Metals are an extremely overlooked category within financial markets. If you exclude Gold, very few traders venture into hard metals. It's wild when you consider the sheer number of real-world use cases: they're essential for the car you drive, the phone you use all day, the infrastructure for buildings, and endless industrial applications.

The constant push of technological development creates a long-term bullish bias for metals, as demand really only seems to keep increasing. In this article, we'll go into everything you need to know about trading metals as an asset class, so you can tap into this overlooked market with relatively little competition.

Trading Metals through Contracts for Difference

Before diving into the specifics of metals, a solid understanding of how CFDs work and how they differ from buying futures contracts is required. These are some of the key features of trading through a CFD:

- A CFD is a cash-settled derivative. This means you never physically buy, sell, or take delivery of any goods. You are speculating on a contract that is made to track the prices of metal futures in major markets. Using a CFD thus allows you to speculate on prices without ever having to worry about rolling over a futures contract or undertaking physical delivery.

- CFDs allow you to use leverage, enabling you to use your capital more effectively. Using leverage wisely allows you to hold multiple positions at a time without tying up all your capital in just one asset. It also allows you to size up positions and potentially make significant profit from intraday swings that would otherwise achieve only a small percentage gain. Leverage is a tool; when used wisely, it can amplify potential returns, but if used without understanding, it can also increase the size of losses.

- Unlike a physical investment, holding a CFD position past the daily market close typically incurs an overnight financing charge (or 'swap fee'). This cost makes holding positions for extended periods less profitable. Therefore, the strategies discussed below are suited more for short to medium-term trades instead of longer-term investments.

