USDJPY Fails to Hold Gains, Turns Negative

16 May 2022

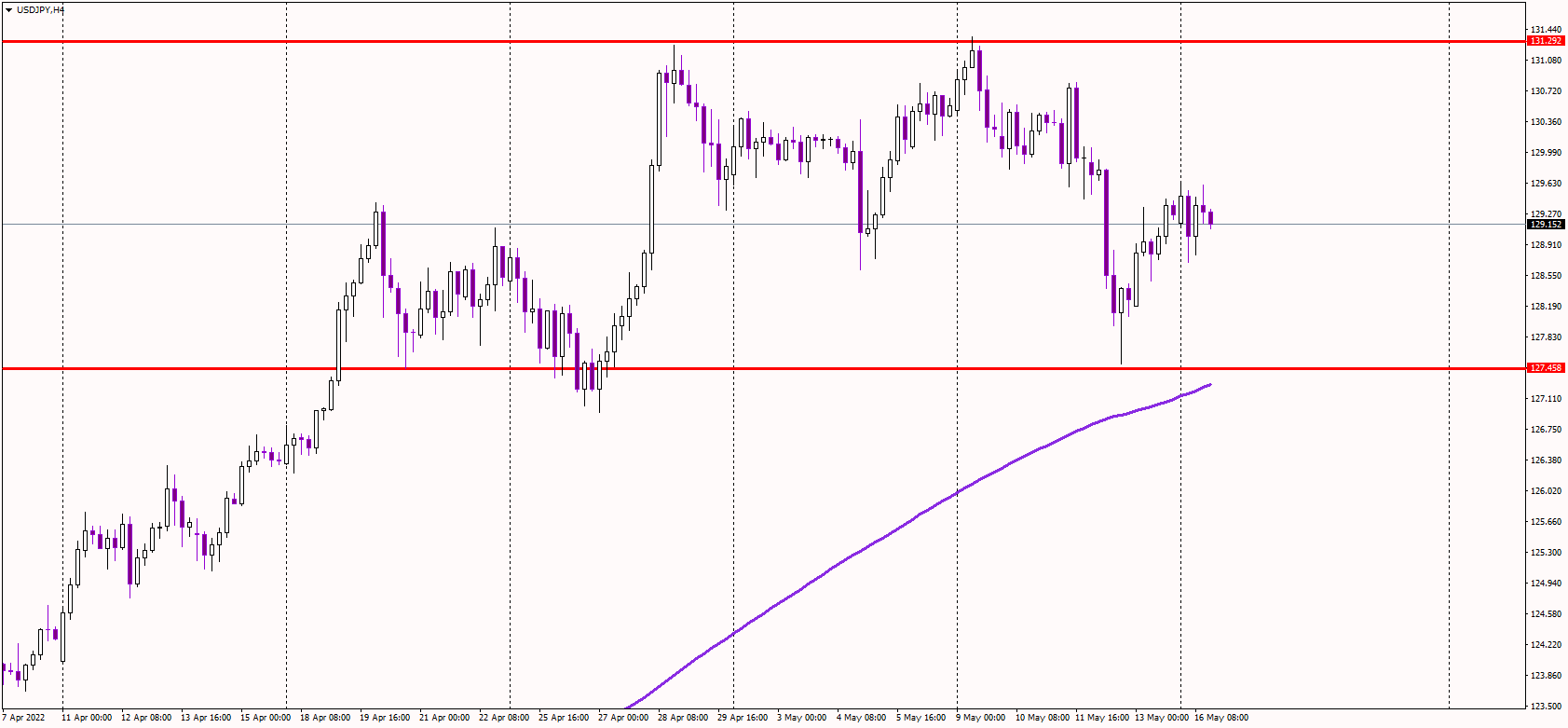

Earlier gains in the USDJPY pair are quickly gone as US traders sold the rally, keeping the pair below the psychological 130 threshold. At the time of writing, the pair traded at around 129.10, slightly lower on the day.

Global economy slowdown

Goldman Sachs raised worries about U.S. growth this year by lowering its predictions to reflect the financial market turmoil caused by the Federal Reserve's tightening of monetary policy. As a result, the bank now forecasts 2.4% annual growth this year and 1.6% growth in 2023, down from 2.6% and 2.2% previously.

As a result of the current round of virus-related restrictions in China, new economic statistics from the country came in weaker-than-expected. Retail sales in China fell 11.1% in April compared to the same month the previous year, the worst loss since March 2020, while industrial production fell unexpectedly by 2.9%.

“The market’s concerns around the combination of Fed tightening and expected global slowdown continue to argue in favor of volatility and instability in risk assets,” said analysts at ING in a note. “Ultimately, this should keep many investors interested in buying the dollar dips.”

Consolidation ahead

For now, the US yields might have peaked, implying some consolidation and profit-taking in the USDJPY pair following the recent gigantic rally.

Since the USD has failed to post new highs, it looks like a double top pattern, a bearish reversal formation. The formation would be confirmed by a drop below 127. In that scenario, we might see a more significant decline as traders would start exiting their long positions.

On the other hand, the intraday resistance appears near 129.60, with another selling zone at around the 130 barrier, should the pair start rising again.