The past week has been a perfect example of how bad news can be seen as good news, as long as it leads to the Fed cutting interest rates. The labor market is showing more and more cracks, but so far, investors aren’t worried about the underlying strength of the U.S. economy. As long as the Trump administration runs inflation hot again, the show goes on.

Macro

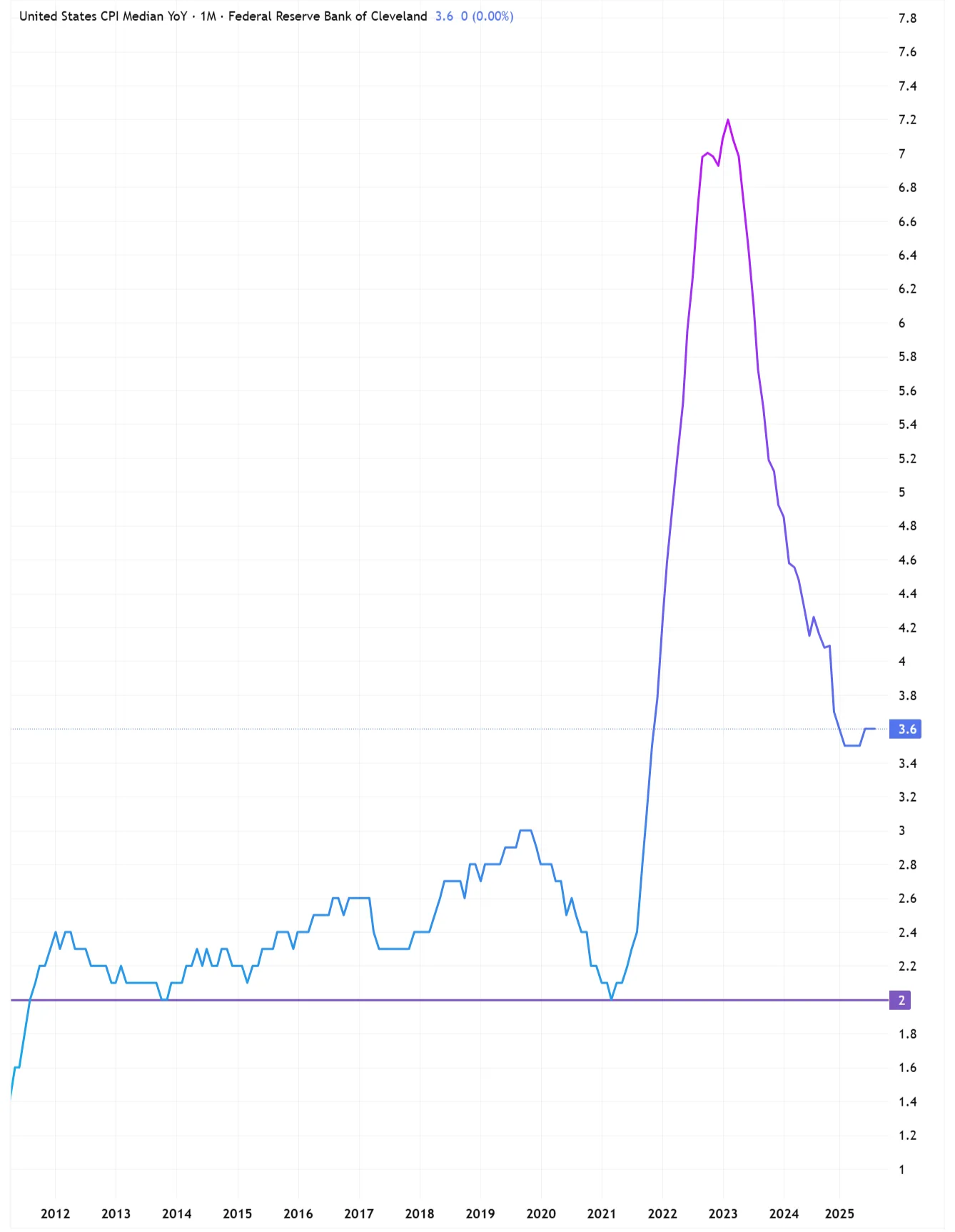

It’s been more than four years since inflation was last around 2%, and yet the Fed is cutting again, proving that the pursuit of its dual mandate (moderate inflation & strong labor market) has led to 3% becoming the new 2% inflation-wise, and the economy’s strength is taking priority.