Defining Metals as an Asset Class

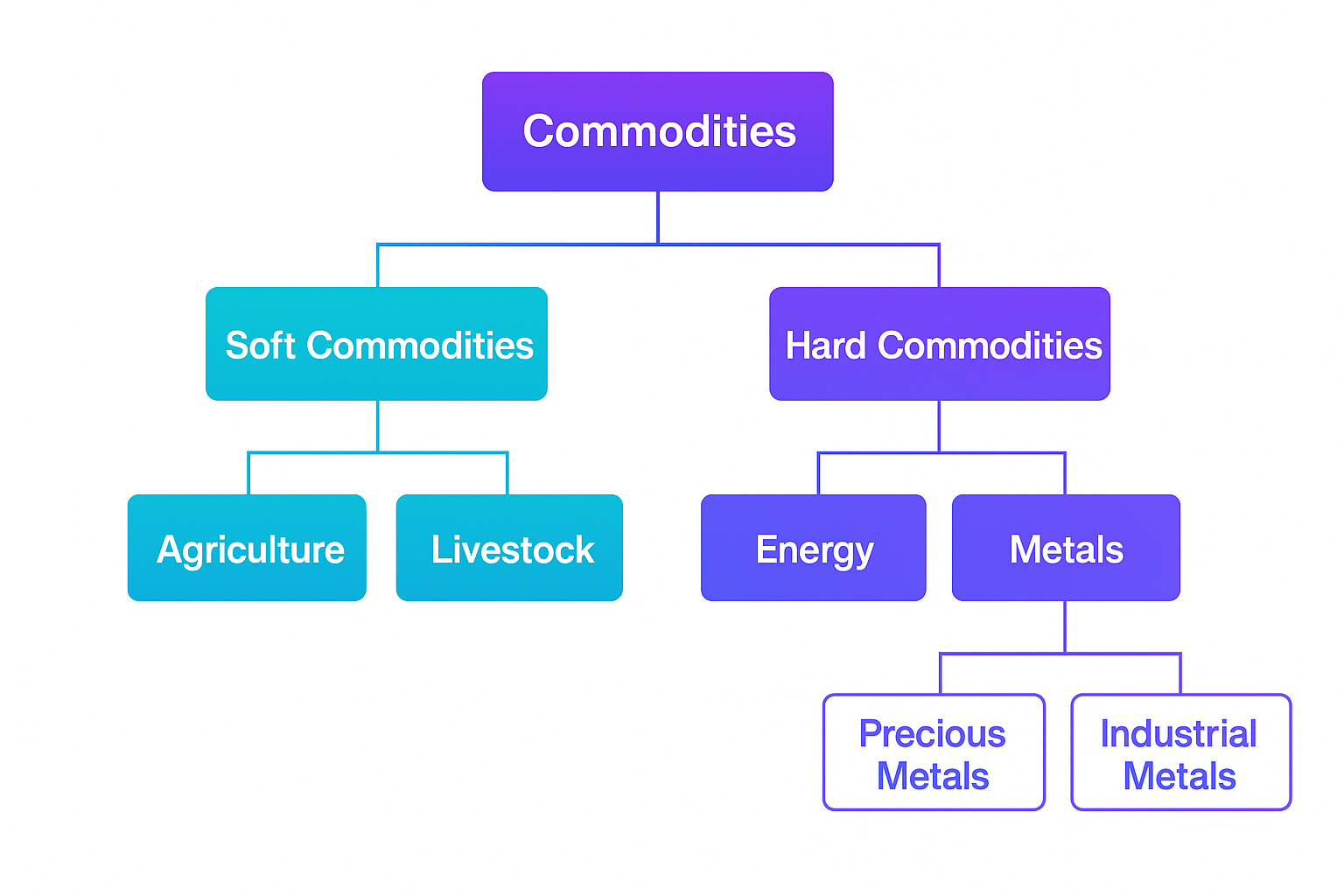

Metals are a core constituent of the vast commodities asset class. But since commodities are such a broad category, let's clarify exactly where metals fit in. There are so many subdivisions that traders often get confused by the specific terms used.

Image 1: All Subdivisions of Commodities Visualized

Metals fall into the Hard Commodities group alongside Energy (Oil, Gas, etc.) and are further divided into two main categories:

- Precious Metals: Valued for their rarity or as jewelry. They trade like a safe-haven asset and are largely uncorrelated with indices. (e.g., Gold, Silver).

- Industrial/Base Metals: Primarily used for industrial purposes. They are generally correlated to indices because demand for them depends entirely on the overall strength of the economy. (e.g., Copper, Aluminum).

Metals: A Superior Inflation Hedge

Metals are often recommended for portfolio allocation because of their proven effectiveness as an inflation hedge. Since inflation is simply measured by the rising cost of goods and services, commodity prices naturally trend upward as the raw materials needed to produce those goods become more expensive.

Academic research further backs this up; an analysis of major inflationary periods between 1970 and 2020 showed that commodities consistently outperform equities and bonds in high-inflation periods. Specifically, a 1 percentage point surprise increase in US inflation has historically resulted in an average 7 percentage point real (inflation-adjusted) return gain for commodities. In contrast, the same trigger caused stocks and bonds to decline by 3 and 4 percentage points, respectively.

That dynamic makes them attractive to traders, because as stock markets start declining, institutional money (hedge funds and mutual funds) increasingly shifts assets toward metals, especially Gold. This flow creates huge buying pressure that can significantly drive up Gold prices.

Understanding Precious Metals

We can define the following assets as Precious Metals:

- Gold

- Silver

- Platinum

- Palladium

We can essentially look at these four metals as an asset class, just like how you would define Indices, and note the similarities that define this group.

Quick Guide to Understanding Correlation:

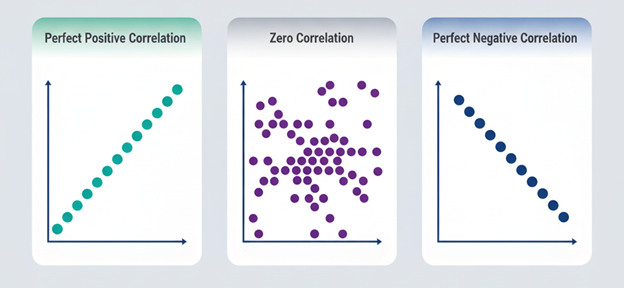

Before diving into the specifics, let’s quickly refresh on correlation, as it's key to trading this asset class:

- Positive correlation: When one asset moves up, the other also moves up. A correlation of exactly 1 means that both assets copy each other’s price action exactly.

- Correlation close to zero: There is no consistent relationship between the two assets. Sometimes they will move together (due to chance), but over the long run, there is no link between the two.

- Negative correlation: When one asset goes up, the other one tends to move down. A correlation of exactly -1 will lead to both assets perfectly mirroring the other asset's price behavior.

