Introduction

We’ve got a lot to dive into: the BoE is surprisingly divided, as the RBA maintains its focus on lowering inflation. Furthermore, we’re using the anchored VWAP to to check on a possible long-term bullish bias and compare price behavior in American and European indices, and finally, we dive into interesting technical setups on AUDNZD and Live Cattle markets.

Global Macro

In the macro landscape, the major news this week was an interest rate decision from both the Reserve Bank of Australia and the Bank of England.

Both countries are struggling with very similar monetary policy issues; inflation remains elevated well above the 2% mark, while interest rates are already quite high. The economy seems like it could use the extra fuel from a rate cut, but at these current inflation levels, that’s not possible.

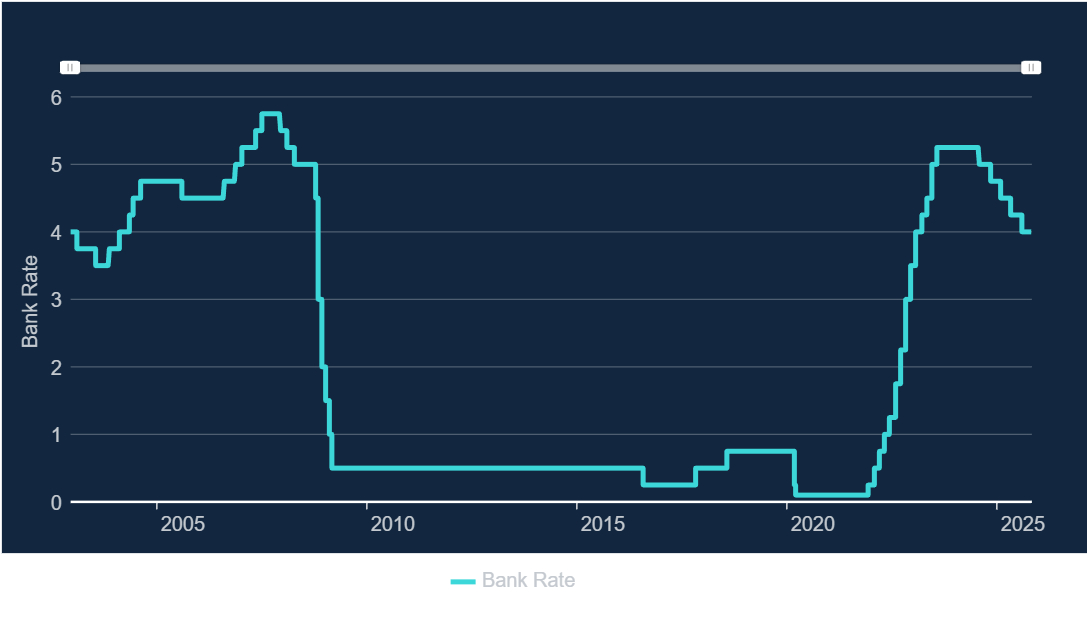

Bank of England Bank Rate

The BoE specifically mentioned that it’s prioritizing getting inflation under control first, as the risks of resurging inflation are higher than those associated with a weakening job environment. However, this decision was far from the consensus; in fact, out of the nine members of the BoE, only five voted to keep rates stable, whereas the remaining four voted for a 25 basis points rate cut.

This means that a weakening labor market or lower inflation by the next meeting will make a rate cut at the next meeting in December extremely likely, as the decision was already very close this week.

Equities

Indices took a breather this week, albeit a very shallow one, leaving them only a couple of percentage points short of the ATHs. In the S&P 500, price is approaching the upper band of the anchored VWAP, which we discussed last week, as it has acted as consistent support on multiple occasions this year.

S&P 500 on the Daily Timeframe since April

Currently, the upper level of the first standard deviation band sits at the $6,710 level. This is thus a key level to watch, although price might drop a bit beyond that, as it has done on the majority of the tests this year.

Anchoring our VWAP at the April bottom for European indices gives a very different image compared to American ones:

DAX on the Daily Timeframe since April

Rather than the upper band serving as support, it’s been very consistent in acting as resistance. Auction Market Theory teaches us that price is likely to remain in a ranging environment as long as price is contained within this range, meaning that European indices have an uphill battle to fight if they want to durably make new All-Time-Highs, like their American and Japanese counterparts.

Forex

In Forex, AUDNZD is trying to break out of a multi-year consolidation, driven by the macro backdrop of a much looser monetary policy from the Reserve Bank of New Zealand compared to the RBA.

