How to avoid being stopped out

To avoid the common issue of getting stopped out in trading, you can follow some simple strategies.

Firstly, make good use of risk management strategies. When traders stick to these rules, it's almost certain they won't get stopped out. Every trade is accompanied by a Stop Loss (SL) order, stepping in to halt the trade well before it could reach the stop-out level.

Another essential tactic is avoiding oversized trading orders, which is part and parcel of your risk management plan. Seasoned traders stick to clear rules, never risking more than a predetermined amount in each trade. This precautionary approach prevents falling into the trap of significant losses.

Shift your focus from fixating on exact numbers to percentages when planning, thinking, and executing trades. For instance, following the rule of never risking more than 2% of your balance ensures you won't get stopped out. Even if you lose half of your trading balance, your risk per trade stays at 2%, providing a safeguard against substantial financial hits.

To safeguard against blowing up your account, traders must be disciplined, follow a profitable trading strategy, and implement effective risk management. Maintaining a trading journal to track progress and managing emotions like greed and fear is vital. Always plan your trades and stick to your plans.

Lastly, ensure you have enough capital set aside for professional trading. Many traders deposit small amounts and aim for huge profits every month, leading to taking excessive risks and often hitting stop-out levels. In the unpredictable world of trading, careful planning, emotional control, and sensible risk management can make all the difference.

A stop out level – Key takeaways

So, what is stop out level Forex trading and what does it sometimes lead to? Let’s have a quick summary. With the help of margin and leveraged deposits in Forex trading, traders can increase their positions significantly. When they open a margin account and decide to place a trade, their Forex broker requires a certain portion of the position (used margin) so that it can maintain that position open.

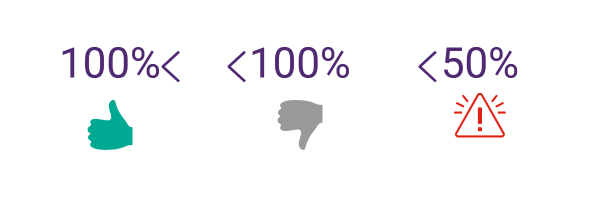

One of the most important elements of the margin is the margin level. It helps traders check their trading funds and make sure the account balance doesn’t become empty. A margin level at 100% is generally considered a good point in Forex trading.

However, when a trade doesn’t go as planned, and it produces losses, the margin level can easily go below 100%. If it reaches a certain point (usually it’s 50% margin level), the broker will start closing the positions automatically until the margin level goes above that point. This is called stop out in FX, and the level at which it begins – a stop out level.

Forex traders are typically very cautious not to reach this level because if they do, some of their trades (or even all of them) will automatically be closed. On the one hand, it saves them from reaching a negative account balance, but on the other, it stops their trading process and doesn’t allow them to generate payouts anymore.

FAQ on stop out level in Forex trading

What is a stop out level in Forex?

In Forex trading, traders frequently use margin accounts to increase their position sizes. If they didn’t do that, they would need to deposit large funds like tens or even hundreds of thousands of dollars, which is not something that many people can afford.

So, to use margin and leveraged positions, traders need to deposit a tiny portion of their actual position. It will be a kind of service payment for the broker. However, as the new positions are open, these funds taken by a broker increase as well.

And at some point, where the existing funds on the account balance become smaller (usually half) than the funds taken by the broker, a process called stop out will begin. When this happens, the broker automatically closes open positions until the balance goes back to the satisfactory level.

What is Stop Out in Forex, and why do you need to keep track of it?

When you use leverage to have a larger trading capital, advantages of this approach also come with quite pressing risks, which is where the stop out Forex signal comes into play. Even though you can increase your prospective payouts with an increased trading capital, you're also increasing the amount of loss that you can experience in the market.

And when you get a certain amount of losses in a row, your available equity decreases. Once it goes below the used margin, it reaches the stop out level. At this point, the broker will not just notify you about the shortage of margin funds and close your active positions until the balance is restored.

When you get a stop out trading notification, the best thing you can do is refill your account balance so that the least number of your active positions are closed by your broker.

How to calculate stop out level in Forex?

When it comes to the margin, there is an element called the margin level that indicates how much funds are left in the account to open new leveraged positions. It is a combination of the two additional elements: the available equity and the used margin.

To calculate the margin level, you must divide the available equity by the used margin and put it in percentages: (available equity/used margins)x100%. If the margin level is above 100%, a trader can open new trades.

But, if the margin level goes below 100%, the broker will start “stopping out” the current positions. A stop out in Forex usually happens at the 50% margin level. In real numbers, it means that the funds on the account are half the size of the funds taken by the broker. And at this point, the positions will be closed automatically until the margin level goes above 50%.

What is the difference between the Forex stop out level and a stop out?

When the margin level goes below a certain point – often it’s 50% in Forex, – the broker starts to automatically close the positions. This is called a stop out, and it happens without the broker’s actions.

Some people mix stop out and stop out level and while the two are similar in a fundamental way, they still are two different things. On the one hand, a stop out is an event that happens at some point in trading. Basically, it’s when a broker closes the positions automatically.

On the other hand, a stop out level is a certain point at which the action of “stopping out” occurs. It represents a certain margin level, which is usually 50% in Forex trading. Therefore, a stop out and a stop out level are different terms, while they represent the same action.

How to use a Stop Out calculator?

Stop out calculators help traders measure the price at which the trade will automatically get closed by the broker and what will be the loss amount. In general, Stop Out calculators require you to fill in which account currency you are using, the amount of equity, currency pair type, long or short position, and a trade size. The calculations are done automatically and are highly precise.

What is Stop Out Forex meaning in simple words?

Stop Out level is a predetermined margin level at which a broker closes an active position to prevent further losses. Traders use leverage (using borrowed money from their broker) to increase their purchasing power, consequently, if they open oversized positions, they are in danger of losing more money than what they had on their account.

How to avoid stopping in forex?

There are various ways traders can keep themselves from getting stopped out. The first and the easiest way to avoid getting stopped out is to use a proper leverage. High leverage increases your purchasing power and can result in higher profits, however, if the trade goes against predictions, losses can also increase significantly. When smaller leverage, around 20:1 and 30:1 is used, account balance is much safer. One more important way to defend yourself is to always use a Stop Loss order. A Stop Loss order will stop the trade way before your broker does. It's important to always use the Stop Loss order, as the number one reason why most traders blow up their accounts is that they let their losing trades run.