Introduction

Welcome to this week’s Market Pulse. An otherwise quiet week got shaken up by Trump, as markets fell back into tariff fears. More rate cuts from the Fed are expected, despite a complete absence of inflation and unemployment data.

Global Macro

Trump-China TACO

Last week on Friday, Trump stated that China had kicked off a Trade War, and the U.S. would levy a 100% tariff on all Chinese imports starting November 1st.

This immediately led to big selloffs in the S&P 500 and Nasdaq. Afterwards, we got the quickest TACO (Trump Always Chickens Out) yet, with just eight hours between the escalation and de-escalation of the trade war.

Fed rate cuts priced in

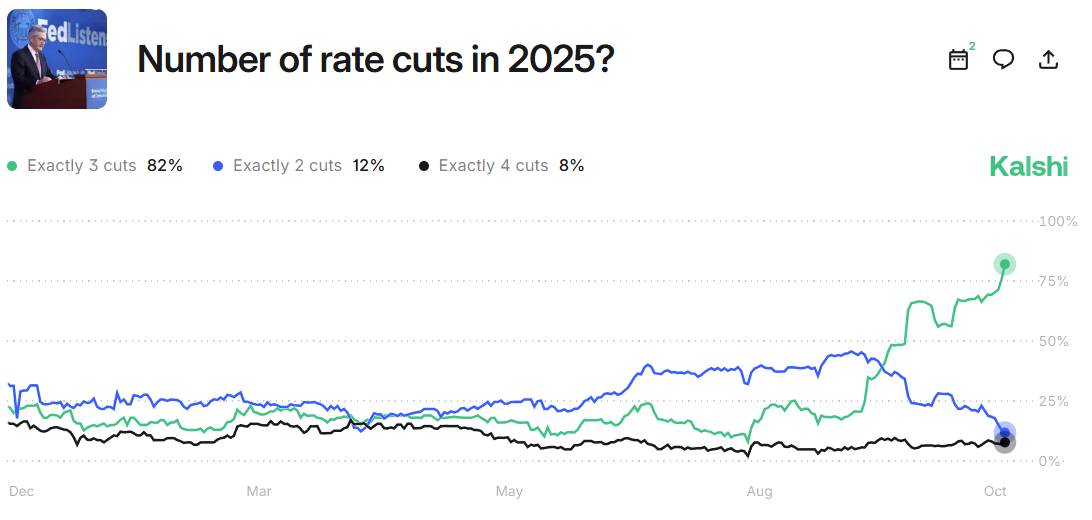

Despite the lack of US data due to the government shutdown, markets are pricing in higher likelihoods of rate cuts in both of the remaining FOMC meetings this year (October & December). We’re seeing a lack of consensus, however, in how many rate cuts to expect.

The traditional tool for this has been the CME Target Rate Futures, which are currently expecting a 99% chance of a rate cut in October and an 80% chance of an additional 25bps rate cut in December.

On the other hand, Kalshi prediction markets are estimating that there is a 93% chance that the Fed will cut at least three times this year. While this might seem overly optimistic, these prediction markets have proven to be highly accurate at predicting events in the past, which means that this outcome should at least be considered.

However, as it’s unlikely that the government shutdown will be solved by next week Friday, it will mean that the Fed will come into their October FOMC meeting with no new inflation data since the last cut. This nuance could mean that markets are overstating the odds of rate cuts.

