Introduction

This week saw little in the way of macroeconomic releases, which is exactly what the market needed to sustain its upward momentum and put in new record highs across a multitude of asset classes.

Global Macro

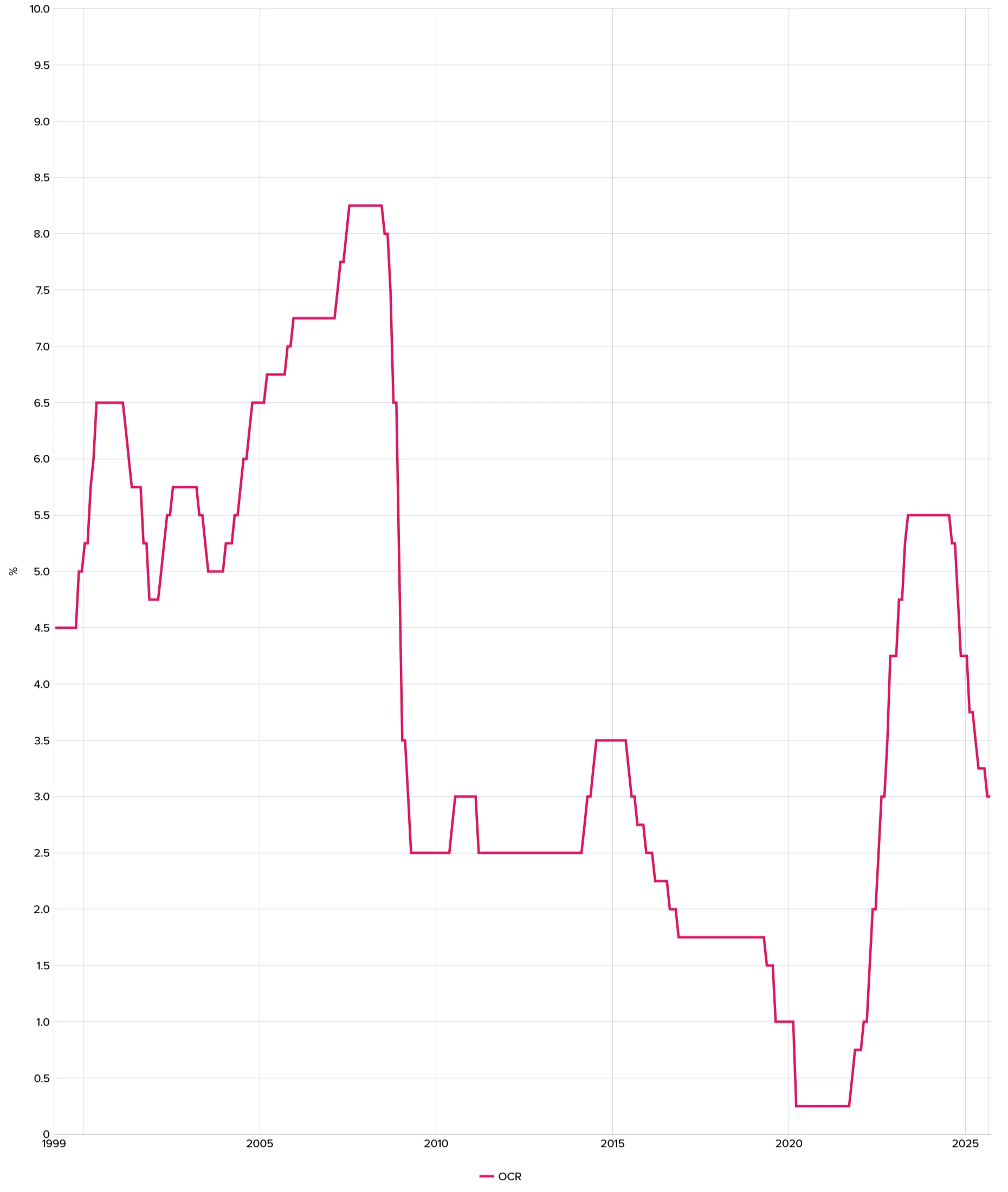

New Zealand Interest Rate Decision

A week after its Australian counterpart, it was time for the Reserve Bank of New Zealand to make its interest rate decision. Before this meeting, the Official Cash Rate (OCR) was set at 3.0% following a 25bps cut in August. Markets had priced in another 25bps cut, as the last inflation number came in at 2.7%, only slightly above the targeted 2%.

The RBNZ surprised markets, however, by going for an aggressive 50 basis points cut. The committee explained that this was a countermeasure against the weakening economic growth they had been observing, while still expecting inflation to return to their 2% target by the first half of 2026.

U.S. Data Backlog Intensifies

As the U.S. Government shutdown persists, a backlog of to-be-released data is increasing. However, no resolution is expected in the short term, so as things stand, this backlog will continue to grow.

Japanese New Prime Minister

Against expectations, Sanae Takaichi won the leadership election of the Liberal Democratic Party last weekend. Takaichi is expected to become Japan’s next prime minister and is known as an economic ‘dove’. Before her election, markets were pricing in rate hikes from the BoJ as Japan had been struggling to get inflation under control. Following Takaichi’s election, however, it now seems much more likely that rates will be held steady, with economic growth being prioritized over moderate inflation, following the example being set in the United States.

