EURCHF Plunges 200 Pips as SNB Unexpectedly Hikes Rates

16 June 2022

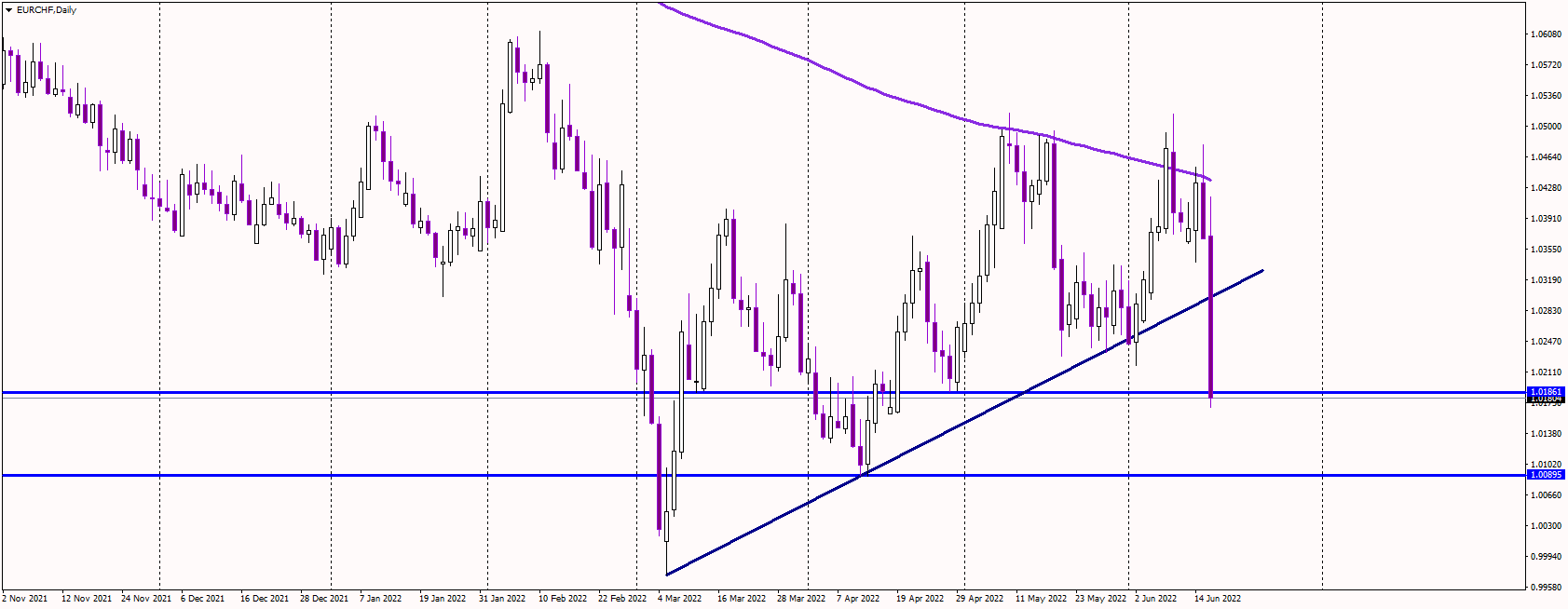

The EURCHF cross declined more than 200 pips, or 1.7% on Thursday, following a somewhat surprising decision by the Swiss National Bank to raise rates.

When writing, EURCHF traded at 6-week lows in the 1.02 area.

SNB hikes rates

At the conclusion of the June monetary policy meeting, the SNB shocked the markets by raising the policy rate by 50 basis points to -0.25%. Moreover, the SNB left the door open for more rate increases at the following meetings to combat escalating inflationary pressures.

Following the decision, According to Reuters, Chairman Thomas Jordan stated that the Swiss franc was no longer highly valued as a result of its recent decline.

"There are signs inflation is spreading to goods and services not affected by Ukraine and pandemic. Without policy rate rise today, forecast inflation would be much higher," he said.

Parity in play again?

It looks like the support near 1.0180 will not hold the selling pressure, likely sending the price further lower toward April lows at 1.0080. However, market players might want to retest the parity again, which managed to hold in March.

Alternatively, if sentiment improves, the price must stabilize above 1.0250 to cancel the immediate bearish pressure. Considering the declines in global markets such as equities and bonds, the Swiss franc could continue strengthening.