Equities

American Sell-Off

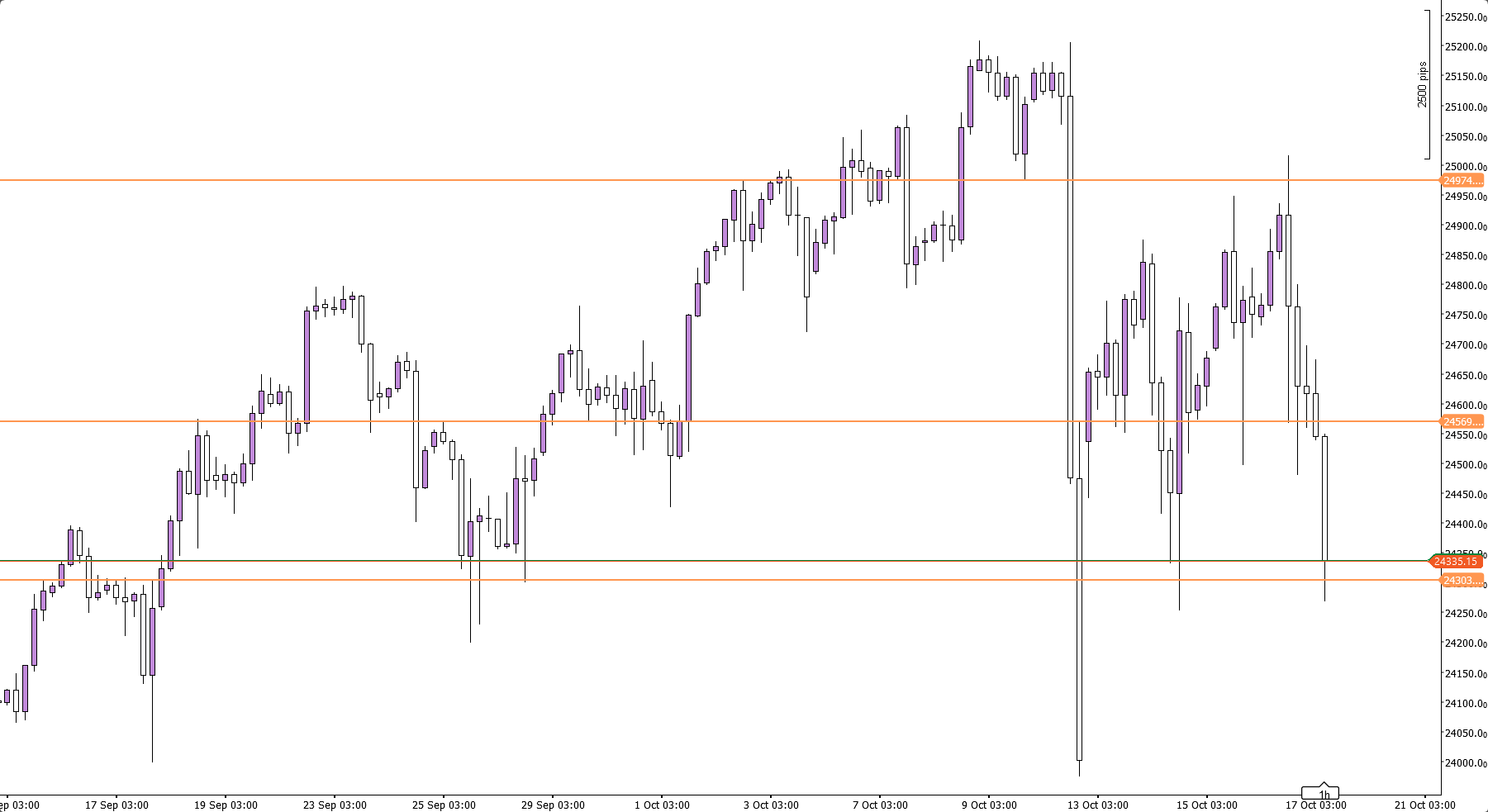

After last Friday’s Trump tweet, U.S. indices saw a swift sell-off. The S&P 500 and Nasdaq dropped respectively 4% and 5%. Currently, we can see three major Support/Resistance areas on the 4 hour Nasdaq chart.

As of release of this week’s rundown, the lower bound of this range is being tested. A bullish pattern here would be a sweep of the previous low at $24,253, with a swift acceptance back into the range, holding the $24,303 level. At that point a rotation to the upper end of this range at $24,975 would become a likely outcome.

Europe and Japan holding up strong

The NIKKEI, Euro Stoxx and DAX held up well compared to their American counterparts. Although they too sold off on the Friday tariff news, their drops were relatively smaller and price has been able to regain those losses, with price consolidating just under All-Time-Highs.

Forex

In Forex, the past week has been shaped most notably by a weak Dollar, seeing all Dollar denominated pairs edge closer to their swing highs (or lows).