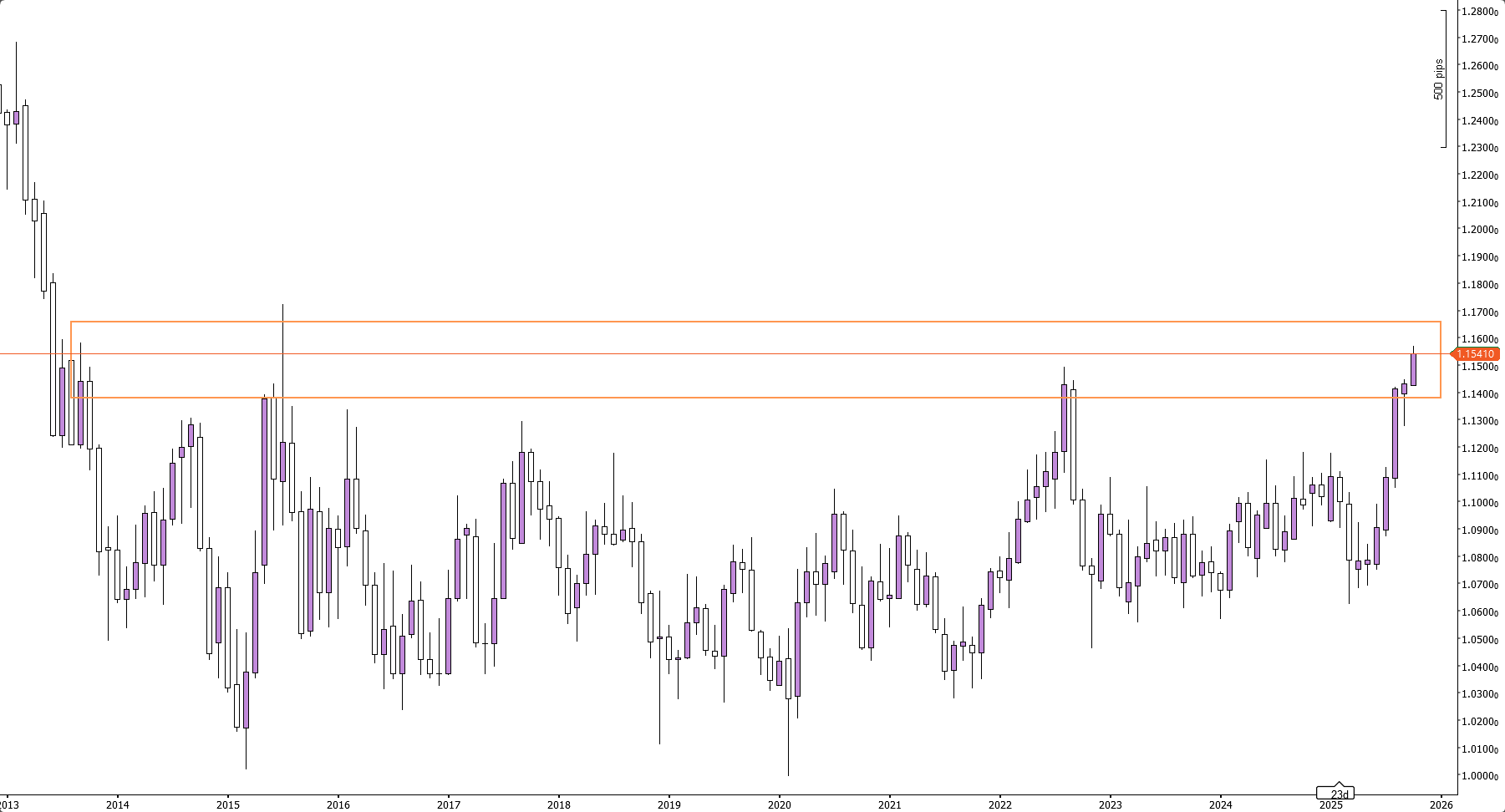

AUDNZD on the Monthly Timeframe since 2013

From a technical perspective, the 1.14-1.165 range is absolutely crucial and can give two possible setups from here:

- Price starts to falter, is unable to break through the resistance, which opens up possibilities for a longer timeframe short position, targeting price to accept back within its multi-year range

- Price breaks through the area, spends some time above it, and eventually comes for a rounded retest from the other side, allowing for a long, targeting new highs

