EURUSD Advances Toward 1.06

21 June 2022

The euro jumped above 1.0550 today as investors sold the greenback, mainly due to the improving sentiment and a slight downtick in short-term US yields.

European problems

President of the European Central Bank Christine Lagarde stated during her testimony before the European Parliament that a recession in the eurozone was not their "baseline scenario" and reaffirmed their intention to hike key rates by 25 basis points (bps) in July.

Olli Rehn, a member of the Governing Council of the European Central Bank (ECB), stated on Tuesday that "it is highly likely that September rate rise is greater than 25 bps."

The markets are currently pricing more than 1% of hiking this year, but the ECB is so behind inflation that a 1% hike will unlikely stop the inflation.

Is EURUSD looking bullish?

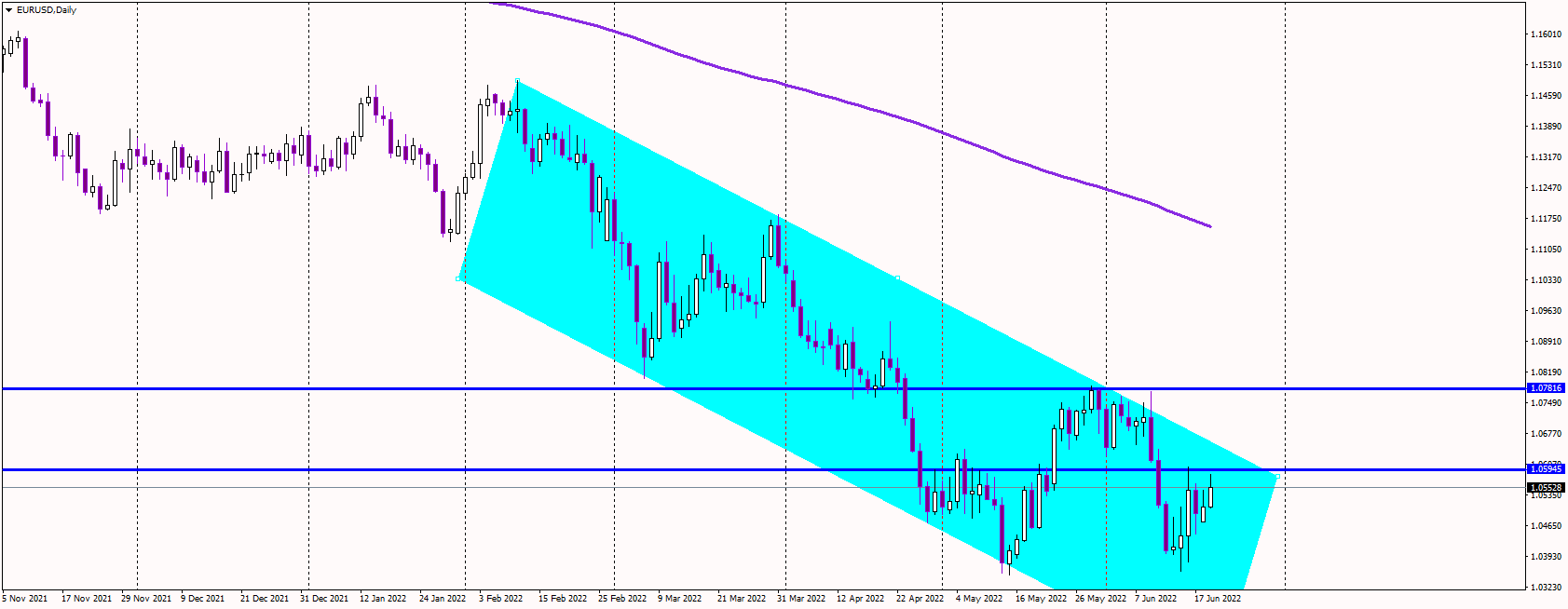

It looks like the EURUSD pair could finally break out from the long-term bearish channel, likely leading to a more meaningful rally. The next resistance is at 1.06, followed by June's highs at 1.08.

On the downside, the euro failed to create new lows and stopped at 1.04, which could also be interpreted as a bearish weakness. Thus, the 1.04 support is the critical level for this week's trading.