Introduction

From a surprising NFP print to Silver’s breakout performance, traders have had plenty to digest even amidst lower volatility. With the Federal Reserve and the Bank of Japan poised to make their moves, the stage is set for a potential unwind of the carry trade. Here is your breakdown of what moved the markets this week and what to watch as we approach the next FOMC meeting.

Global Macro

The headline data this week was the Non-Farm Employment (NFP) Change. Data came in significantly lower than expected, with job creation being negative compared to an expected flat result. Prices briefly dipped after this announcement but then rallied into the end of the week, indicating that we’re back into a bad news is good news environment.

Generally, equity prices rally upon ‘bad news’ when the following two criteria are met:

- Current economic policy is restrictive, i.e, interest rates are above the neutral rate, which is slowing down the economy

- The market believes the Federal Reserve has enough room to cut rates.

Both circumstances need to be met. If the Fed were to signal that fighting inflation remains its sole priority, the concept that "bad news is good news" (because it leads to rate cuts) would go out the window.

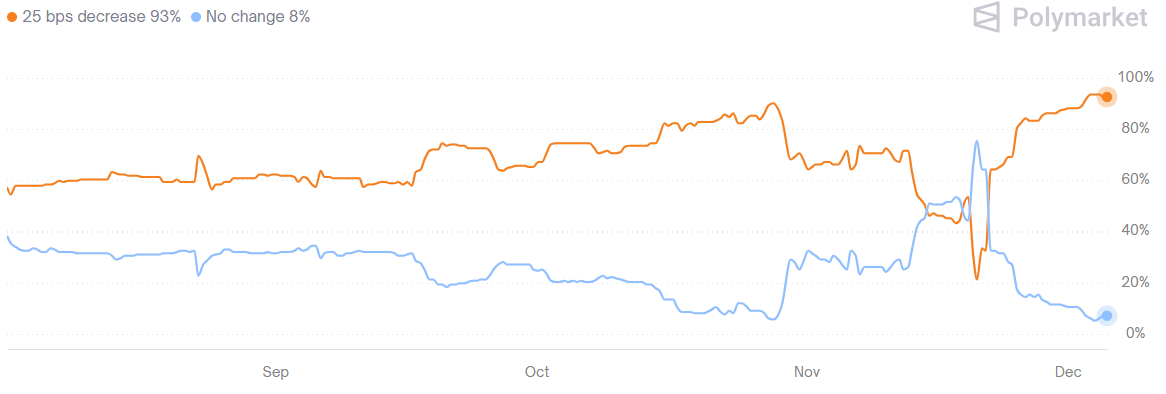

For now, however, both criteria appear to be met. This sentiment is reflected in the current odds for the December FOMC Meeting:

Polymarket sees 93% odds, while the CME Rate Futures show 87% odds of a 25bps rate cut. Heading into next week, we enter the data blackout period right before the meeting, so these expectations are unlikely to shift significantly.

Equities

Equities experienced a relatively quiet week. While most indices finished in the green, volatility was quite subdued compared to previous weeks, evidenced by the VIX index hitting the 15 level.

VIX on the Daily Timeframe

While Technical Analysis is rarely applied to the VIX, the chart confirms that volatility was compressed this week. It would not be surprising to see the VIX climb higher next week, especially considering we are approaching a FOMC meeting.

Forex

Much like equities, the Forex market saw a subdued week with relatively low volatility. Most major currencies climbed higher against the Dollar, resulting in the DXY closing the week in the red. The key pair to watch next week is USDJPY.

It appears the "carry trade" may unwind further, as the Fed is expected to cut interest rates by 25 bps, while the Bank of Japan (BoJ) is very likely to hike by 25 bps.

Quick Definition: A Carry Trade is when investors borrow money in a low-interest-rate country (like Japan, where rates are currently around 0.5%) and deposit it in a country with much higher interest rates (like the U.S.).

Leverage is often used to make these trades worthwhile in percentage terms. The USDJPY carry trade is the most popular example. However, it is crucial to understand that while attractive in calm environments, carry trades can unwind dramatically if the funding currency (the Yen) appreciates against the target currency.

A Projection of what an unwinding of the USDJPY Carry Trade could look like

If the Fed cuts rates and the BoJ hikes simultaneously, holding the USDJPY carry trade becomes significantly less attractive. This could lead to a rush of traders selling their USD to buy back Yen. Because these trades are often highly leveraged, even a small move can trigger margin calls. This triggers forced selling, potentially leading to a cascade where USDJPY could drop rapidly.

Forex traders would be wise to monitor the upcoming interest rate decisions and prepare for potential volatility in this pair.

