The second most consumed grain after rice, wheat is an essential ingredient in countless popular foods. It’s the foundation for pasta, bread, cereal, and the flour used in baking. Given its global importance, wheat holds a significant position in the financial markets. We're here to equip you with the knowledge to translate your understanding of this staple commodity into potential trading opportunities.

Trading Wheat via Contracts for Difference (CFDs)

Before diving into the specifics of wheat, a solid understanding of how CFDs work and how they differ from buying futures contracts is required. These are some of the key features of trading wheat through a CFD:

- A CFD is a cash-settled derivative. This means you never physically buy, sell, or take delivery of wheat. You are speculating on a contract that is made to track the prices of wheat futures in major markets. Using CFDs thus allows you to speculate on prices without ever having to worry about rolling over a futures contract or undertaking physical delivery.

- CFDs allow you to use leverage, enabling you to use your capital more effectively. Using leverage wisely allows you to hold multiple positions without tying up all your capital in just one asset. It also allows you to size up positions and potentially make significant profit from intraday swings that would otherwise achieve only a small percentage gain. Leverage is a tool; when used wisely, it can increase potential returns, but if used without understanding, it will amplify the size of losses.

- Unlike a physical investment, holding a CFD position past the daily market close typically incurs an overnight financing charge (or 'swap fee'). This cost makes holding positions for long periods less profitable. Therefore, the strategies discussed below are suited more for short- to medium-term trades instead of longer-term investments.

Understanding Wheat Production and Geography

Wheat is a resilient crop that thrives in moderate climates, requiring temperatures between 15−24°C during the growing season and a minimum of 5°C otherwise. It also needs at least six hours of direct sunlight and moderate to high rainfall.

These requirements mean wheat is predominantly grown in temperate areas. The crop's high adaptability and the existence of specific wheat types suited to different regions ensure that a large number of countries contribute to its production. This geographical diversification is a major factor that significantly decreases the risk of a single, concentrated weather event damaging a large portion of the global supply.

The major wheat producers are among the world's largest and most populous nations, with China, India, Russia, and the U.S. being the top four. Together, they account for just under half of the total global production, which underscores the relatively low geographical concentration risk, especially considering the landmasses of these countries.

The Global Seasonal Cycle

Because wheat is cultivated so widely, traders must consider different seasonal tendencies and their corresponding peak risk windows, which vary based on the growing region:

| Region |

Planting Season |

Harvest Season |

Peak Risk |

| US Plains |

September-October |

May-July |

Winter kill |

| EU |

September-November |

June-August |

Localized Drought |

| Russia/Ukraine |

September-November |

July-August |

War Escalation |

| Australia |

April-May |

October-December |

Late Season Heat |

The strategic spread of wheat production across both the Northern and Southern hemispheres establishes a continuous, year-round supply pipeline. This structure acts as a natural hedge, mitigating the risk of a catastrophic single global crop failure.

Wheat Fundamentals

End-use segmentation and Inelasticity

A critical nuance in trading wheat is recognizing its specific demand profile. Wheat is composed of different types, each with its own specific industrial purpose, and they are not easily interchangeable. This means the overall demand is somewhat inelastic.

For instance:

- Hard Red Spring is used for bagels and croissants.

- Hard Red Winter is used for breads.

- Soft Red Winter is primarily used for cookies and cakes.

- Durum is used specifically for pasta.

Since the fundamental food demand is relatively stable, any significant production shortfall in a specific type of wheat can exert sudden and volatile price spikes.

Demand Segmentation: Food vs. Feed

Generally, there are two types of Wheat demand, and they each have their own nuances:

- Food Demand: This segment is used for human consumption. Demand here is highly inelastic due to deeply ingrained cultural consumption patterns and the fact that most wheat-based products are considered to be ‘basic goods’, i.e,. Items people require and will purchase regardless of price fluctuations.

