Introduction

This week was strongly macro-driven as narratives were dominated by interest rate decisions across three key central banks. While Powell delivered the expected third consecutive rate cut, FX and indices were surprisingly calm. However, Silver is in a historic bull run, and EURSEK seems to be providing a bullish bias coming into next week.

Global Macro

FOMC

This week brought the long-awaited FOMC meeting. Expectations coming into the meeting were a 25bps cut and relatively hawkish guidance from Powell going forward. That is exactly what we got.

In total, there was a decent amount of dissent. Miran, the usual dove, voted for a 50bps cut, while Goolsbee and Schmid voted for no change. In the post-FOMC press conference, Powell clearly stated that the Fed is now within the higher range of where the neutral rate is estimated to be.

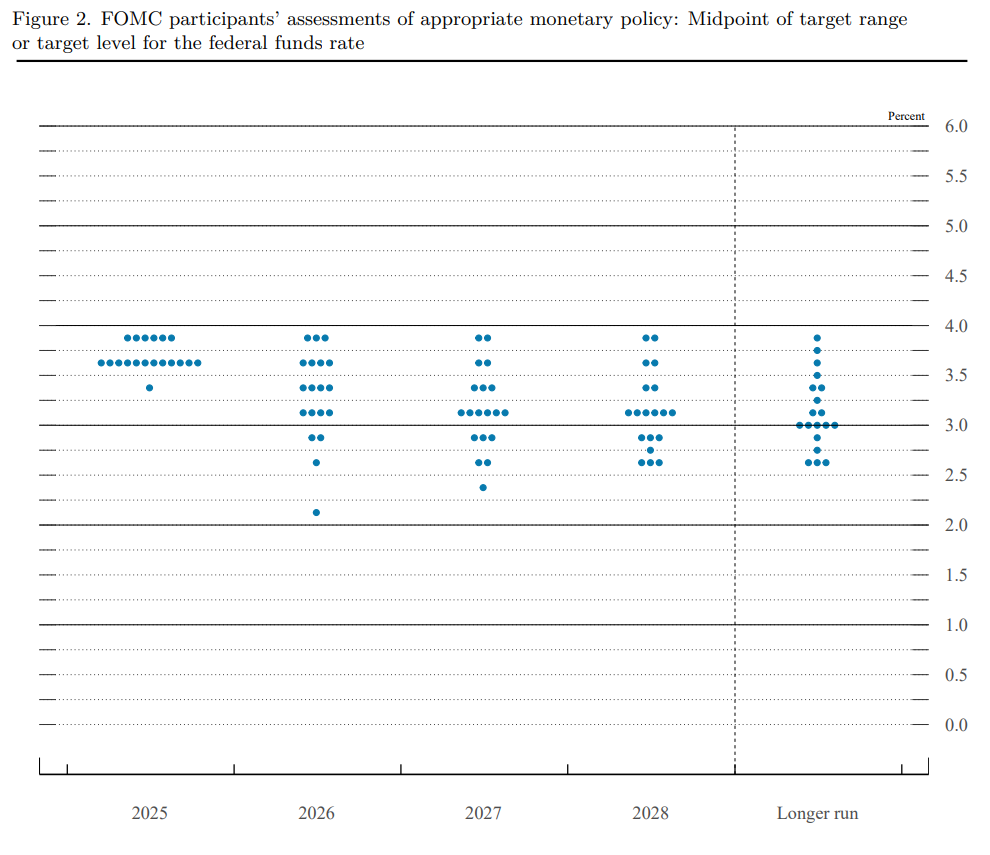

The December 2025 ‘Dot Plot’ indicating where all FOMC members think the interest rates will be at the end of the stated year

This means that there’s a large hurdle to overcome to see more rate cuts in the next meeting. The only way a rate cut is possible is if the labor market aggressively deteriorates, as the Fed has signaled that it is now prioritizing economic support (meaning lower rates) over a strict focus on inflation.

