a place to either buy or sell something automatically.

With FX, it’s always about closing the trade. For example, imagine that you have a $1000 trade open for the AUD/JPY currency pair. You soon see that the exchange rate is growing significantly and you’re starting to generate a decent payout. At some point you think that you’ve already made more than you were planning to, but what if there’s a chance you can make more?

These are the cases where greed simply takes over completely and it becomes almost impossible to control greed while trading.

But, if we add a mechanism that closes the trade for you, we remove that “what if” scenario from your side as a trader. The software doesn’t care about “if” or “may”, it just knows that some point it needs to close the trade, and that point has been indicated by you.

Therefore, by letting the software take care of closing, you remove yourself and therefore your greed and emotions from the process, thus making it slightly more efficient.

Goal setting

Next, we have goal setting, which is not as technical as using stop orders. Basically, what traders usually do is create their trading plan alongside a trading goal. Usually, the trading goal is created for the whole year and in most cases, it’s not calculated with the actual amount of funds you want to generate as a payout, but you calculate via percentage. This is one of the best ways to control your emotions when trading because there’s always a backup plan or something else you can do.

For example, let’s say that your year’s goal is 50% of your current investment, which means that your monthly goals are about 4-5%, which is definitely achievable. But here’s the case, it’s not really 4-5% every month.

Let’s say that you managed to reach your goal of 5% payout in the first month and you start preparing for the next. However, you now have larger capital, so your previous 5% goal for the next month is now slightly less than 5%, making it seem easier. This continues as you go through the months and by the end of the year (if everything went according to plan) your goals are somewhere around 1-2% or so. This helps traders control greed while trading because it becomes progressively easier and more fulfilling to achieve these goals in the long run.

Pre-trading ritual

One of the first things that we usually hear from successful traders when explaining their strategy is the daily routine they have created for themselves. In most cases, people try to keep it as simple as possible, but usually, there is at least one activity they always do before jumping on the computer or mobile device and start placing trades.

This is most definitely the most “customizable” approach you can take out of all the tips and tricks highlighted above. Your pre-trading ritual could be anything starting from having a large cup of coffee before the trade or just walking your dog or working out.

In order to control emotional trading, you will most likely need to start trading with a positive mindset. In most cases, the most successful traders tend to get some of the most tedious and unpleasant tasks done before they actually start trading. This helps them receive this very positive emotion of accomplishment for having those tasks finished and helps them approach trading with much less fear and much more confidence.

However, this needs to be done very carefully as well. We don’t want our lack of emotions or excess of confidence to turn into greed when actually placing these trades. Most traders tend to have intervals for their trading duties, such as having 2-3 hours for research, 1 hour for placing the trade, and the rest just adjusting their stop orders and taking the rest of the day off, not touching the charts at all.

This helps with stopping greed while trading as you slowly get the idea that you could place another trade well into the evening when everybody is just closing their positions and waiting for the next session.

Mistakes to avoid when learning to control your emotions

As disheartening as it may sound, there will most definitely be some mistakes that you will encounter when trying to control your emotions. But, as already mentioned before, making mistakes is one of the best if not the best way to finally master emotional control during trades and many other skills as well. However, it does help to know what things you should try to avoid as much as possible if you can help it.

Large trades

Large trades are very alluring because they can generate a lot more payouts. However, they are extremely dangerous no matter how guaranteed some kind of price change may be. The reason why avoiding large trades helps with stopping emotions while trading is because you get to have a shot at a lot more trades with smaller volumes, thus giving yourself a lot more experience in different market trends, even if they are all unsuccessful.

Trading is extremely dangerous and risky and making trades larger increases that risk by at least 10 times over.

Irrelevant assets

The next mistake is trading instruments that you’re not particularly interested in or don’t trade on a regular basis. This clouds your judgment as you don’t know how much is too much or too little. It amplifies your emotions because at some point you will not know what you are doing and could cause panic openings or panic closings of trades.

Comparison to other traders

One of the worst things that traders tend to do when stopping greed while trading is comparing themselves to others. In most cases, they compare themselves to successful traders that more often than not, have much more experience, knowledge, and risk-management skills. This creates the illusion that you are underperforming, when in reality you may be performing amazingly well for your experience level. Comparisons could lead to more risky trades and overall forcing beginners to bite off more than they can chew.