Sentiment worsened over the previous days, sending stocks in the EU down from their all-time highs. Rising COVID cases, more lockdowns, and soaring US yields have halted the ongoing march to records.

Earlier in the day, the French Business Climate in Manufacturing improved slightly to 109.0 in November, up from 107.0 in October.

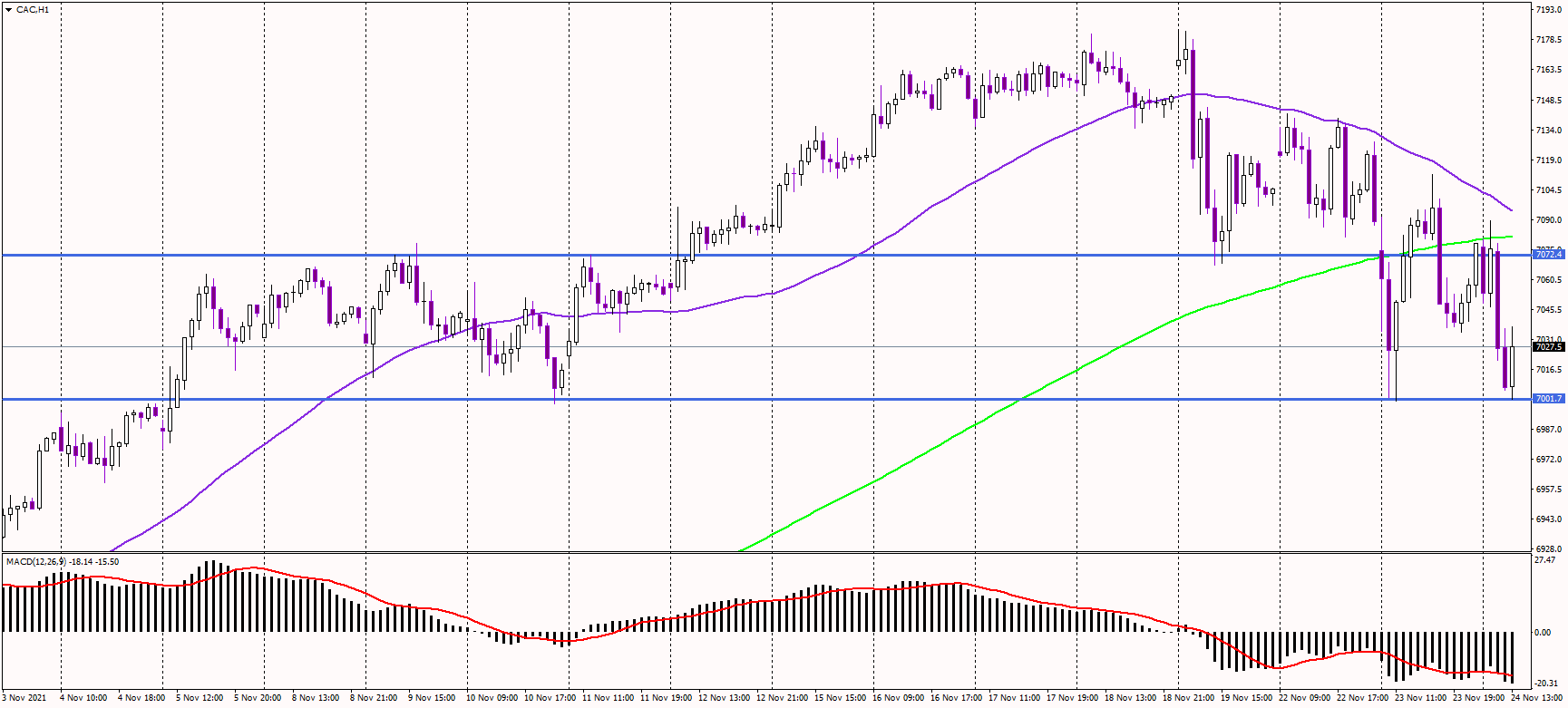

At the time of writing, the French CAC index was down 0.8% on the day, trading at around 7,030 EUR.

The key short-term support now stands at the psychological level of 7,000 EUR, where previous lows are also located. Moreover, many technical oscillators point to oversold conditions at the one-hour chart, implying a possible bounce.

The initial target for bulls will be at previous highs and lows at around 7,070 EUR. After that, bulls need to reclaim this area to attack the current cycle highs at 7,170 EUR.

Alternatively, if the index drops below 7,000 EUR, more considerable stop losses of long positions could be destroyed, potentially sending the price further lower toward 6,900 EUR.

Weak euro and ultra dovish ECB monetary policy should support European equities, despite ongoing lockdowns. If inflation stays high, investors will likely park their money into stocks and not into bonds.

CAC hourly chart 1 PM CET