Introduction

Welcome to this week’s market pulse. As always, we’ve distilled the noise into clear insights to help you stay a step ahead of the competition. This week was a busy one, so let’s get into it.

Global Macro

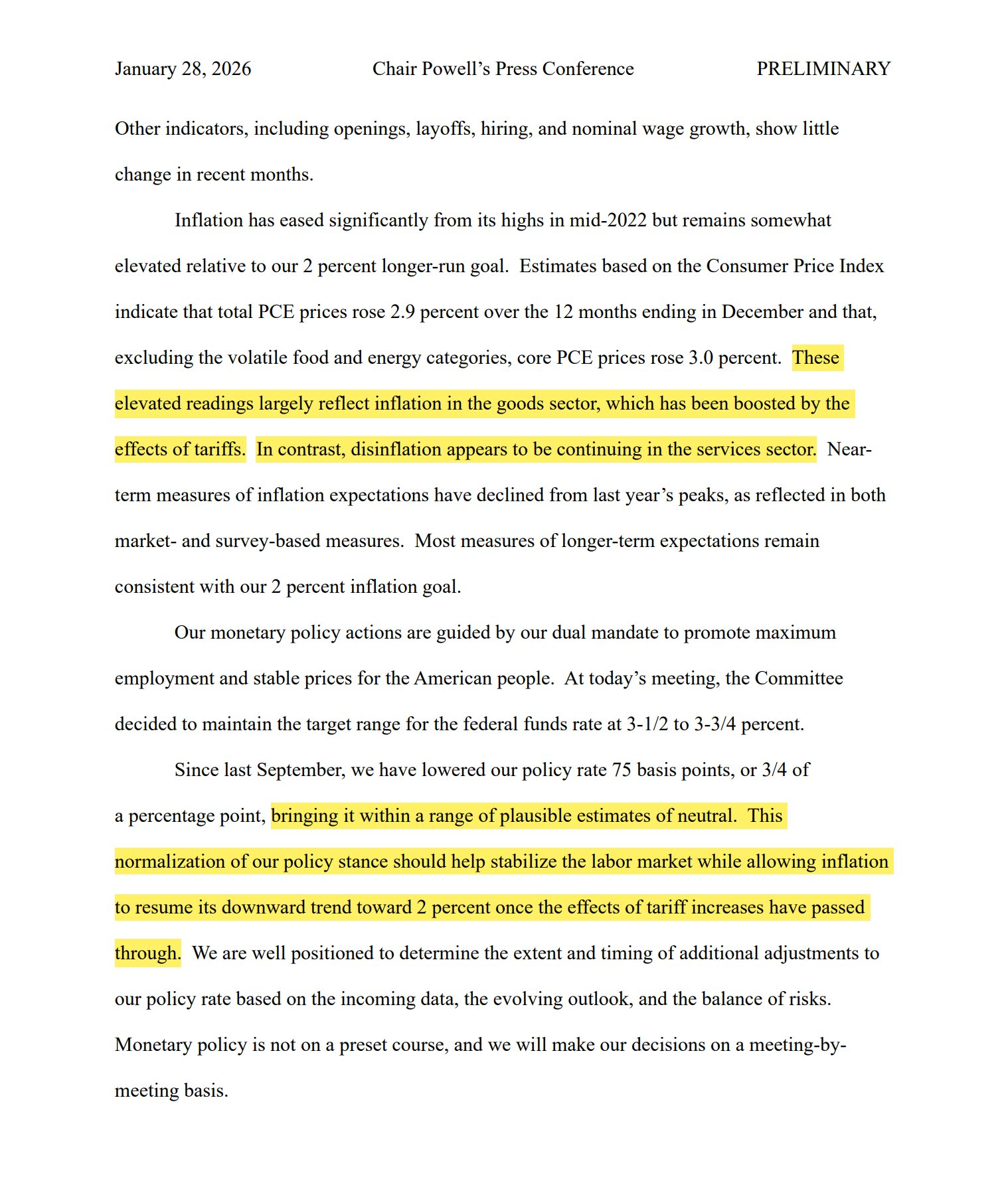

This week, all eyes were on Wednesday’s FOMC meeting. While anticipation for FOMC always runs high, the outcome largely aligned with market expectations, and the market’s reaction was subdued. The Committee voted 10-2 to maintain rates within the 350–375 basis point range.

Screenshot from the FOMC Press Conference open statement

Powell sounded slightly more hawkish compared to December’s meeting, stating that the labor market is in a better place than it was then, with inflation mostly being propped up by temporary tariff effects.

Under the current guidance, a rate cut in March appears unlikely unless we see a significant spike in unemployment data. At the current rates, the Fed thinks it’s well positioned to wait things out, although Miran and Waller (the two dissenters) disagree with that vision.

Equities

Equities had a solid start to the week, rallying from Monday to Wednesday’s New York open, before then reversing course and closing the week around break-even. Interestingly, only the ES (S&P 500) and NQ (Nasdaq 100) managed to print new All-Time Highs. However, given that these indices had been lagging recently, this looked more like a catch-up move rather than underlying strength.

