The U.S. Government shuts down, Silver shines, and NQ flirts with $25k

Introduction

The U.S. Government has officially shut down, suspending any data releases. Conveniently for the bull market, it meant no Non-Farm Payrolls (NFP) data on Friday, allowing financial markets to continue chugging along as if nothing had happened.

Global Macro

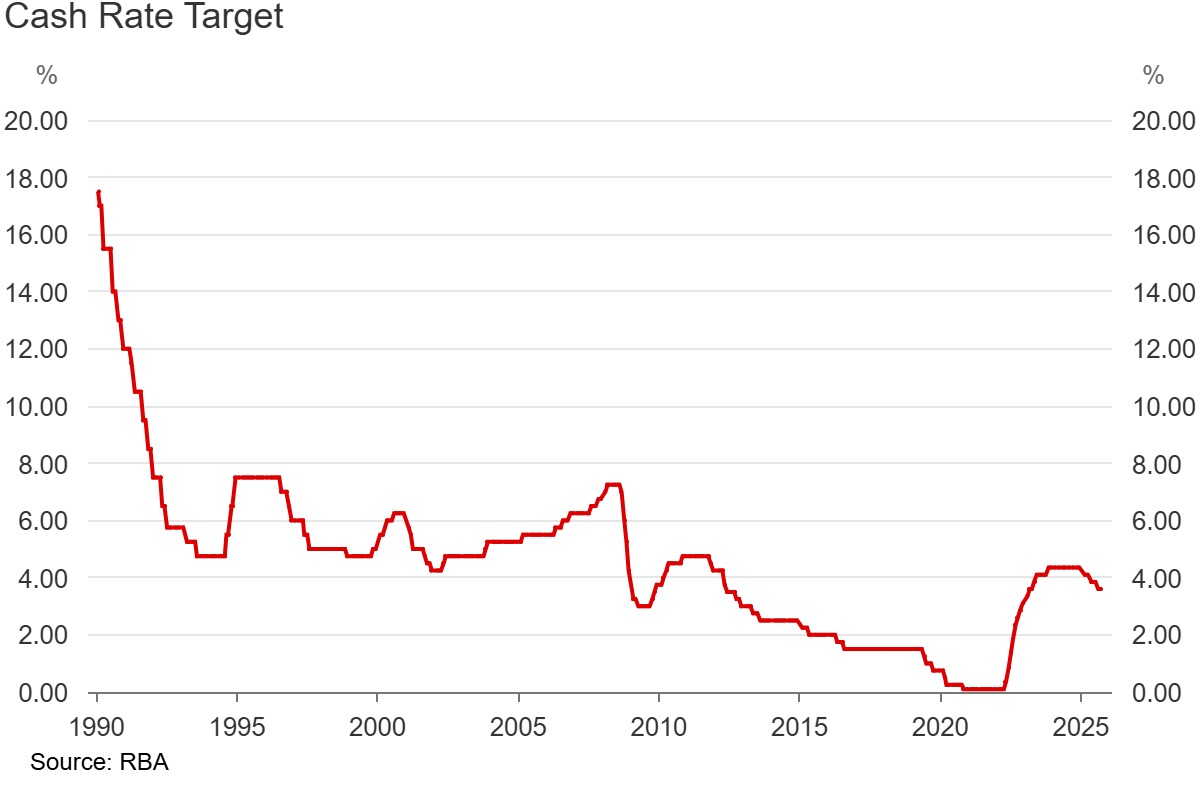

Australian Interest Rates

The Reserve Bank of Australia kept rates at 3.6% as expected, stating that the economy is fragile but recovering. With inflation proving to be sticky, they chose to keep rates as they are. Just like the Fed, the RBA has a dual mandate of both maintaining price stability and achieving full employment.

This vote was unanimous, and so far, no hints are being given of more rate cuts later in the year, with some of the tone of voice suggesting that rates might stay at 3.6% for a bit longer, stating that the earlier rate cuts are yet to come into effect.