Commodities

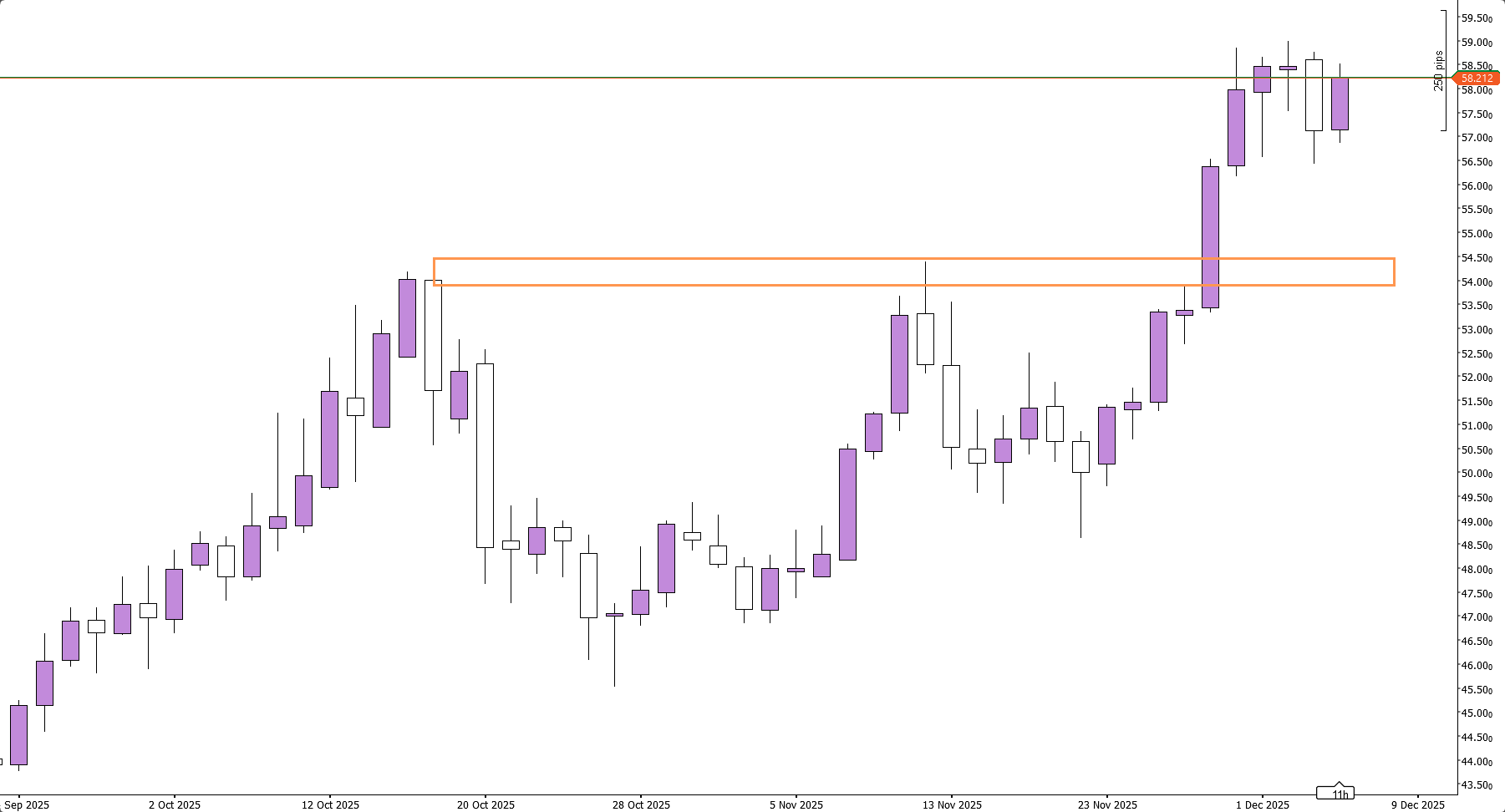

Silver was the eye-catcher this week, strongly outperforming Gold, which is still sitting well below its All-Time Highs (ATHs). Silver, on the other hand, has broken out convincingly, leaving a very strong structure to potentially retest from above.

Silver on the Daily Timeframe

This $53.8-54.5 level created a double top and then saw a short pullback right before the push through. Because of this context, this level is more likely to hold than a normal Support/Resistance flip.

However, it is also quite plausible that price won't even test this level in the short term. Often, when a level is this significant and obvious, price action may front-run it, as there is significant demand waiting just below.

Conclusion

One-sentence summary of the week

Silver leads the charge while the rest of the market takes a breather before the FOMC.