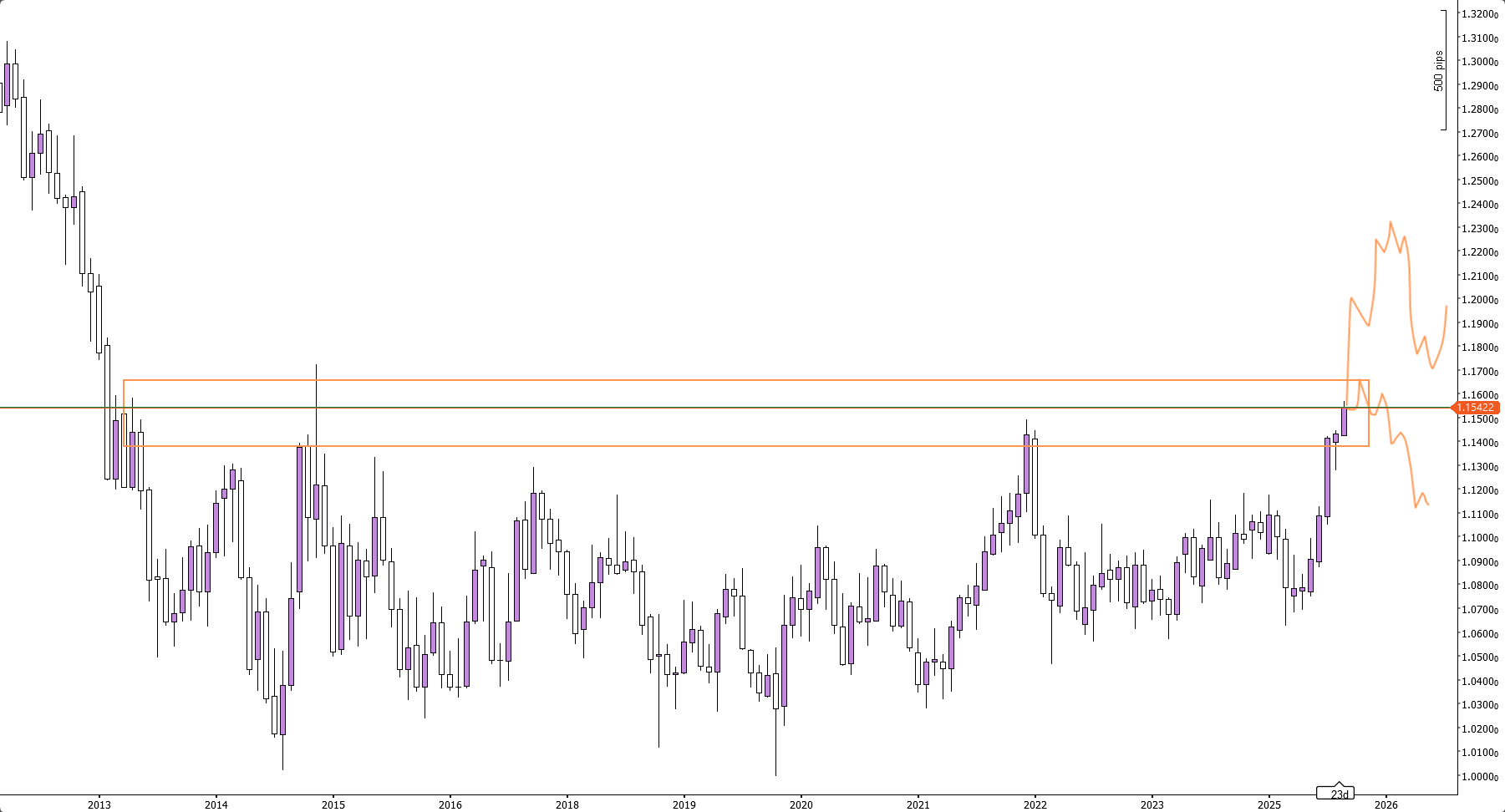

This is what those two scenarios look like, visualized:

Monthly AUDNZD Chart, visualizing both scenarios

Which one of these patterns will play out is highly dependent on price action over the following days and weeks.

Commodities

In commodities, both Gold and Oil have been stuck in a tight range this week with uneventful price action. Live Cattle prices have been an eye catcher, however, as rumors have been circulating about an easing of import restrictions by the U.S. Government of Mexican, Argentinian, and Brazilian beef, all of which are major suppliers.

This easing of American trade policy is coming at a point where beef inventories are at absolute multi-decade lows, but with signs indicating that this may be the bottom of the trough in the multi-year cattle cycle. If true, that would lead to very aggressive selling in the cattle market over the coming weeks/months.