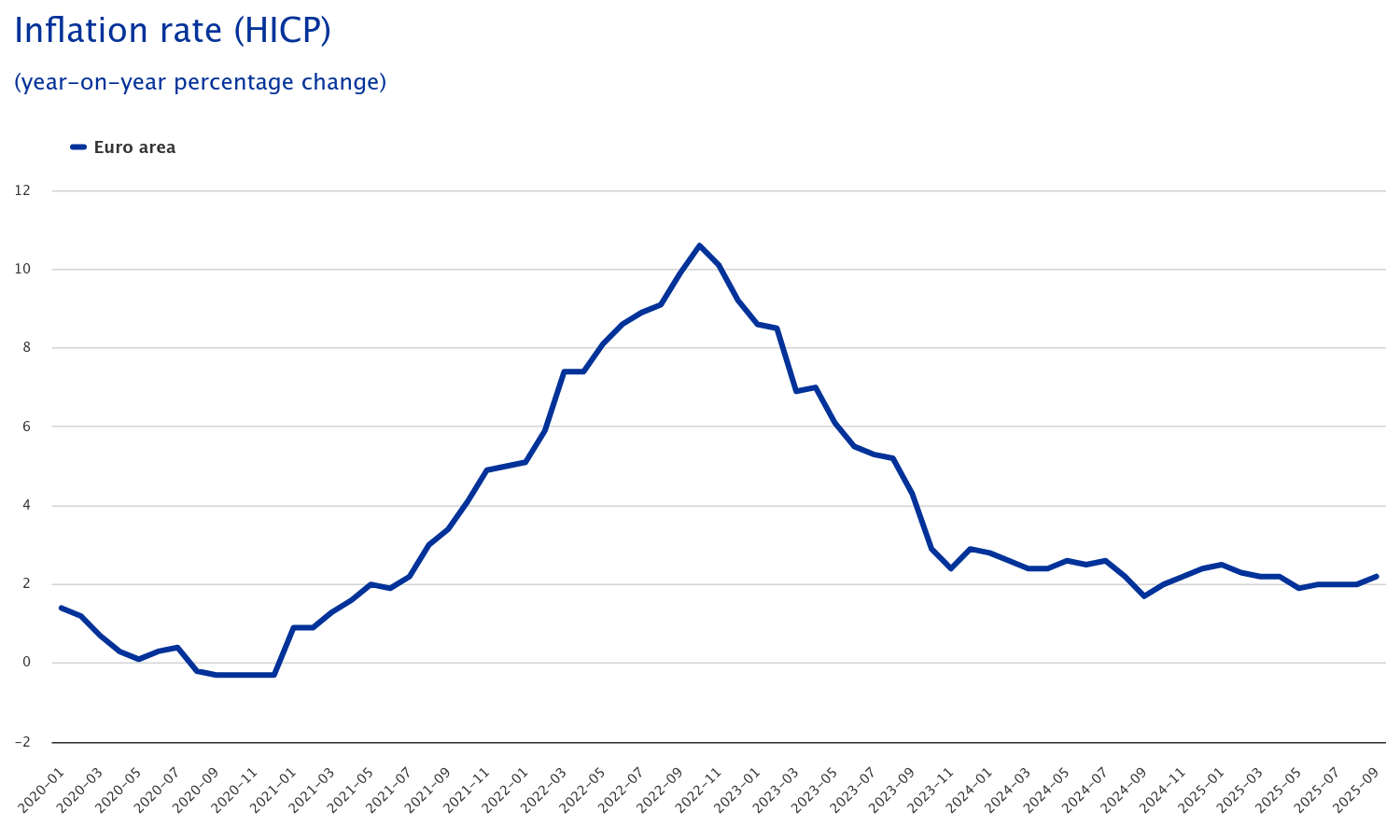

European Inflation

In Europe, the most important inflation meter, being the Core Harmonized Index of Consumer Prices (Core HICP), came in at the expected 2.3% Year-over-Year. This shows that the ECB has consistently gotten inflation under control.

U.S. shutdown

On the American side, no relevant data came out, as the American government has shut down. We were expecting unemployment data through NFP and the Unemployment Rate, but none will be released. You can’t have a bad unemployment rate if it’s not coming out.

