Choosing the right trading account is a crucial step in your trading journey. The ideal account will align with your trading style, experience level, and financial goals. Brokers like Axiory understand this and offer a variety of account types, each with unique features and benefits. Let's explore Axiory's account options to help you make an informed decision.

Why Account Types Matter

The type of trading account you choose can significantly impact your trading experience. Different accounts offer varying leverage, spreads, commissions, and platform options. Selecting an account that matches your needs can lead to more efficient trading and potentially higher profitability.

Axiory Account Types: A Detailed Look

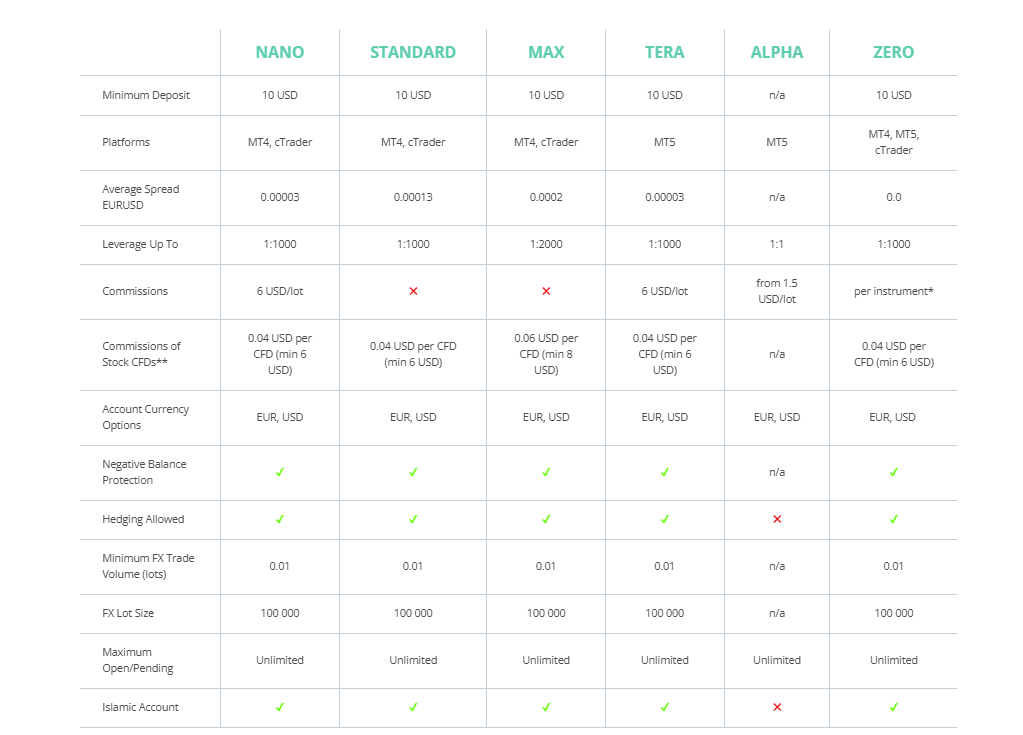

Axiory offers a range of account types, each designed to cater to specific trading styles and preferences.2 Here's a breakdown of the available options:

- Nano Account: This account is well-suited for beginner traders. It offers tight spreads and charges a commission per lot traded. It's available on both MT4 and cTrader platforms.

- Key Features: Low spreads, commission-based, suitable for beginners.

- Platform: MT4, cTrader

- Best for: Beginners, scalpers.

- Standard Account: A commission-free account with optimal trading conditions. It has slightly wider spreads compared to the Nano account. Available on MT4 and cTrader.

- Key Features: Commission-free, variable spreads.

- Platform: MT4, cTrader

- Best for: Traders who prefer commission-free trading.

- Max Account: This account offers the highest leverage among Axiory's accounts. It's a commission-free account with variable spreads. Available on MT4 and cTrader.

- Key Features: High leverage, commission-free.

- Platform: MT4, cTrader

- Best for: Experienced traders seeking high leverage.

- Tera Account: Exclusively available on the MT5 platform, this account offers trading conditions similar to the Nano account with tight spreads and a commission per lot.

- Key Features: Low spreads, commission-based.

- Platform: MT5

- Best for: Traders who prefer the MT5 platform.

- Alpha Account: This unique account is designed for share trading on the MT5 platform, allowing you to invest in exchange stocks and ETFs. It operates on a commission basis with no leverage on shares.

- Key Features: Commission-based, direct share and ETF trading.

- Platform: MT5

- Best for: Stock and ETF investors.

- Zero Account: This account offers zero spreads on selected FX pairs for over 90% of the trading day. It charges a commission per instrument and is available on MT4, MT5, and cTrader.

- Key Features: Zero spreads on select pairs, commission-based.

- Platform: MT4, MT5, cTrader

- Best for: Active traders, scalpers seeking tightest spreads.

Choosing the Right Account for You

Selecting the right Axiory account depends on several factors:

- Your Trading Style: Are you a scalper, day trader, swing trader, or long-term investor? Different account types suit different styles. For example, scalpers might prefer the Nano or Zero account with their tight spreads.

- Your Experience Level: Beginners might find the Nano or Standard account easier to navigate, while experienced traders might opt for the Max or Zero account for specific advantages. Stock investors will find the Alpha account suitable.

- Your Risk Tolerance: Leverage levels vary across accounts. Higher leverage offers greater potential returns but also higher risks. Choose an account with leverage that aligns with your risk appetite.

- Your Preferred Platform: Axiory offers trading on MT4, MT5, and cTrader. Ensure the account type you choose is available on your preferred platform.

- Your Budget: While Axiory's minimum deposit is generally low, consider the commission structures and spread types to estimate your potential trading costs.

Making Your Decision

Carefully consider your individual trading needs and compare them with the features of each Axiory account type. By evaluating your trading style, experience, risk tolerance, platform preference, and budget, you can confidently choose the account that best positions you for success in the financial markets.