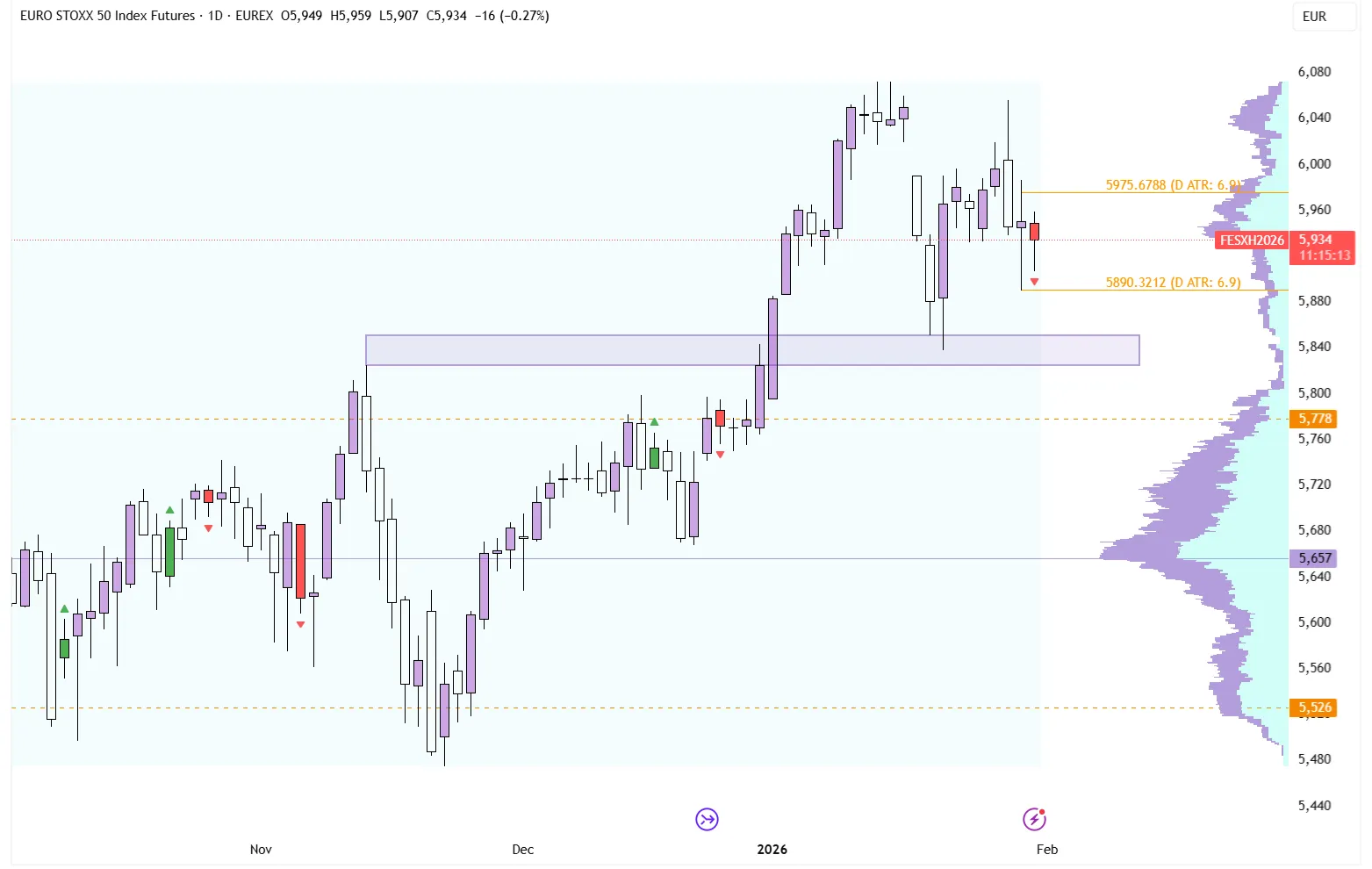

Euro Stoxx 50 on the Daily Timeframe In the Euro Stoxx, the technical picture is particularly clean.

The €5,825–€5,850 zone is the critical area to watch, as it marks a confluence of the current Daily Swing Low, the breakout high from December 30th, and the prior ATH. The market saw an aggressive rejection immediately after filling the Weekly Open gap at €6,050, with the day ultimately closing as a Bearish Engulfing candle. This kind of aggressive selling shows bears are in control, until proven otherwise.

Forex

The Dollar had a very rough start to the week, continuing last week’s downside momentum and dropping to levels not seen since early 2022. However, the Dollar regained strength into the latter end of the week and is now creating an exhaustion candle on the weekly timeframe.