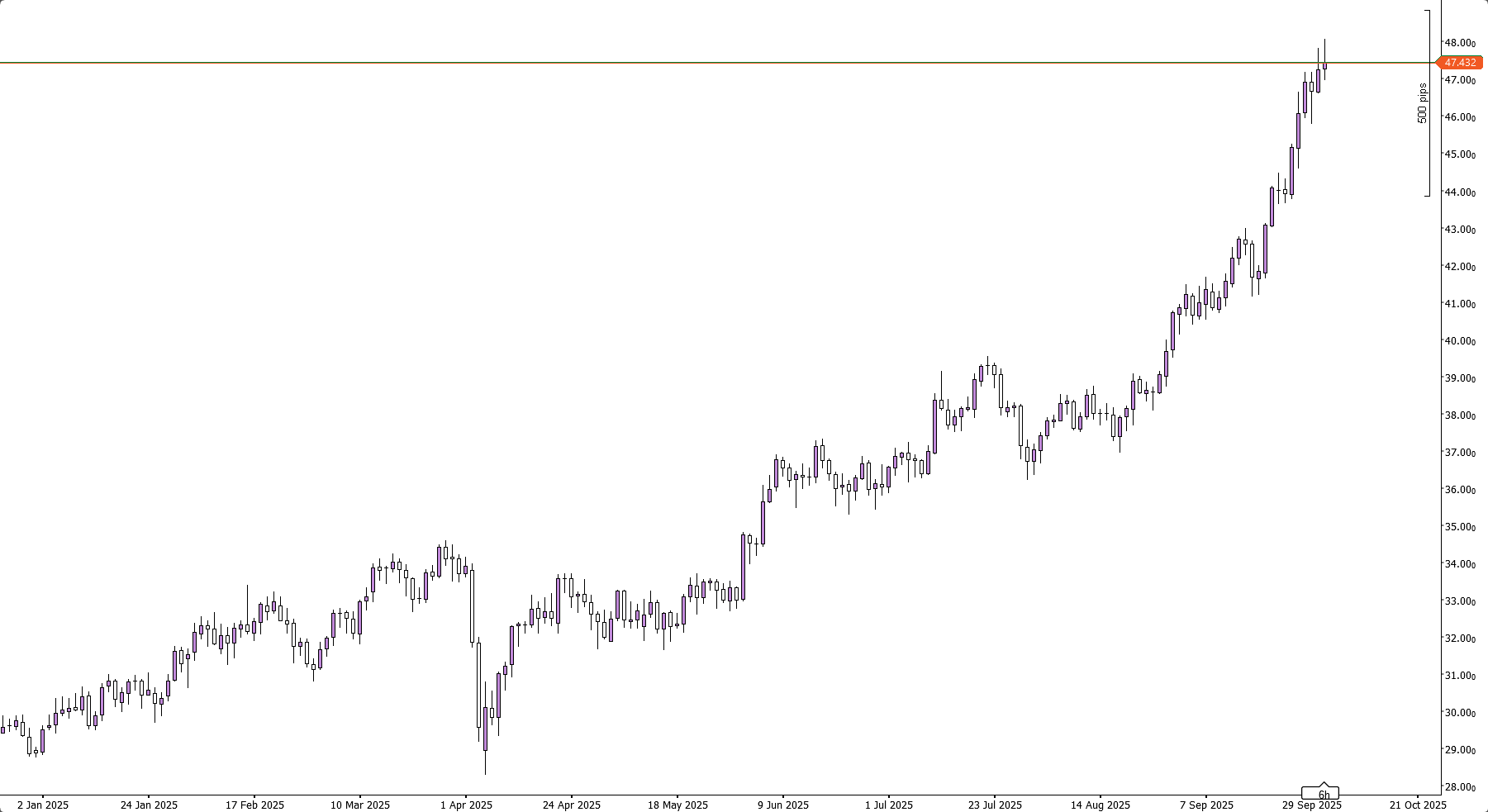

Equities

Indices continue to impress, with the S&P 500 firmly within the 6.700$ territory and NQ knocking at the door of 25.000$. This naturally raises the question: “When will this bull run end?”

From a purely technical view, however, the charts don’t look worrying, as the price seemingly isn’t experiencing a blow-off top, but rather a gradual staircase up.

Inversing the Scale: battling your bias

An interesting technique to battle emotions and biases is to simply invert your scale. This will allow you to come to the chart from a new perspective and keep an objective look at things. Doing so on the S&P 500, prices look overextended, but price is also still consistently putting in Lower Lows and Lower Highs (inverted), showing that the trend is king for now.

European Indices

The DAX doesn’t look anywhere as overextended as American indices, showing a healthier uptrend, with more structure having been built in.

However, if American indices were to durably start declining, it could still very well drag the European and Asian indices down with it, as cross-contamination across major financial markets is very likely.