The Fed thinks its current policy is still restrictive, even after the 25bps cut to the 4.0-4.25% range. Powell said this rate cut was ‘risk management’, which is something he hasn’t said before.

It seems the conviction that tariffs could durably drive up inflation has lessened, and Powell, along with other Fed members, now views it more as a potential one-time bump. In that sense, this rate cut serves as a hedge against the risk of misjudging the impact of tariffs on inflation, with the added side benefit of easing some of Trump’s political pressure.

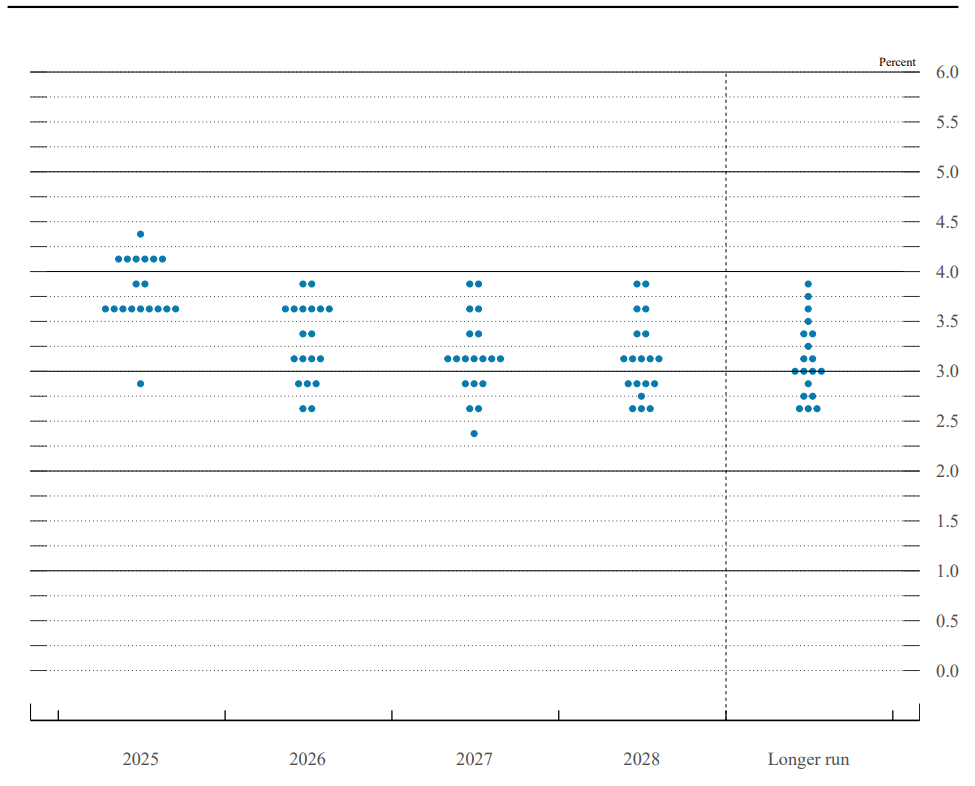

Regarding this week’s meeting, the dot plot, which illustrates where Fed members expect the funds rate to be in the coming years, paints an interesting picture. The dots are widely dispersed, signaling a lack of consensus within the Fed on the path of inflation and the approach to potential further rate cuts.