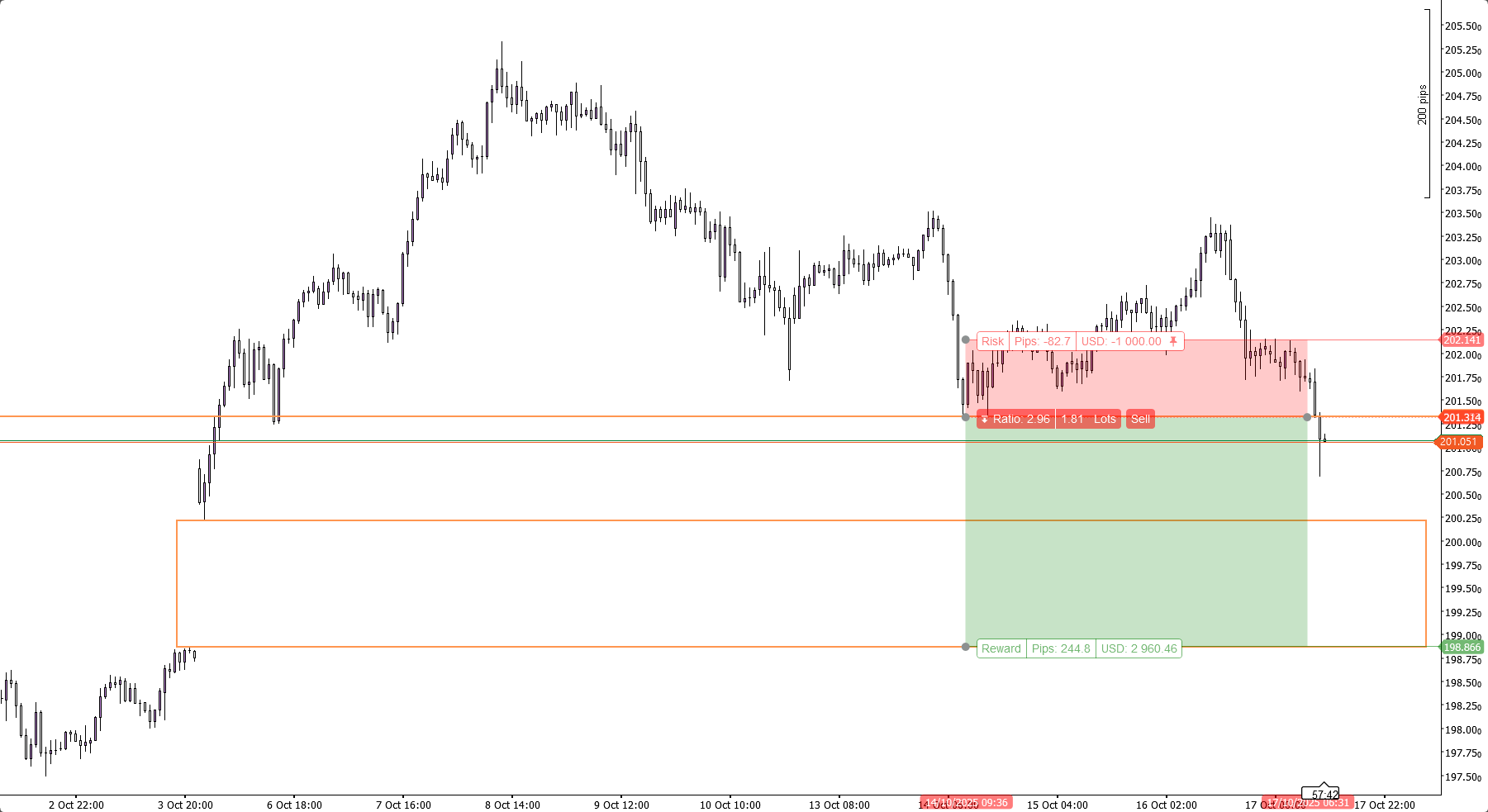

In GBPJPY, price is moving down in an attempt to close the Weekly Open gap that price left on the 6th of October. As a high percentage of these market gaps tend to fill, a potential setup could involve identifying a strong support area that, upon breaking, flips into a key resistance level. Traders could look to enter a short position off that level, with the gap fill as a target.

