EURUSD Jumps Back Above 1.08

20 April 2022

The USD has suffered some profit-taking on Wednesday, sending the dollar index notably lower.

The USDJPY pair dropped one percent from its 20-year highs, diving below 128, while at the same time, the EURUSD pair was up half a percent, trading back above the 1.08 level.

Commenting on European Central Bank’s (ECB) monetary policy outlook, policymaker Martins Kazaks said that a rate hike is possible as soon as July. He also said that the ECB doesn't need to wait to see more robust wage growth before adjusting monetary policy.

Additionally, industrial production in the eurozone improved notably in February, rising to 2% year-on-year, up from -1.5% in January. As a result, the monthly gauge rose from -0.7% to 0.7%.

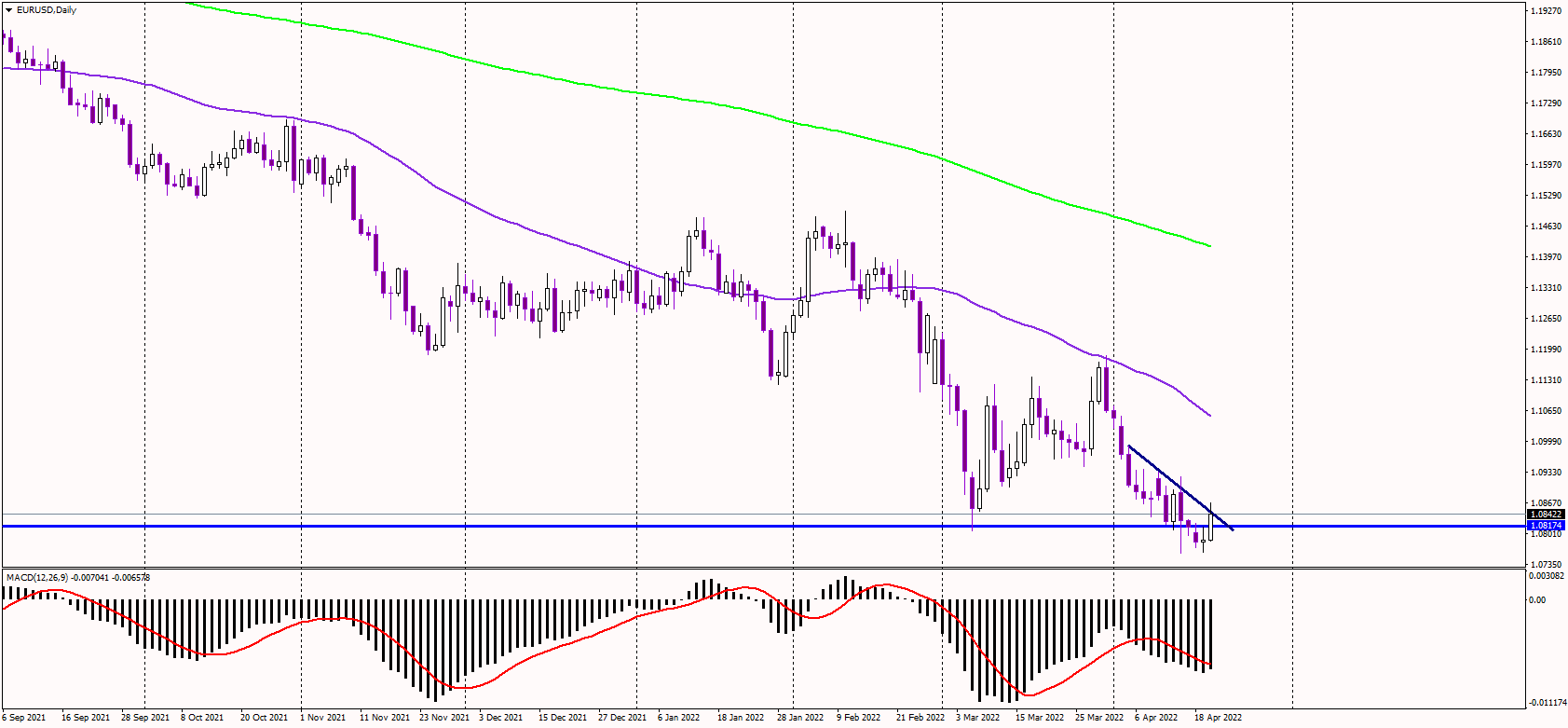

The euro advanced above 1.08, with the latest breakdown to new lows appearing now as a bearish trap. However, as long as it remains above 1.08, the short-term outlook seems bullish.

Moreover, the pair seems heavily oversold, likely helping to stage a recovery rally once the euro rises above 1.0850, where the short-term bearish trend line is.

Alternatively, if sentiment deteriorates again, the current rally might be sold-off quickly, targeting the 1.08 support before attacking the recent cycle lows near 1.0760.