The dot plot visualised this clearly, with the median projection anticipating just one rate cut in 2026. However, CME FedWatch markets are pricing in two rate cuts for 2026, which currently seems like the more probable outcome.

Bank of Canada Interest Rate Decision

The Bank of Canada (BoC) has kept its interest rates stable at 2.25%, as expected going into this meeting. It appears the BoC intends to hold rates steady for a while longer, as inflation has fallen to 2.5% while the unemployment rate has declined slightly.

In this environment, where inflation is edging toward the target but not fully under control, and the labor market is showing resilience, the BoC has no reason to make any changes.

Swiss National Bank Interest Rate Decision

The SNB sits in perhaps the most unique position of all major central banks. Switzerland, historically known for its anti-inflationary approach, has seen inflation levels return to near zero, with interest rates now also firmly at 0%.

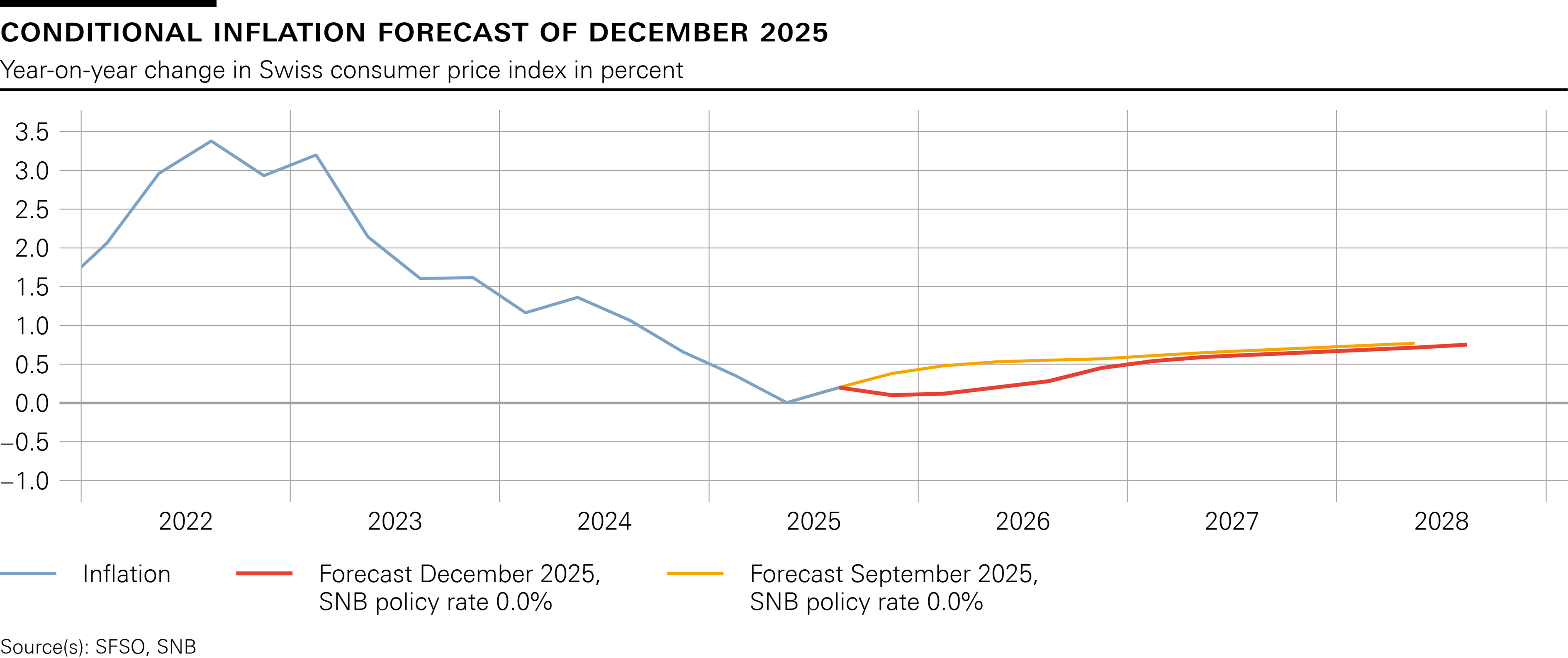

Swiss inflation, including forecasts

The SNB expects inflation to pick up slightly in the next year, with economic growth stronger than expected. This points to another scenario where the central bank is unlikely to make changes in the near term. Also, it seems the SNB aims to avoid cutting rates back into negative territory. The Swiss economy would likely need to see inflation consistently at sub-zero levels before negative interest rates are reconsidered.

Equities

Equities saw a surprisingly calm week. The expectation coming into Monday was consolidation ahead of the FOMC, followed by the aggressive moves we often see post-meeting. We did get tight consolidation from Monday through Wednesday, with the Nasdaq stuck in a 332-point range, but the price didn’t durably expand post-FOMC.