Commodities

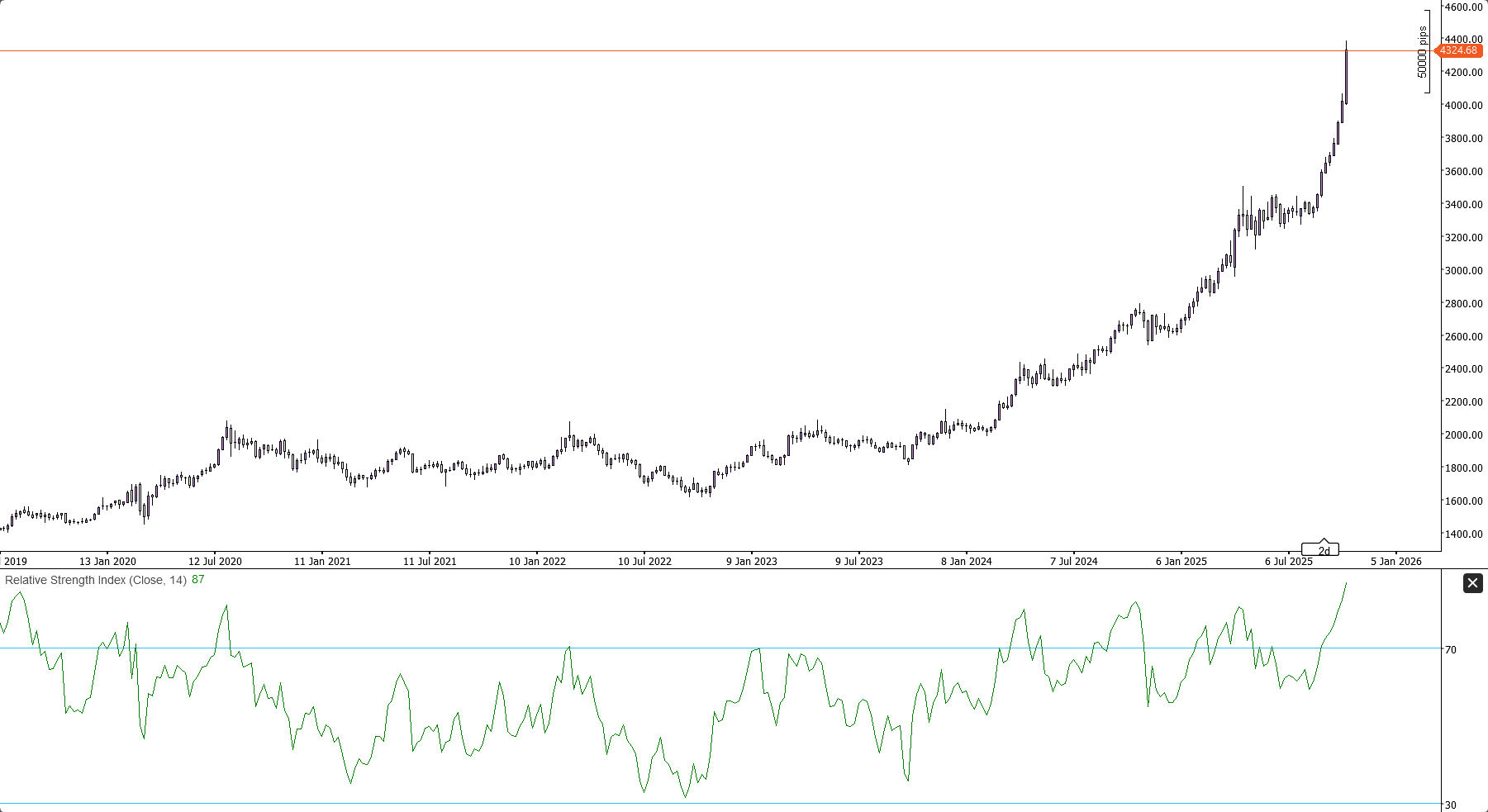

Last week, Gold bulls were celebrating the iconic $4,000 landmark, and just a week later, price is even higher, already up to $4,300. The asset hasn’t seen a down week since the start of August, and the Weekly RSI is now at 87, levels unseen since 2007.

While the Relative Strength Indicator in and of itself isn’t a reliable predictor of future price movement, it does show that in the short-term, Gold is well into the overbought area, which might signal a possible consolidation, but calls to prudence as the upward push is strong.

This week, Silver followed suit like usual, pushing to $54. However, it failed to keep up its recent trend of outperforming Gold, which is reflected in the GOLD/SILVER chart consolidating at the lows.

Conclusion

One-sentence summary of the week

Tariff terrors saw U.S. Indices drop, as Gold is historically overextended