Friday has brought some consolidation to the Forex market, but overall the greenback remained bid, pushing the EURUSD pair to new cycle lows below 1.1440.

The policy divergence between the Federal Reserve and the European Central Bank (ECB) drives the pair's action. While the Fed is expected to hike rates two or three times in 2022, the ECB has reiterated its stance not to hike rates in 2022. Therefore, the long-term downtrend might persist in the EURUSD pair.

Earlier today, the euro zone's industrial production for September improved modestly to 5.2% year-on-year (from 4.9% in August). At the same time, the monthly change came out at -0.2%, up from -1.7% previously. Both numbers managed to beat analysts' estimates.

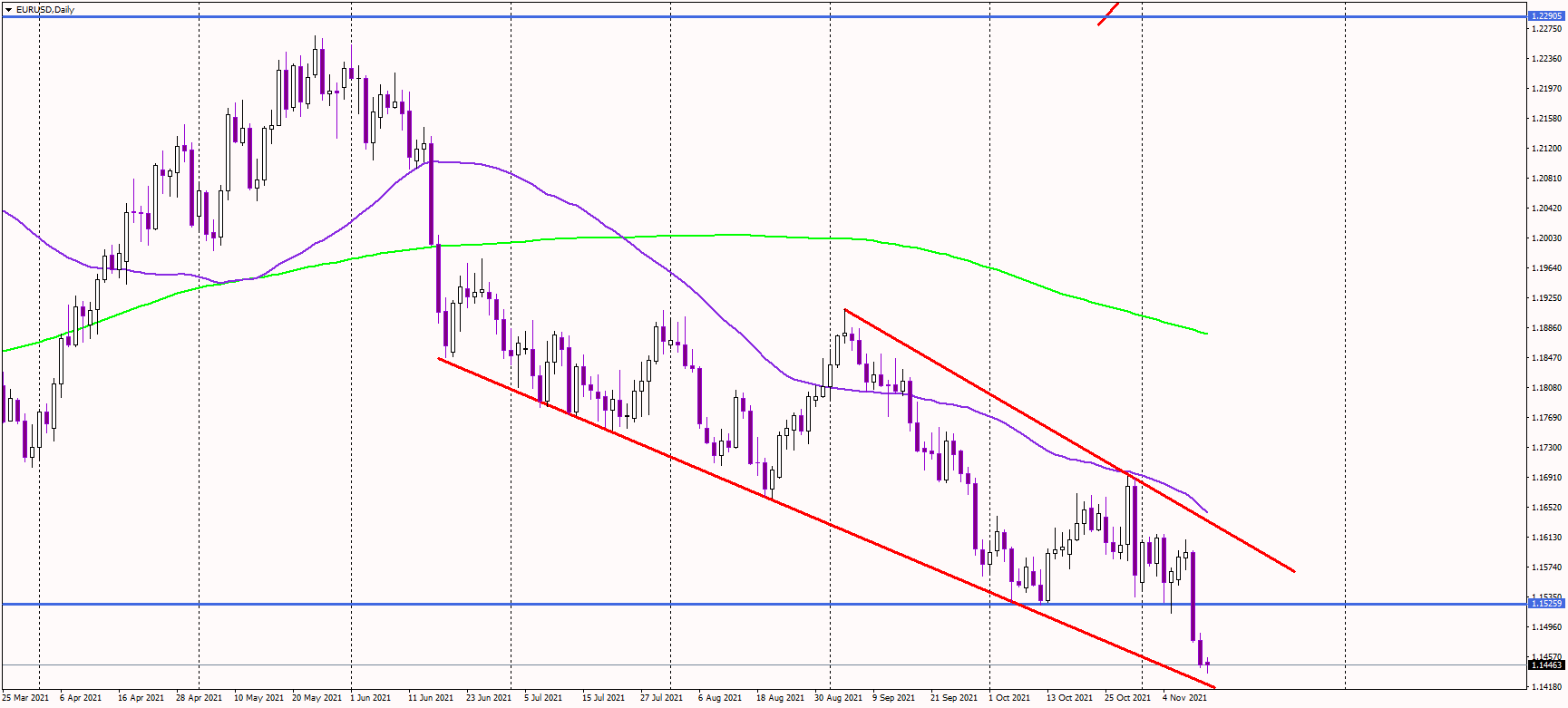

The single currency dropped to the supporting descending trend line again, limiting the pair's decline since July. Therefore, considering the oversold conditions and the presence of significant support, we might expect a slight bounce, targeting 1.15 and previous lows of 1.1520.

If the pair jumps above 1.1520, the immediate bearish pressure could ease, with a possible rally toward the upper descending trend line near 1.1580. Alternatively, if the euro drops below the lower trendline at 1.1420, a further decline to 1.1360 might occur.