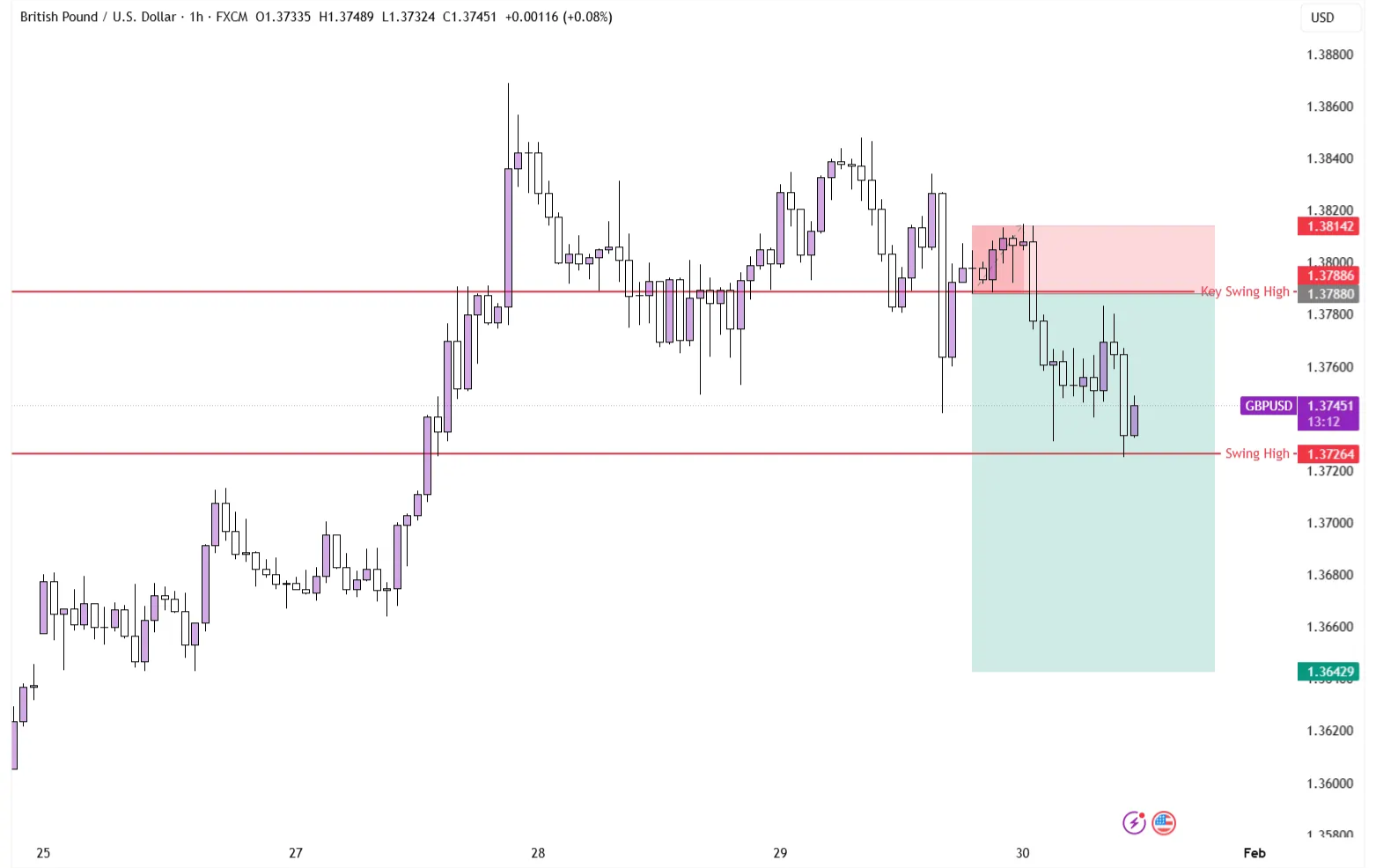

GBPUSD on the Weekly Timeframe

This reversal is most evident on GBP/USD, where the price is currently forming a Swing Failure Pattern (SFP), sweeping a major Weekly Swing High. If price manages to close below 1.378, and ideally even below 1.372, it would provide a strong bearish bias coming into next week.

We often discuss SFPs in this newsletter, but context is key. An SFP carries the most weight when it sweeps a prominent, higher-timeframe liquidity point, which is exactly what we are seeing here.

GBPUSD on the Daily Timeframe

The following is an example of what a setup could look like, coming into the Monday open with a bearish bias on GBP/USD. Assuming price closes as an SFP (a critical requirement for this setup), the prior Key Swing High at 1.3788 becomes a point of interest.

This level has a history of providing precise touches, signifying its importance. At this moment, 1.3788, our prior Key Swing High broke last served as a support area. However, since then, the price has broken down from that level, now serving as an untouched area that has flipped from support to resistance. Shorting price from that level and trying to take it down to this Week’s lows, which seem vulnerable, could shape up as a high Risk:Reward setup.

Commodities

Headlines were once again dominated by Gold and Silver as they continued their historic bull runs. However, the vertical move may be showing signs of fatigue.

Gold on the Daily timeframe overlaid with Silver

While calling an exact market top is often a futile exercise, the recent daily price action for both metals is important to watch. Historically, large daily candles that end the day in the red following a parabolic move have helped anticipate incoming corrections.

Conclusion

One-sentence summary of the week:

The Fed stays put, a Weekly Bearish bias in GBP/USD, and exhaustion signals in Gold and Silver.