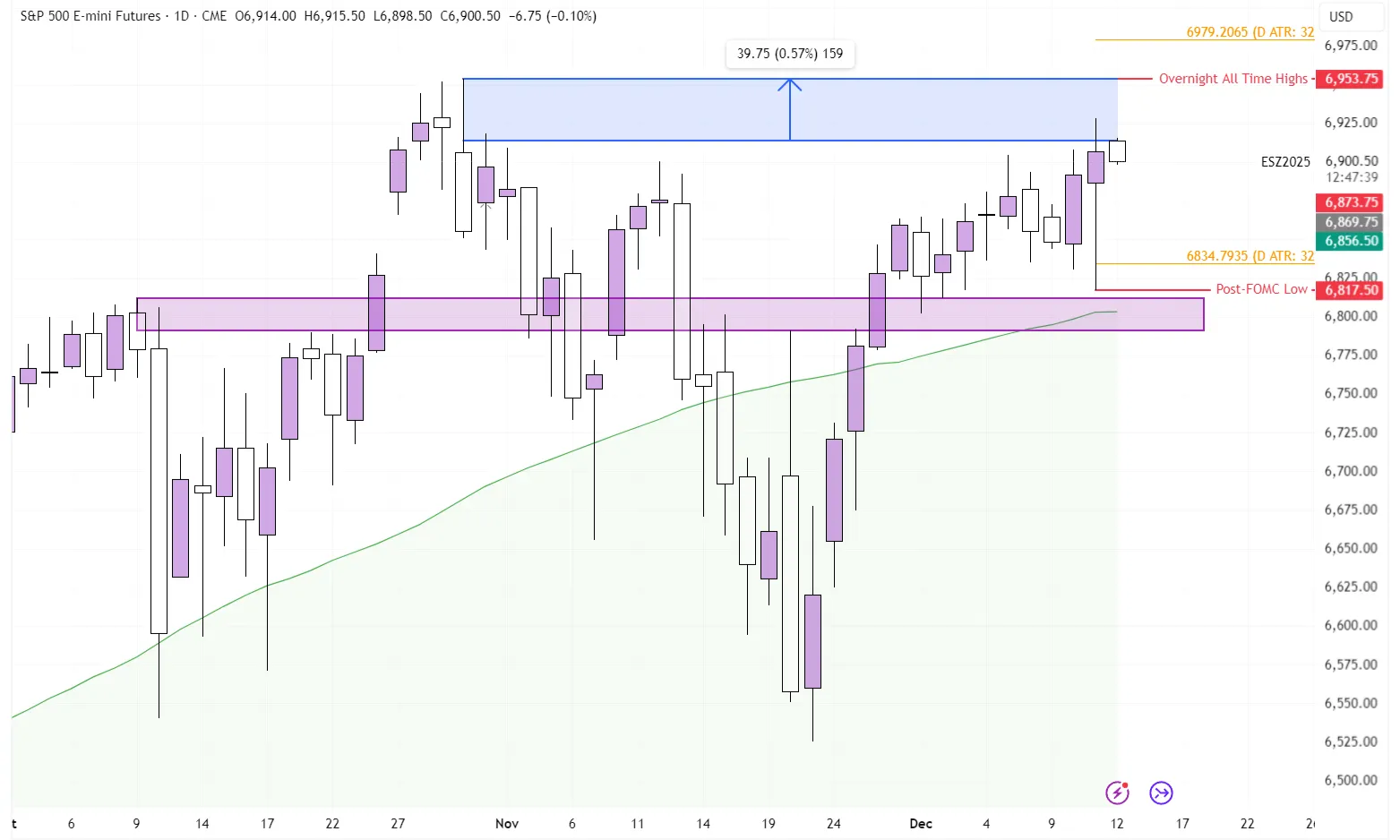

S&P 500 on the Daily Timeframe

The S&P 500 saw a slightly stronger week compared to the Nasdaq, with the ES now just 40 points of its previous All-Time-High. Since these ATHs were created with "poor highs" (highs that were not aggressively rejected), market theory often suggests these levels may get retested in the near future. Now that markets have cleared potential interest rate scares, it seems likely that prices attempt a Christmas rally.

Forex

The DXY (U.S. Dollar weighted against all other major currencies) saw its third consecutive down week. Interesting price action was found in EURSEK, an often-overlooked pair. On Thursday, the pair put in an "indecision candle," where price covered an above-average range (i.e., the candle is larger than surrounding ones) and featured relatively long wicks on both sides. Usually, as the name insinuates, these candles indicate that market participants cannot agree on prices.