With just two more FOMC meetings left this year, these are the following expectations of Fed members by year-end:

9 of 19 see 2 more cuts

2 of 19 see 1 more cut

6 of 19 see no more cuts

1 sees 1 rate hike (back to the 4.25-4.5% range)

And then Stephen Miran sees a whopping 5 rate cuts. However, this might be an attempt at gaining Trump’s favor for next year’s chair position.

Theoretically, Fed members always have to make their decisions exclusively based on the economic data. But since Trump has made it very clear that he wants to see interest rates lower, there is an opportunity for any of the Fed members to now push for more rate cuts, which would then significantly improve their chances of being appointed as Fed chairman once Powell’s term runs out in May of 2026. In cases like these with Stephen Miran, it is thus hard to know whether his decision is based on fundamental beliefs or if political games are being played.

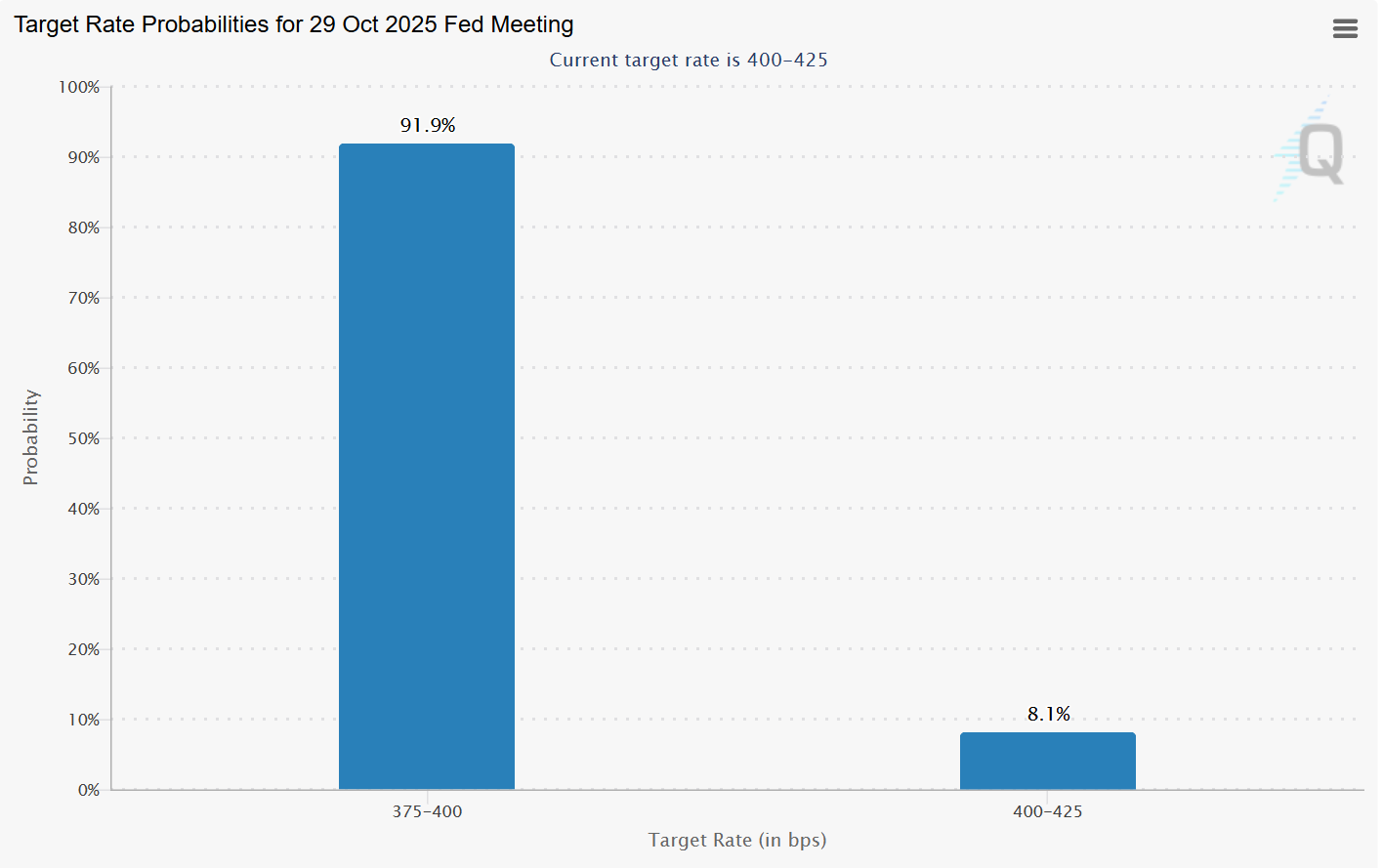

In conclusion, the takeaway from this quite eventful FOMC meeting is that interest rates have been cut, but are still restrictive, and that we should probably expect at least one more rate cut in either October or December.

CME Futures are now pricing the likelihood of a 25 bps rate cut in October at 91.9%, with no one expecting a 50 bps cut. The odds of a rate cut could be slightly overstated, however, as the Fed might pivot to a more hawkish stance for the next meeting if it sees that inflation remains sticky.

Stocks

In situations like these, where bad news is good news because it leads to lower future interest rates, it’s often tricky to figure out how risk-on assets will perform. The market could see the recent developments from two sides:

- The Fed is cutting; everything to all-time highs!

- The Fed is cutting because the economy is bust, sell everything!

