Introduction

This week's market action saw global indices and commodities reach new heights, fuelled by the momentum of last week's cautiously dovish FOMC meeting. With a relatively quiet macroeconomic calendar, a clear path opened up for American and Japanese equities to hit new all-time highs. The bullish sentiment extended to precious metals, too, with both gold and silver relentlessly pushing to new records.

Global Macro

This week presented a notably calm environment from a macroeconomic perspective, with few events of significance capturing the market attention.

Unchanged Swiss Rates

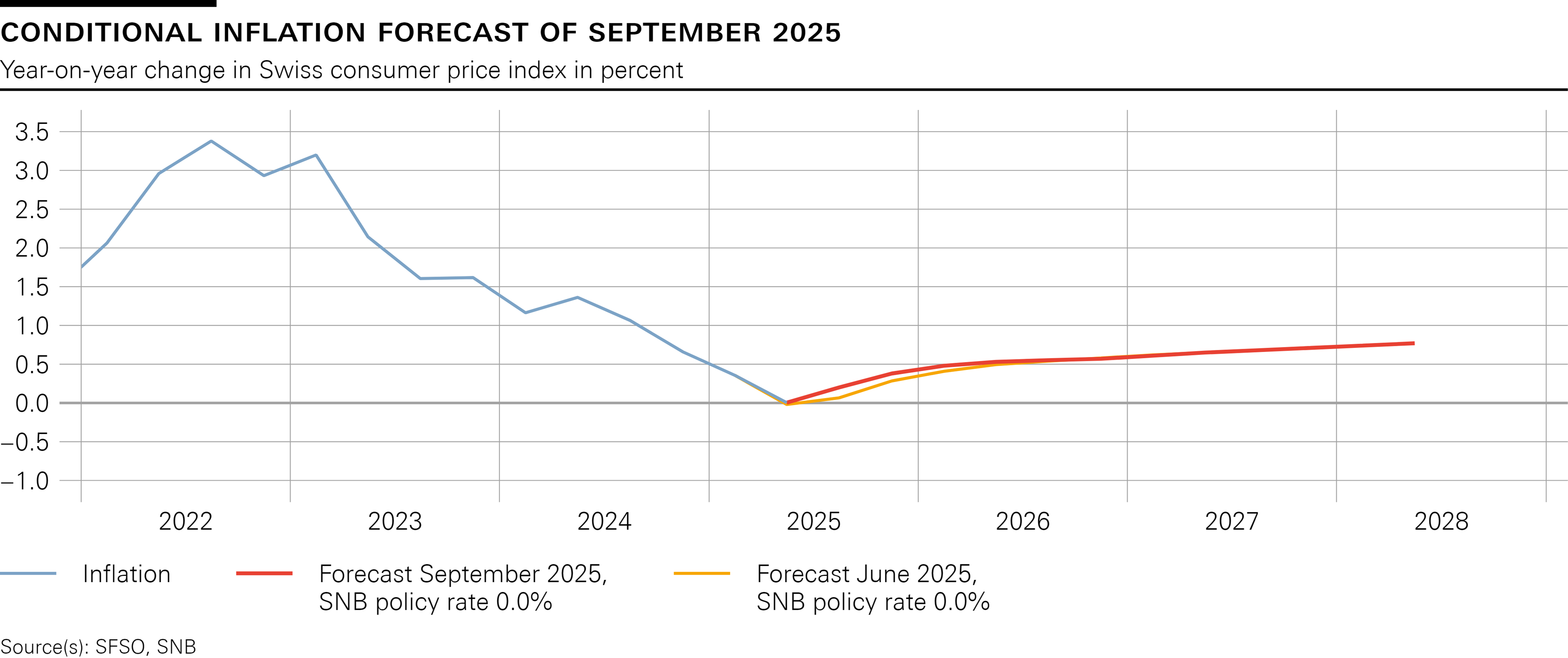

One of the week’s key events was the interest rate decision of the Swiss National Bank (SNB). As anticipated, the SNB maintained its benchmark interest rate at 0%.

The central bank projections suggest that inflation is expected to only reach 0.5% in 2026 and 0.7% in 2027, assuming that the rates remain at the current level of 0%. This environment could very well end up leading to a return to negative interest rates, as the SNB is worried about economic growth.

US Data Continues to Trickle in

Following last week’s cautiously dovish rate cut, the market’s focus remains squarely on US labour market strength and inflation metrics. On the growth front, the latest Gross Domestic Product (GDP) figure, reporting 3.8% Year-over-Year (YoY) growth, significantly surpassed the 3.3% consensus forecast.