- Feed use: This segment, in contrast to the previous one, is highly elastic. When Wheat prices drop in comparison to Corn, it becomes a viable substitute as livestock feed.

-

Inter-Commodity Correlation: Wheat & Corn

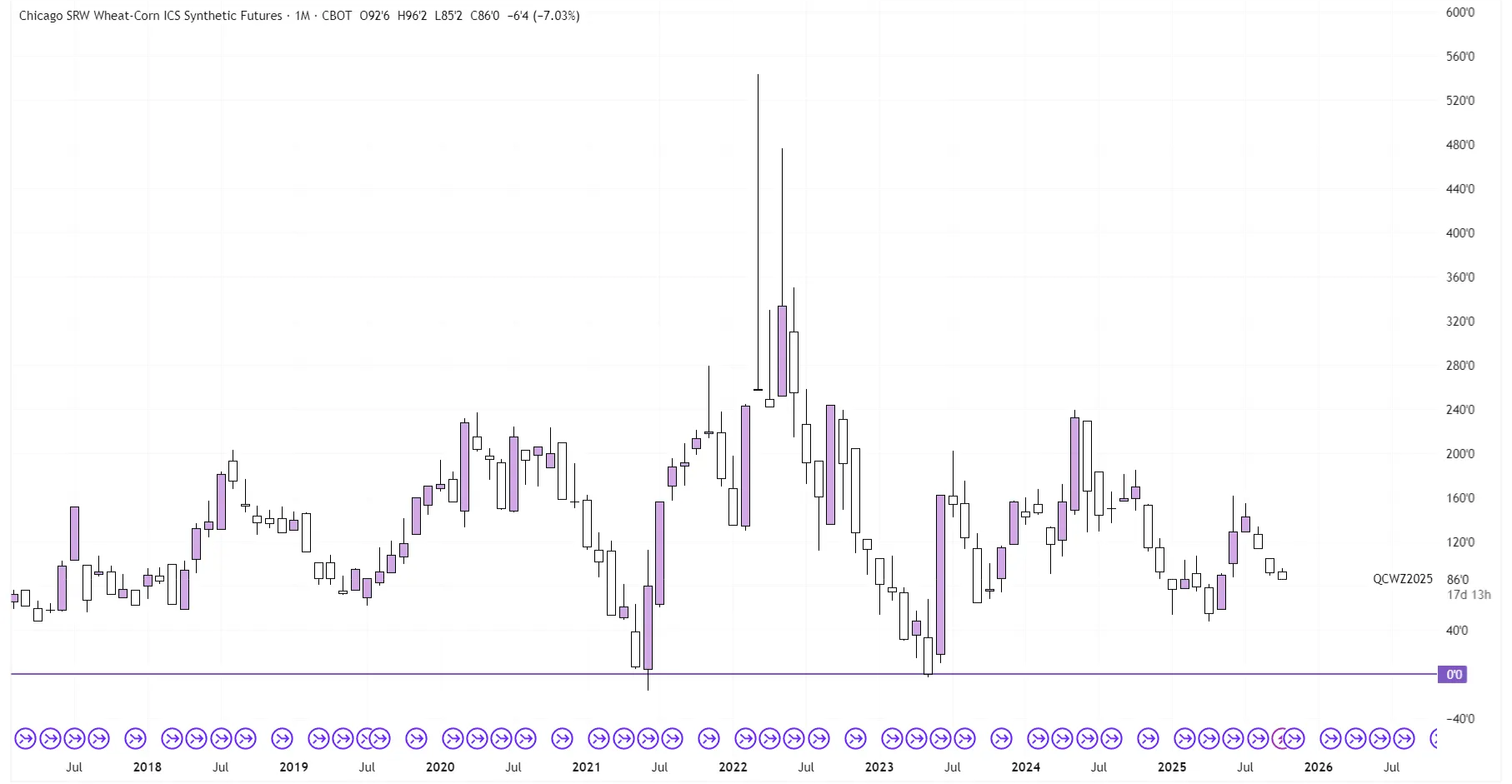

The wheat market is a direct competitor to the corn market, particularly in the animal feed sector. This competition means that traders should monitor the Wheat:Corn spread. This is most easily tracked through the Wheat-Corn Synthetic futures on the CBOT (ticker: QCW), which measures the price difference between Soft Red Winter (SRW) Wheat futures and Corn futures.

