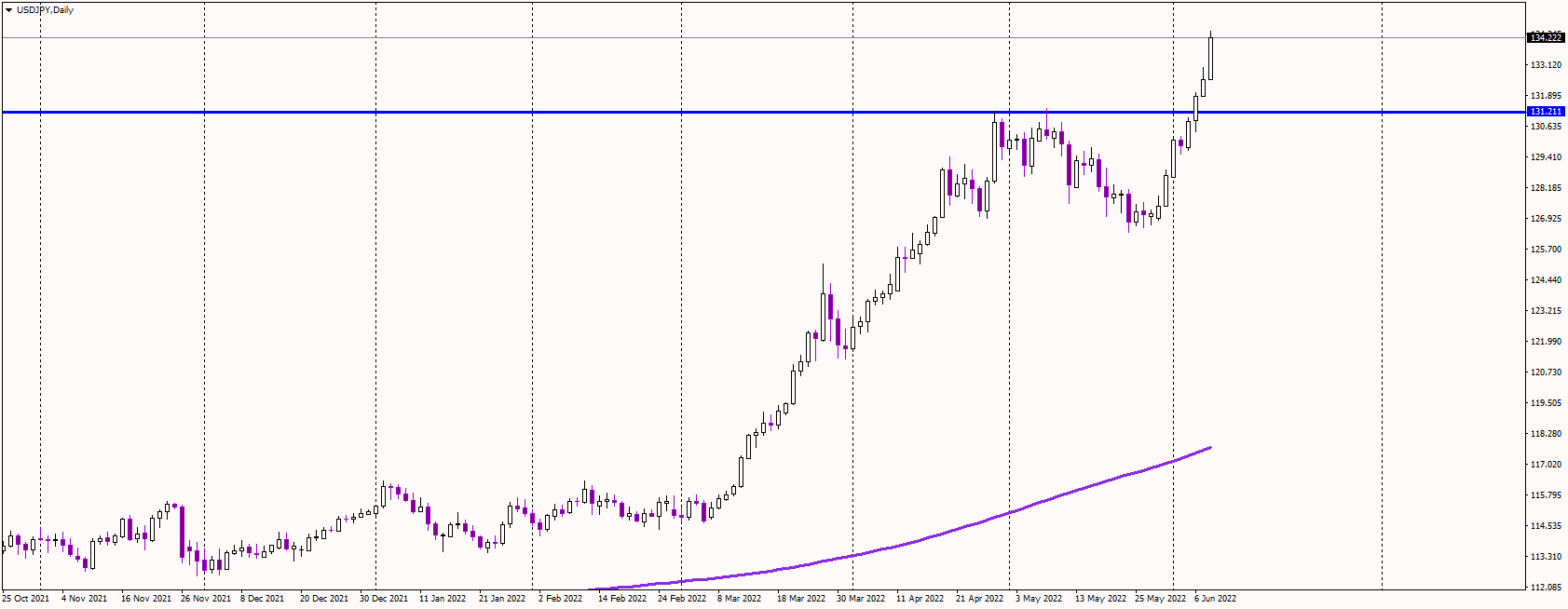

USDJPY Jumps 1%, Touches 2002 Highs

08 June 2022

Another day, another record for the greenback as the yen remains unfavorable in the current inflation environment due to the Bank of Japan's inactivity.

US Housing market deteriorates

Mortgage applications in the United States fell even lower last week. Increasing interest rates and higher home prices brought buying and refinancing activity to its lowest level in more than two decades.

According to the Mortgage Bankers Association's weekly market composite index, mortgage loan application volume fell 6.5% in the week ending June 3. This was the fourth weekly loss in a row, and the dip from the previous week was 2.3%.

"Weakness in both purchase and refinance applications pushed the market index down to its lowest level in 22 years. The 30-year fixed-rate increased to 5.4% after three consecutive declines. While rates were still lower than they were four weeks ago, they remained high enough to still suppress refinance activity," Joel Kan, MBA's associate vice president of economic and industry forecasting, said in a press statement.

BoJ remains dovish

According to Reuters, Bank of Japan (BoJ) Governor Haruhiko Kuroda stated on Wednesday that the BOJ must continue to promote economic activity by maintaining the existing monetary easing

"The current 2% inflation is simply caused by higher energy prices and will not be sustainable. Therefore, we have to continue our monetary easing to support economic recovery and make the labor market much tighter," he said.

As a result, the USDJPY pair pushed above 134, achieving the highest level in more than 20 years. The divergence in monetary policies is hard to ignore, likely leading to further gains for the pair.

The primary medium-term support is now seen at 131.20, where previous cycle highs were. As long as the USD trades above it, the uptrend remains intact.

Bulls will likely be targeting 135, but from the medium-term perspective, we might see USDJPY above 140 for the first time since 1998.