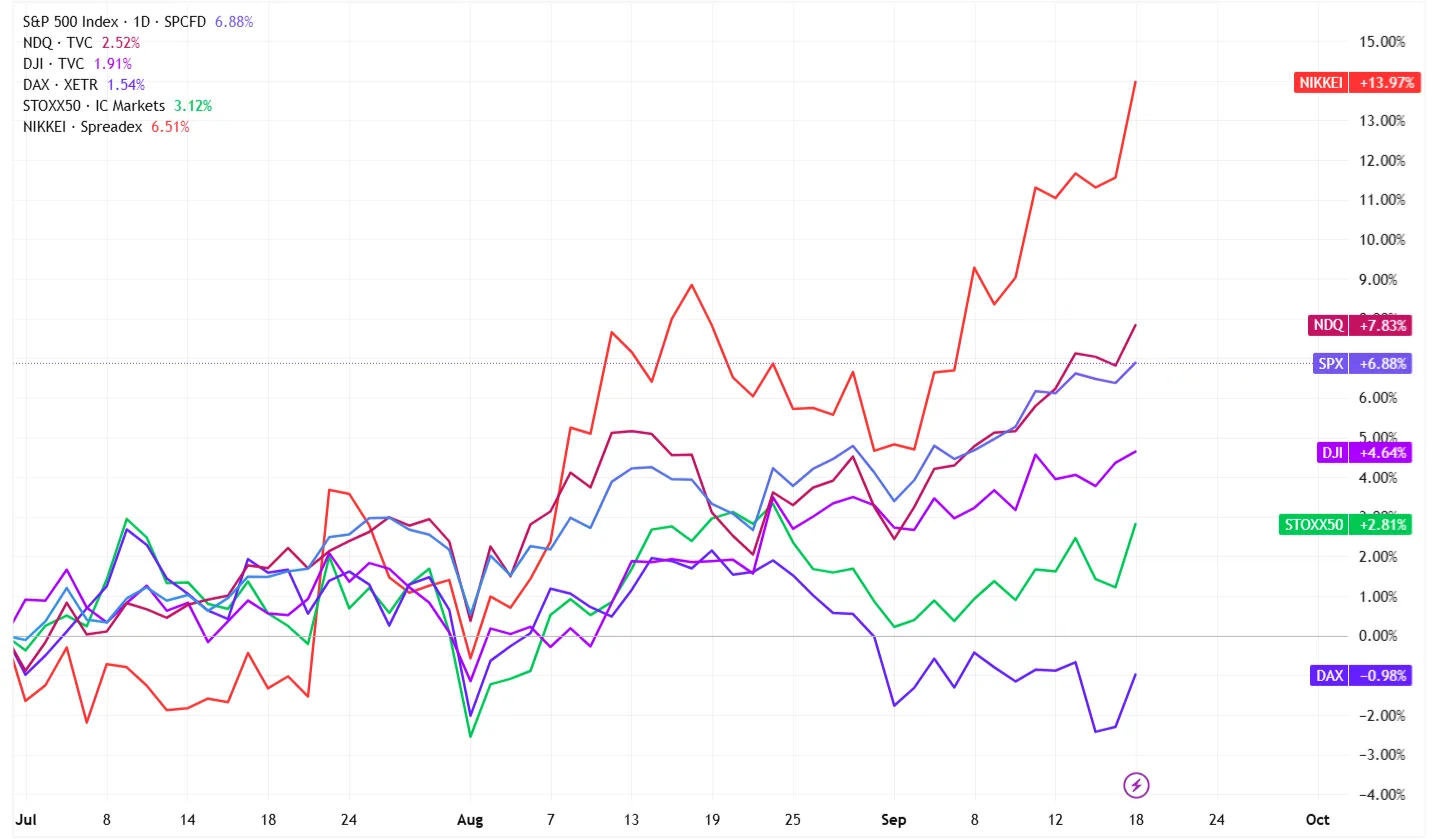

So, really, things for a big part come down to the market sentiment at the time. Which is currently cautiously optimistic, with markets at all-time highs (S&P 500 $6.656,80 & NQ $24.550), driven by the AI hype. But others are also seeing the worrying data coming in, the uncertainty of the tariffs, which have still not really shown up in inflation, and might take a lot longer to show up, Trump threatening the Fed’s independence, and general valuations of the stock market are in their upper percentiles when looking at average P/E ratios.

Nonetheless, the party is still going on, so as Chuck Prince said, we must keep dancing.

Other major indices are also at or close to ATHs, with the NIKKEI leading the pack with an impressive 14% profit in the second half of 2025 so far, profiting from a weaker Yen. On the European front, the DAX & STOXX 50 are lagging.

Forex

EUR/USD is still at its highs, but is currently creating a Swing Failure Pattern (SFP) on the weekly chart, showing a sharp retracement since the FOMC meeting.

SFPs on their own aren’t a reliable indicator for price, but considering this sweep was of a prominent swing high, the relevance of this one is much bigger. Next week, there could be some interesting short opportunities, unless we were to see the price climb back above the 1.18306 level before Friday evening, which would invalidate the weekly SFP.

