EURJPY Returns to Cycle Highs

29 April 2022

Sentiment improved notably on Thursday and Friday, leading to a solid rally in risk assets, such as the EURJPY cross or stocks.

The euro traded 0.4% higher against the yen at the time of writing, seen near 137.70 ahead of Friday's US session.

EU and US data on agenda

According to a preliminary assessment released on Friday, the Eurozone economy grew by 0.2% in the three months to March 2022, below expectations of 0.3% and 0.3% previously.

On an annualized basis, the Eurozone's GDP increased by 5.0% in Q1 compared to 4.7% in the fourth quarter of 2021, meeting predictions of 5.0%.

Additionally, the annualized Eurozone Harmonised Index of Consumer Prices (HICP) increased by 7.5% in April, up from 7.4% in March, according to Eurostat's latest statistics released on Friday. The consensus predicted a value of 7.5%.

In April, core data increased by 3.5% year over year, compared to 3.2% expected and 2.9% booked in March.

During the US session, personal income and spending figures, as well as the April consumer confidence index, will be released. In addition, the Chicago Purchasing Managers Index will be published as well.

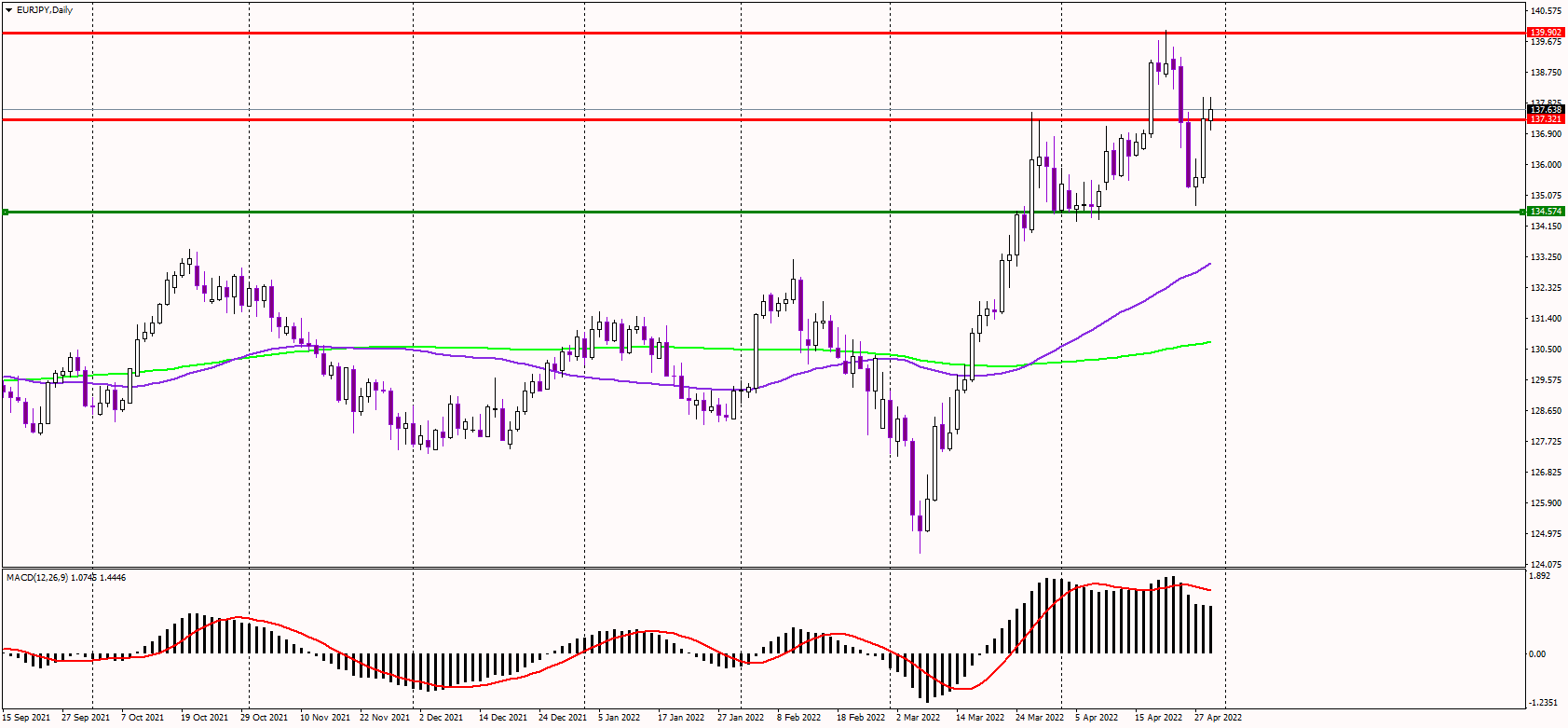

It appears that the medium-term support could be found in the 134.60 region (the green horizontal line). As long as the price trades above it, the medium-term outlook seems bullish.

The short-term support/resistance will likely be in the 137.20 zone, and if the euro jumps above it, the short-term trend could remain bullish.

The most notable resistance is now at the cycle highs at 139.90. Failure to jump above it could lead to profit-taking. On the other hand, a strong push above 140 could send the single currency toward 145 in the following weeks.