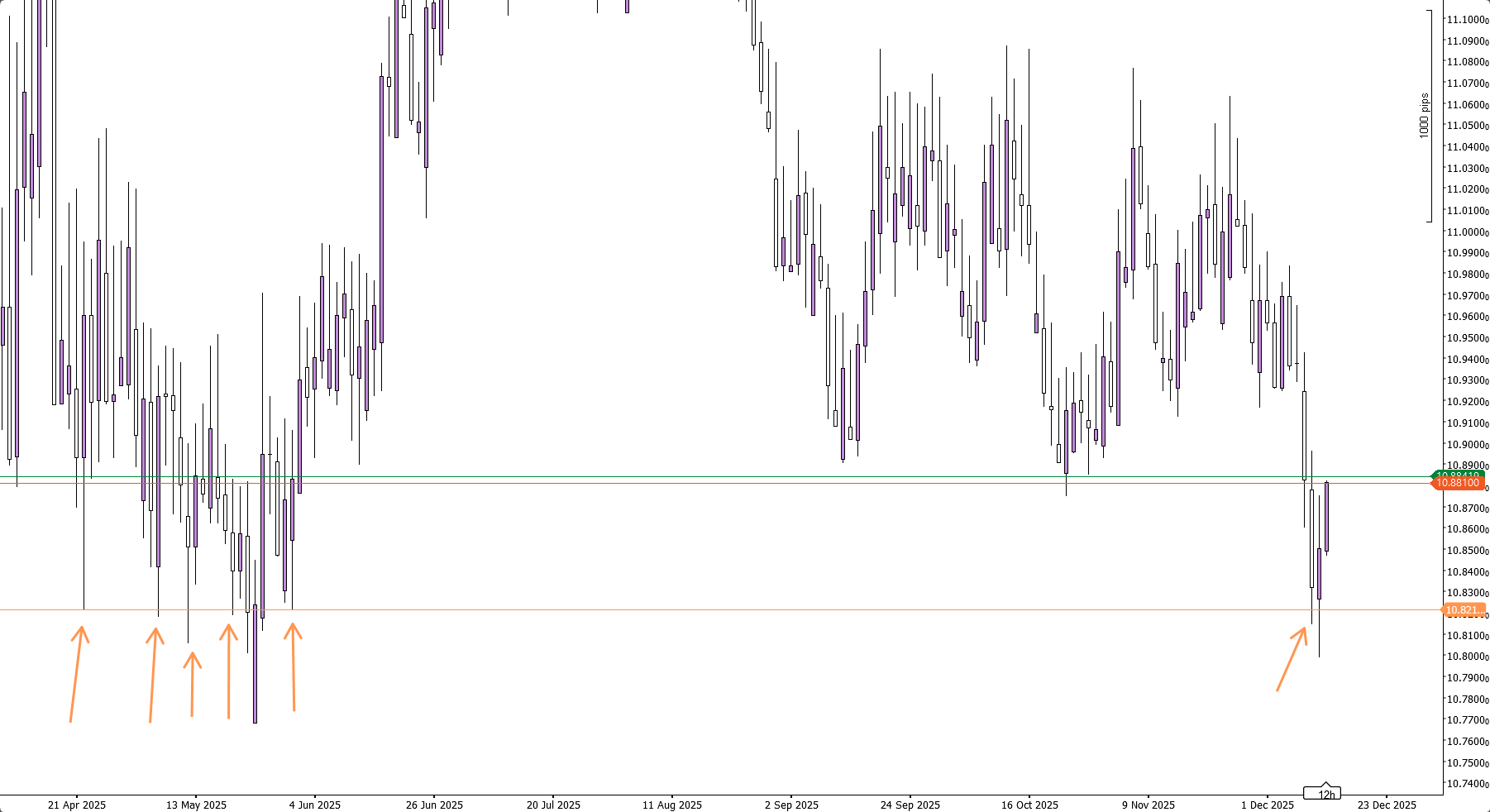

EURSEK on the Daily Timeframe

However, this particular move had a specific context, making it appear bullish rather than neutral. First, price swept an incredibly important Support/Resistance (S/R) level. The 10.8 level has acted as precise support on five prior occasions, with Wednesday also testing this area. We then swept that level and closed convincingly above it, creating a Swing Failure Pattern (SFP).

Secondly, Friday's price action is now continuing the momentum of Thursday’s SFP. This is a crucial piece of context to determine whether Daily candles provide a Higher-Timeframe bias going forward. Should price manage to close above Thursday’s high at 10.874, traders may view this as a solid bullish bias heading into next week. Especially the 10.874 level becomes key, as prices often retest the high of a bullish bias candle like this one.

Commodities

The commodity to watch over the past weeks has been Silver. This week it rose 10%, putting in new ATHs at $64/ounce. Gold, however, continues to lag and is still trading below its early October ATHs. Part of this has been a much-needed breather after what has already been a historic run. However, the macro picture for Gold has also gradually softened; with global inflation set to come down, the narrative of Gold as an inflation hedge is weakening.

Silver, on the other hand, has two distinct benefits compared to Gold in this regard:

- It has industrial use cases, allowing it to benefit from strong growth expectations for 2026.

- Its significantly smaller market cap (1/8th of Gold) means that it means it requires a fraction of the capital inflow to achieve the same percentage change in price.