The 4-hour chart is already showing some potential areas to get short from, although execution will depend on how the price develops from here. It’s mostly the upper box that attention should be focused on, as it’s a clear resistance area that’s been tested from both sides and coincides with the swing high from July 1st.

All other majors are showing similar reactions post-FOMC, although the potential setup looks the cleanest on EURUSD.

For the crosses (non-dollar-denominated forex pairs), GBPYJPY continues its slow grind higher, sitting around the 200 mark. These small grinds often result in very strong and sudden price movements, so looking for any key inflection points could open up the potential for a high risk-reward trade.

Commodities

Gold is currently ranging after its recent push to new all-time highs. But more interestingly, silver has been outperforming. It’s long lagged, but now finally seems to be getting some of the same attention gold has been getting. In the past, durable silver outperformance has been relatively successful at predicting the end of gold’s bull run, but the recent outperformance is still in its young stages.

Nonetheless, an interesting development that could be a fundamental trigger for a future swing trade.

On the other hand, oil has been flat for a couple of weeks, after a relatively calm period of international conflicts and demand slowing down.

Conclusion

One-sentence summary for this week:

Macro is getting questionable, stocks are up, and the dollar is showing some newfound strength.

That wraps up the first edition of Axiory’s Weekly Market Pulse. Each week will provide a closer look at market trends and developments, with updates every Friday.