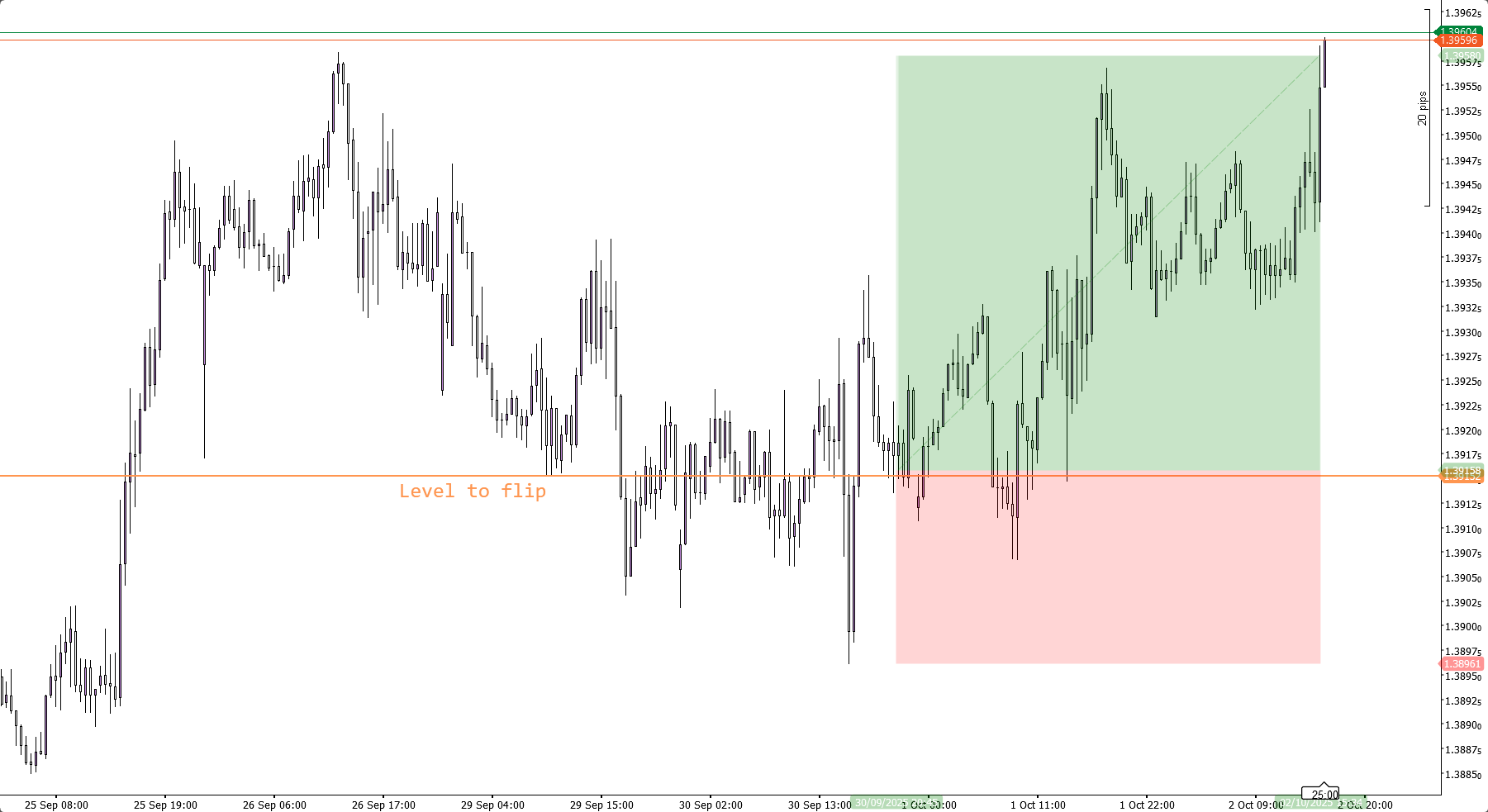

Forex

Last week, we mentioned that USDCAD showed a possible opportunity by going long on a support/resistance flip on the 30-minute chart, the day after a strong trend day. Although the exact execution was very tricky, the original thesis proved to be true. Price has successfully run last week’s high.

Commodities

On the metals front, Gold has continued its steady march to set fresh All-Time Highs. However, Silver has been the standout performer, outpacing its "bigger brother" with a Year-to-Date (YTD) gain of 64%

Conclusion

One-sentence summary of the week:

The U.S. unemployment rate is unknown (thanks to the government shutdown), inflation in Europe is under control, and all indices are chugging higher.