USD/JPY Shows Extreme Volatility amid Government Intervention

22 September 2022

USDJPY plunged circa 500 pips from its daily highs as the Japanese government sold the pair massively, trying to avert the recent deteriorating trend in the JPY currency.

BoJ intervenes in the FX market

According to Reuters, Japanese Finance Minister Shunichi Suzuki stated that they were concerned by excessive foreign exchange swings and underlined that they cannot be ignored at a press briefing following the Japanese government's first intervention in the forex market since 1998.

Suzuki declined to comment on the scope of the involvement or if it was a single effort.

"We will take necessary steps against excessive moves," Suzuki reiterated. "We are always closely in touch with currency authorities of other countries."

Masato Kanda, Japan's senior currency ambassador, told reporters that foreign exchange trading is possible "any day, everywhere, including on holidays."

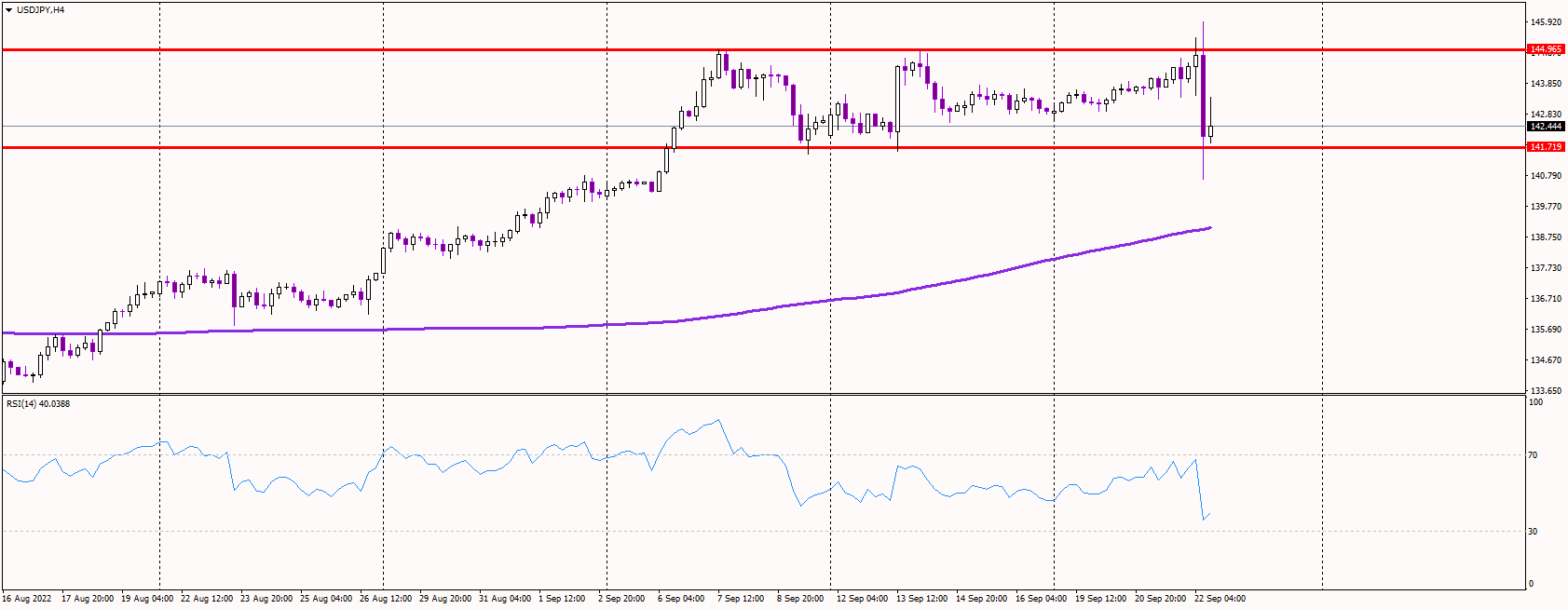

Charts seem neutral

The technical picture now seems rather neutral as investors might be scared to open new long positions until the dust settles.

Moreover, the false breakout above 145 could also deter traders from new longs. As a result, the pair has declined to the lower range of the consolidation phase, spotted near 141.70.

If the pair closes below that level, it could be a bearish signal, targeting 140 in the initial reaction.

On the other hand, a failure to push the price below 141.70 could result in another squeeze higher, targeting the current cycle highs in the 145 region. Volatility is expected to be highly elevated in the near future.