Equities

Due to the surprise election in Japan, the NIKKEI gapped up 2.000 points (4.3%) over last weekend. Both the S&P 500 and Nasdaq continued their grind up, creating new All-Time Highs daily, with European markets also following suit. In summary, all major indices saw new ATHs.

Forex

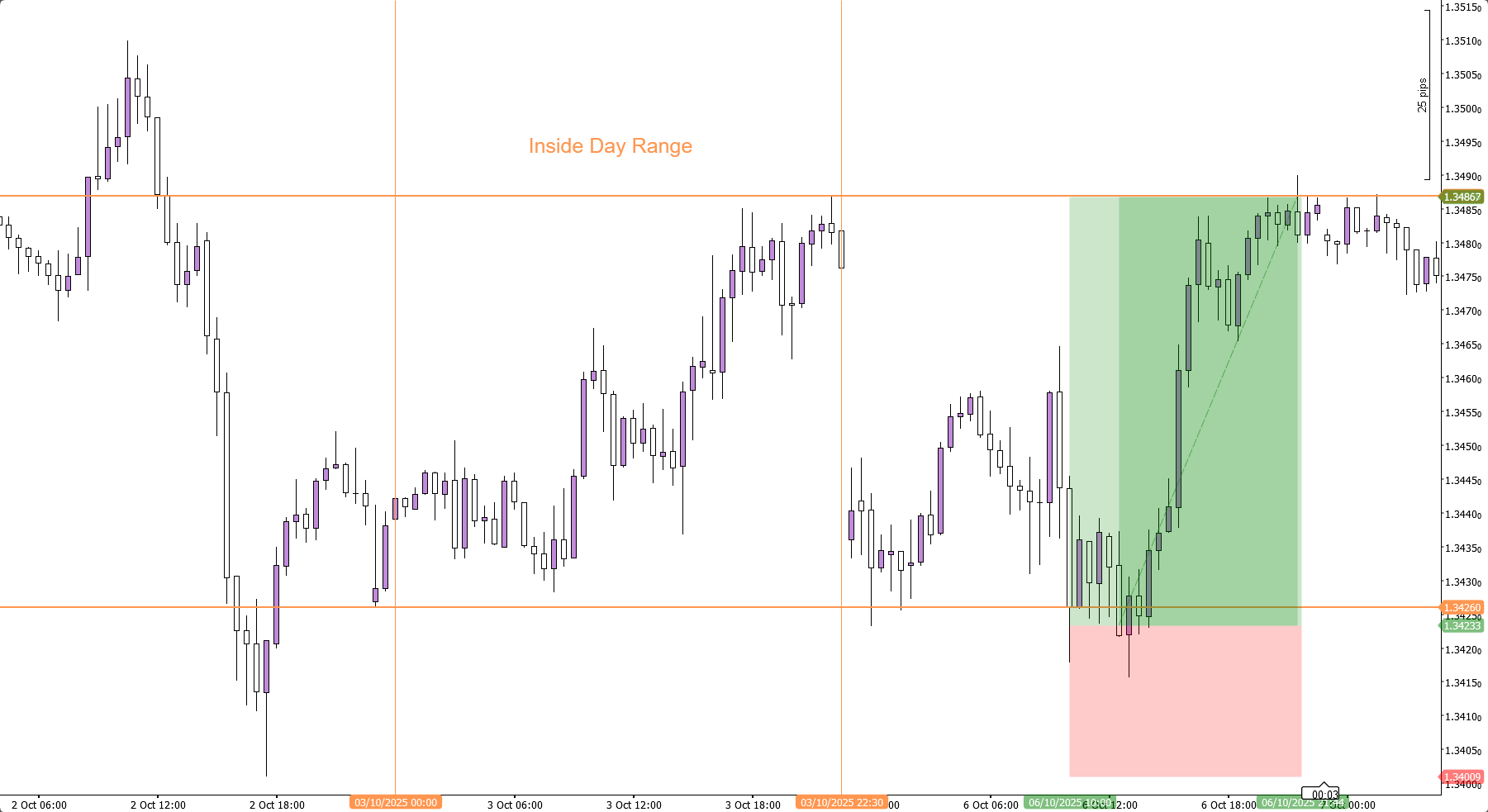

GBPUSD put in an Inside Day last Friday. An Inside Day is when the high and low of the day are entirely contained within the range of the prior day. Typically, this pattern gets taught as a breakout pattern, where the direction of the initial breakout is expected to hold.

However, it quite often generates a failed-breakout setup. This is exactly what occurred here, as price probed one side but quickly failed to sustain its momentum, reversing sharply to test the Inside Day High.

Commodities

Gold broke through the landmark $4.000 level this week, with Silver also hitting $50 an ounce. Silver continues to outperform Gold, a trend clearly visible on the Gold/Silver ratio chart (The amount of Silver ounces you can buy for one ounce of Gold).

The Monthly chart shows that there is a clear support zone approaching in the 73-75 range, which might put a stop to the Silver outperformance when hit. However, after already three distinct touches of this support zone, it wouldn’t be unlikely for the chart to see a small relief bounce and then still break down lower, targeting the 2021 swing low at 62.5.

Conclusion

One-sentence summary of the week:

The risk-on environment persists as global indices, together with hard metals, printed higher records.