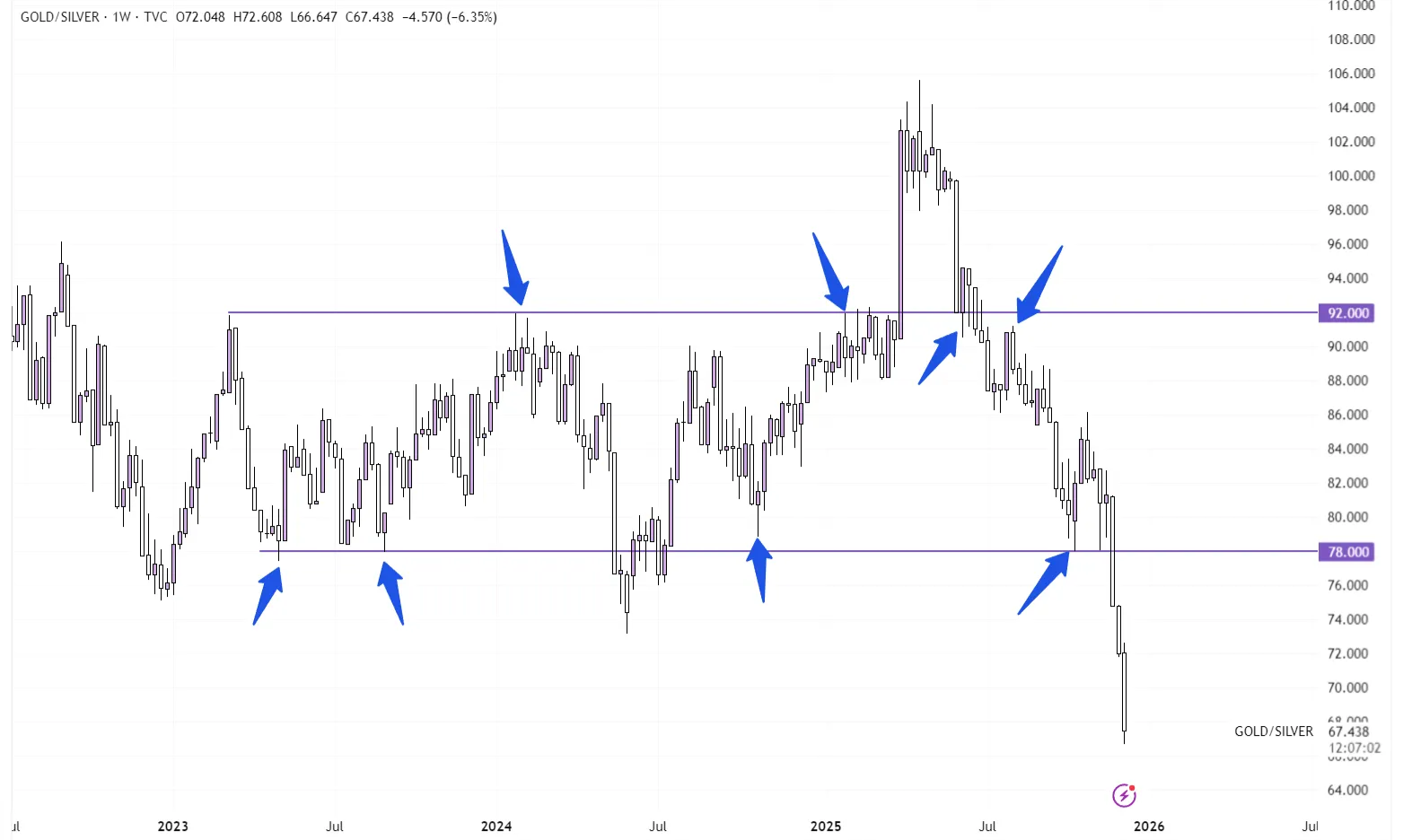

GOLD/SILVER Ratio on the Weekly Timeframe

We can see the deviation between the two assets clearly by watching the Gold/Silver ratio. For the past two years, this ratio has been defined by a clear range where a test of one side inevitably triggered a test of the opposite side. We have now left this balanced environment, with the ratio moving aggressively lower, approaching the 62 level. This represents the 2021 swing low and has historically been a very important level to watch.

Additionally, Silver is often viewed as a leading indicator for Gold. Conventional wisdom suggests that when Silver starts durably outperforming Gold, metals enter a "mania phase," which signals a possible Gold top. However, this is tricky to actually put into practice. Historically, it hasn’t been a precise timing tool for a Gold top, and it leaves open the question of when Silver is actually overpriced versus when the ratio is still dropping.

Conclusion

One-sentence summary of the week:

Central banks deliver as expected, Equities are eyeing up ATHs, and Silver moves aggressively higher.