If you’re unaware of what the Cattle Cycle is, and are interested in digging deeper, we highly recommend checking out this article, which will teach you all the fundamentals you need to know about to trade the live cattle market:

Live Cattle Trading Guide

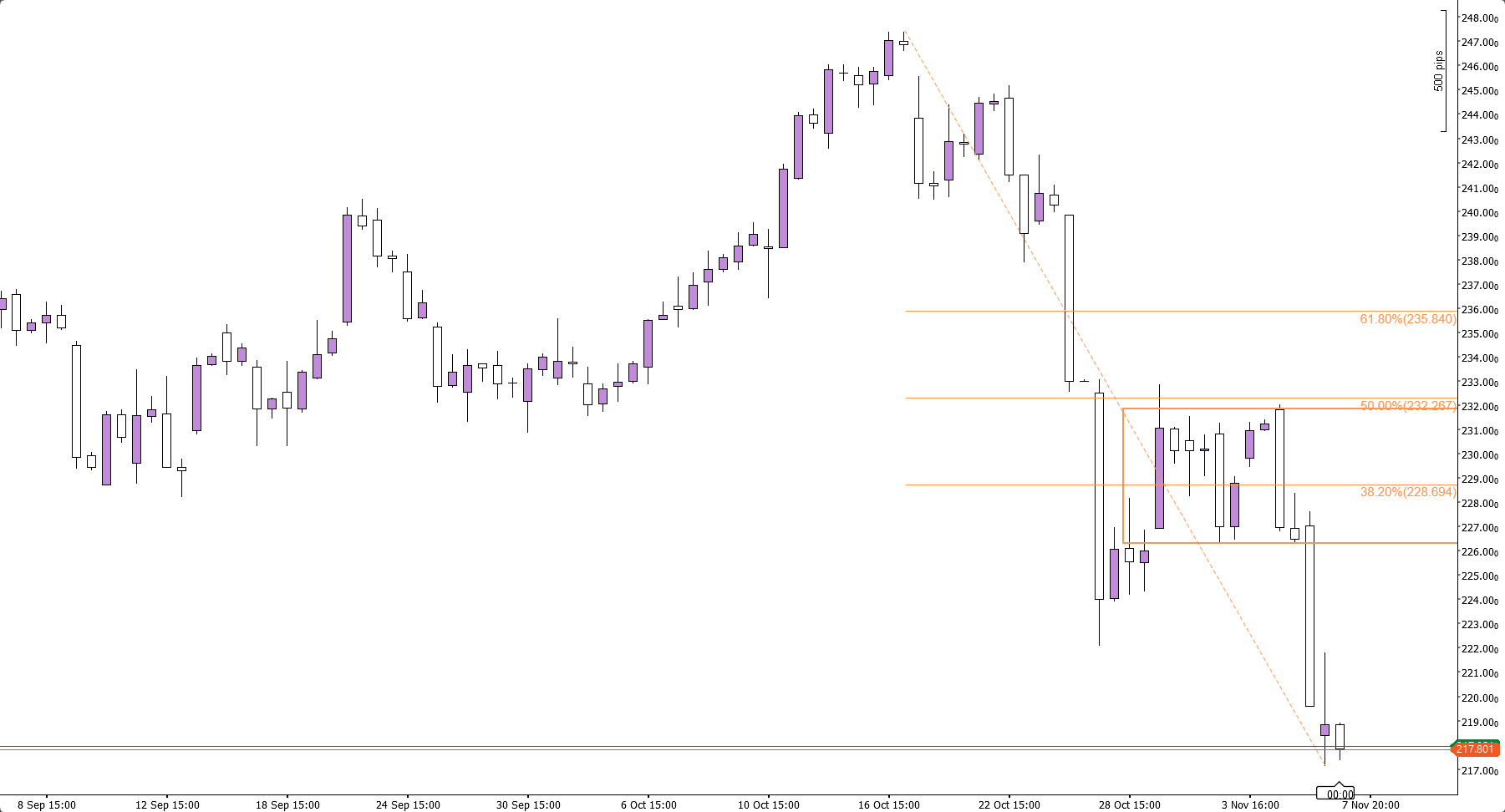

Live Cattle Prices on the 4-hour Timeframe

In the short term, price is creating a very interesting potential short setup. After an initial drop, prices consolidated for several days and have now cleanly broken down. A potential high risk/reward setup would consist of shorting this area with a stop loss above the high and playing for a continuation of the trend, i.e., Lower Lows, always setting an appropriate position sizing based on the available capital and the risk tolerance of the investor. Additional confluence is brought by drawing a fib retracement from the high to the low, as the .382 fib level comes in at the middle of this area.

Conclusion

One-sentence summary of the week:

The Bank of England is divided, the S&P 500 is taking a breather, and European indices are stuck in a range.