The above chart shows us this price difference on a Monthly timeframe, with the zero point (where SRW and Corn trade at the same price) marked. Since 2016, this level has only been hit twice and served as a very strong support area on both occasions, marking the absolute lows.

Since farmers will substitute Corn for Wheat if prices converge, this dynamic provides a structural floor on the price of wheat relative to corn. A unique approach involves trading the Wheat:Corn spread by taking a long position in Wheat and a short position in Corn. This technique is often used to focus on the widening Wheat:Corn spread while eliminating systemic market risk.

Key Supply and Geopolitical Factors

Wheat Streak Mosaic Virus (WSMV)

Micro-level biological threats, such as the Wheat Streak Mosaic Virus (WSMV), are known to cause major yield losses. The risk of WSMV destroying crops is highest when a hail event occurs in late summer, followed by an extended period of autumn temperatures above 18°C. Monitoring this specific weather pattern can provide a lead on potential future supply concerns.

Government Intervention

Compared to many other soft commodities, wheat is a highly protected sector globally. Both the U.S. and the EU have sophisticated systems in place to shield domestic farmers from devastating yield failures or sharp price declines.

- European Union: The Common Agricultural Policy (CAP) manages challenging market situations, such as temporary oversupply. A cornerstone of this policy is the government's direct purchasing and storing of commodities to effectively create a price floor for farmers.

- United States: A multitude of programs provide financial coverage to protect the domestic supply. Specific examples include the Enhanced Coverage Option (ECO) and the Stacked Income Protection Plan (STAX).

These government participations provide trading opportunities, as they are a predictable buyer/seller in the market, helping to establish a floor in wheat prices.

The Russia-Ukraine Complex

Since the Black Sea is a hot spot for growing Wheat, the Russia-Ukraine war has had very strong effects on the market. Originally, Russia and Ukraine had come to a deal to let both of them use the Black Sea to export agricultural produce like Wheat through the Bospohrus strait.

However, Russia decided to pull out of this deal in 2023. But, Wheat prices were only slightly affected as Ukraine is now using a new coastal route. Instead of going straight south through the Black Sea, which would be the fastest route, Ukrainian vessels are now sailing along the coast of Romania and Bulgaria before going through the Bosphorus Strait.

Further escalation by Russia, such as actively attacking these vessels, would likely cause significant price increases, similar to the spikes seen at the start of the conflict in 2022.

Russian Grain Damper

As the world’s biggest exporter, Russia strongly influences global prices through its ‘grain damper mechanism’. This tool is a floating export duty, calculated weekly as 70% of the difference between a government-set reference price and the prevailing price on the Moscow Exchange.

This mechanism increases export duties as wheat prices rise, slowing the pace of exports. By limiting the outflow of Russian supply, global prices are prevented from making sharp downward moves, essentially creating a soft price floor on the downside.

Demographic Explosion

Globally, a surging population is expected to drive a significant increase in wheat demand in the coming decades. In India, for example, demand is projected to double by 2050 compared to the 2019 level. This gradual rise in demand is a potential bullish force in the wheat market, unless producers preemptively and considerably expand production to meet the anticipated growth.

Conclusion

Trading soft commodities like wheat offers an intriguing blend of technical setups and fundamental drivers. By closely monitoring the connection between weather, the Wheat:Corn spread, the Russia-Ukraine war, and governmental policies, you can better position yourself to navigate this dynamic market.

Don't wait for the next harvest: explore live Wheat CFD prices and real-time charts now to spot your entry.