GBPUSD Stalls Near Key Resistance, Awaits US Jobs Data

04 February 2022

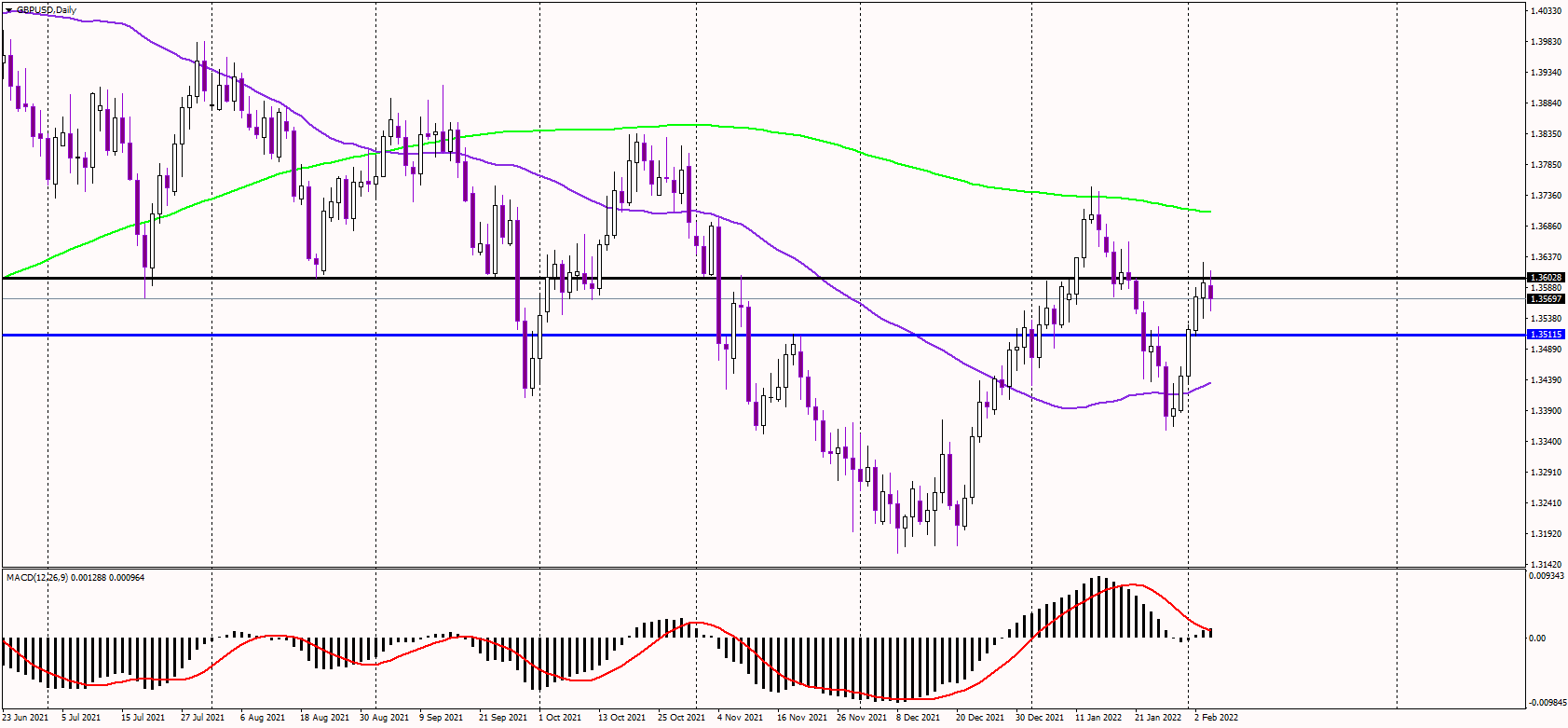

The GBPUSD pair consolidated on Friday as bulls took some profits from this week's rally, bringing the Pound some 200 pips higher.

On Thursday, the Bank of England raised its primary interest rate by 25 basis points to 0.5% (50 bps) as widely expected. However, the following statement showed a bullish surprise as four BoE Monetary Policy Committee (MPC) members voted for a more considerable 50 bps hike that would have taken rates to 0.75%.

Sterling shot higher following the decision and jumped above 1.36; however, it failed to hold onto those gains and slipped on Friday.

Later today, the US jobs market data are due, and market participants expect a notable decline in new jobs, likely undermining the US dollar.

Should the GBPUSD pair jump above the 1.36 level, we could see a rally toward the 200-day moving average (the green line), where the Pound failed sharply in January. Once that level is taken out, the medium-term bull market could return.

On the other hand, if today's US data lead to USD buying, the support for the pair is seen near 1.35. Considering the recent strong rally, the Pound looks overbought in the short-term charts.

On the other hand, the MACD indicator sent a bullish signal on the daily chart, likely supporting the upward price action in the following days.