The Friday release of the Core Personal Consumption Expenditures (Core PCE) index is of particular importance. As this is the Federal Reserve’s preferred gauge for assessing underlying inflation, this data figure will offer crucial insight into whether inflationary pressures are proving to be persistent.

Equities:

US Stocks Reach New Peaks

The week commenced with remarkable strength in American equities, as all major US indices recorded new All-Time Highs (ATHs). The S&P 500 reached $6.699,80 and Nasdaq 100 (NQ) hit $24.786,10. NQ was the outperformer this week. Notably, small-cap stocks, represented by the Russell 2000, also broke out to new all-time highs after a prolonged period of lagging behind.

Technical Outlook on the NQ

On the 30-minute timeframe, a key technical area to watch is the $24.385−$24.410 range which is currently undergoing a "flip" from resistance to support. Looking higher, the primary resistance area is around the $24.625−$24.645 level, beyond which the index should find a clear path towards new record highs.

Overall, the chart appears well-positioned for further upside. While a brief period of consolidation might be necessary before the next major push, the current structure does not indicate a market top. A TPO (Time Price Opportunity) chart suggests poor highs were formed at the recent peak, indicating a high likelihood of a retest. To seriously consider an intermediate-term top, we would need to see aggressive selling pressure step in at the highs. Instead, the current price action suggests buyer exhaustion, meaning a brief consolidation is likely needed before fresh buying power is ready to enter the market.

Global Equity Performance

Across the Atlantic, European indices, including the DAX and Euro Stoxx 50, held up better than their American counterparts, closing the week around breakeven. On the Japanese side, the NIKKEI keeps outperforming and putting in ATHs, although this strength is mostly to be explained through the Yen’s weakness who has lost 2.2% against the Dollar since last week.

Forex

Review of the Past Week

On the Forex side, this week can be simply summarized as Dollar strength. We’ve seen the Dollar rising across all majors, with the lows being formed at the last week’s FOMC meeting.

As discussed last week, a potential short setup on EURUSD was identified, following a Swing Failure Pattern on the Weekly chart. Dropping down to the 4-hour chart showed a clear resistance area. Even though the price didn’t test the area, the higher timeframe bearish bias proved correct with EURUSD closing decisively lower this week.

Outlook for the Week Ahead

Stepping into the next week, the Daily timeframe on all majors is hinting at a short period of consolidation, likely followed by more Dollar strength. This price action, however, will be strongly influenced by the Core US PCE data scheduled to release at 14.30 on Friday CET time (8.30 EDT & 21.30 JST).

The data coming in at expectations would likely lead to a small consolidation. This would drag into the early start of next week, with continuation later in the week. Any surprises on this data would invalidate this bias.

USDCAD Setup

This long bias has the cleanest setup on USDCAD, where the Dollar strength has been even more pronounced than on other majors. A potential way to play this is to wait until next week, seeing at least one day of consolidation. Then monitor for a resistance area on the 30-minute or 1-hour chart to be flipped into support, and use that level to enter a long position, targeting new highs.

This is an example of how a similar setup shaped up in USDJPY last week. Wednesday and Thursday saw a strong uptrend with visually big daily candles. Afterwards, Friday turned into a consolidation day, trying to find support around the upper end of Thursday’s strength day.

The price then failed a minor 30-minute support area and turned it into resistance. At this point, the resistance area could either hold, with price retracing the daily trend candle (Scenario B), or break back through the resistance area again, turning it into future support (Scenario A). Once this happened, the S/R flip is in play, and the execution is to target the highs with a stop below the support area.

Coming into next week, we would want to see something similar in USDCAD to consider a long position once we’ve isolated our flipped support/resistance area.

Commodities

Gold and Silver continue to steal the show, relentlessly putting in new all-time highs. Last week we noted that Silver has started outperforming Gold, which might be a future top signal for Gold.

Year-to-Date, Silver is up 55%, which is just slightly higher than Gold’s 44%. While the prices on both charts look overextended, it’s still too early to consider short positions as the momentum continues to persist.

Conclusion

One-sentence summary for this week:

Fed’s easing catalyst puts indices and hard metals at ATHs, with the Dollar continuing last week’s strength.

Thank you for reading this week's Market Pulse, every week will provide a closer look at market trends and developments, with updates every Friday.