Intra-Asset Correlation

These four metals trade quite closely together and show a high degree of correlation between them.

Percentage Returns for Gold (Candlestick), Silver (Blue), Platinum (Orange), and Palladium (Green) from 01/2024-11/2025

While the total returns differ, the general direction is almost always the same. These differences in return are defined by the specific fundamentals of each metal, as well as the overall interest they are gaining.

In general, the fundamental reason these assets are so closely correlated is that they have the same use case within investing. They’re all seen as safe-haven assets and will typically see investors flock to them for safety, and because they have been proven to hold up as a strong inflation hedge. Gold, specifically, tends to move opposite to stocks during crises, solidifying its role as the ultimate hedge against uncertainty.

Decorrelation

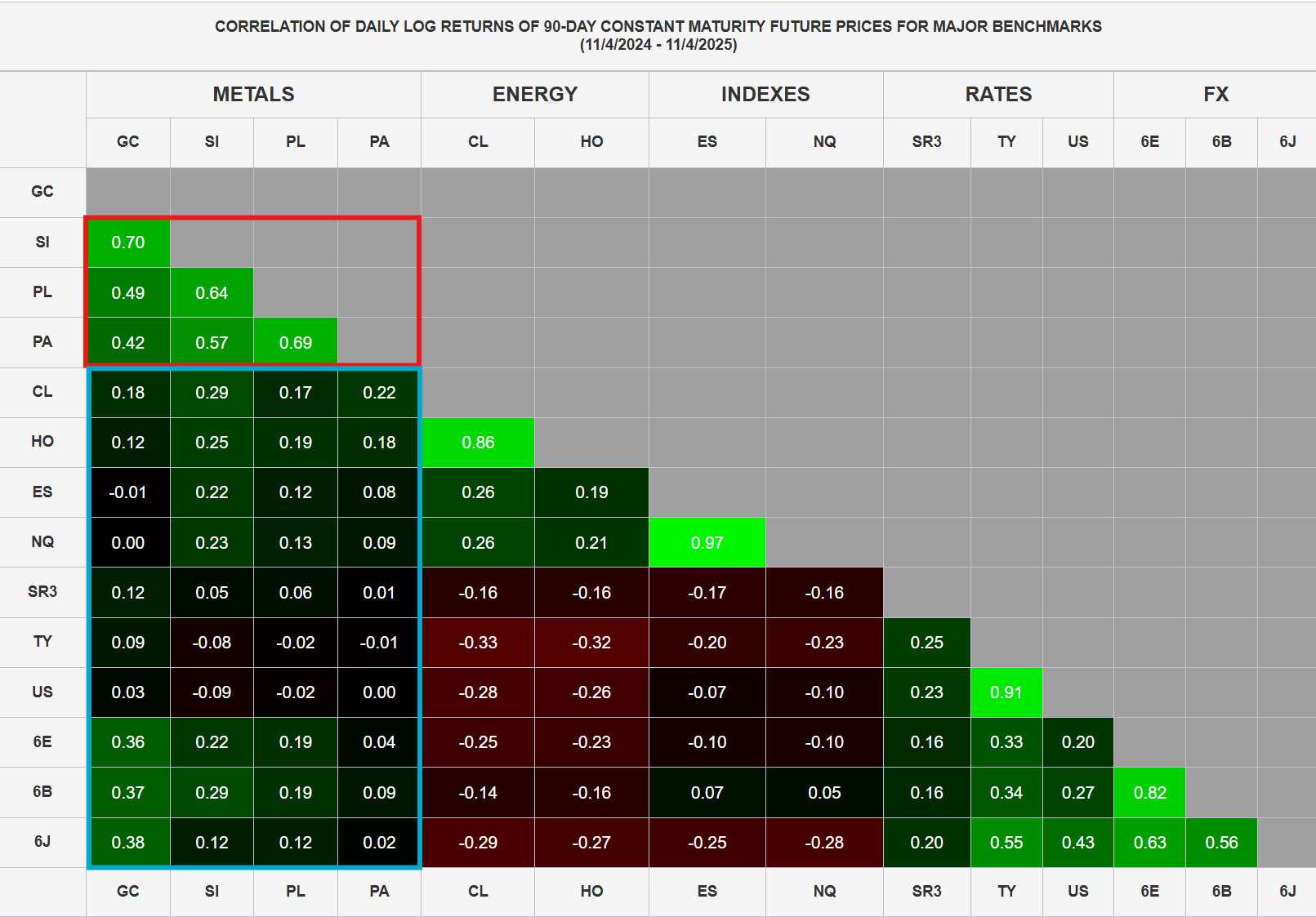

Even though this asset class is highly correlated amongst itself, it is completely decorrelated against virtually all other financial markets. The following table shows the correlation of daily logarithmic returns over a one-year timeframe.

Chart showing the correlation between Precious Metals, and other major asset classes like Energy, Indices, Bonds, and Forex

The red box proves the dynamic we noted earlier, where the precious metals (respectively Gold, Silver, Platinum, and Palladium) show a high degree of correlation amongst each other. Especially Gold and Silver (reading of 0.7) and Platinum and Palladium (reading of 0.69) are strongly correlated.

Additionally, the table shows that Precious Metals as a whole are uncorrelated against virtually every other asset class, as not a single reading comes above 0.3 or goes below -0.1. The sole exception is 6E (EURUSD Futures), 6B (GBPUSD Futures), and 6J (JPYUSD Futures), which are slightly correlated with Gold since they are all hedges against the US Dollar and thus serve a similar purpose.

This lack of correlation is very beneficial to managing risk. Traders often overlook intra-asset correlations and unknowingly take on more risk than they intended.

For example, a trader might follow a strict 2% risk per trade rule to make sure one loss doesn’t damage his account too much, but then goes on to open a simultaneous long in the Dax, the S&P 500, and the Nikkei. Since these are all three indices, any hits to the overall risk-on appetite will immediately drag all three indices down, which means that the trader's true risk is three times as large as originally intended.

Understanding Industrial Metals

Moving on to our other metal subdivision, we have the base metals, where Copper serves as the biggest asset. The following assets fall under this group:

- Copper

- Aluminum

- Zinc

- Lead

- Nickel

Just like precious metals, prices are highly correlated within this group.

Year-To-Date Performance of Copper, Aluminum (Blue), Lead (Orange), Zinc (Light Blue) and Nickel (Green)

This chart shows that these five assets mostly move together, although the general volatility is dependent on the individual market. Copper had one standout moment in which it dropped 18% in one day, as Trump ordered 50% tariffs on copper. But in general, the rest of the moves have largely been the same.

The primary difference in practical trading between the two metal subgroups comes from their fundamental drivers. While precious metals are macro-driven, industrial metals are generally pro-cyclical. Their prices reflect industrial demand, typically rising in anticipation of strong economic growth and falling during recessions. Copper is often referred to as "Doctor Copper" since its prices have traditionally been a leading indicator for general economic strength. Recently, however, this dynamic has become increasingly ineffective.

Fundamental Drivers of Metal Prices

Interest Rates

For non-yielding assets like Gold, changes in inflation-adjusted returns, known as real yields, are the single most important factor impacting prices over the past two decades. Gold offers no interest or dividend payment. The opportunity cost of holding non-yielding gold is thus determined by the real return available on competing financial assets, primarily U.S. Treasury bonds.

When real yields rise (driven by rising nominal interest rates or falling inflation expectations), the opportunity cost of holding gold increases, channeling investor capital toward higher-yielding bonds and causing gold prices to fall. Conversely, when real yields decline (e.g., central banks lowering rates or high inflation), the opportunity cost of holding gold drops, making gold relatively more attractive as a real asset store of value. This relationship suggests that changes in real yields offer an effective predictive tool for gold’s direction.

The U.S. Dollar

Since these metals are priced in the Dollar, their price behavior is naturally related to the Dollar's strength. This creates an expected inverse relationship between the US Dollar Index (DXY) and metal prices.

- A strengthening dollar makes dollar-denominated metals more costly for international buyers using other currencies, dampening demand and applying downward pressure on prices.

- A weaker dollar makes metals more affordable, often boosting international demand.

For industrial metals, this correlation is quantifiable: a 1% rise in the US Dollar Index historically correlates with a 0.3–0.7% decline in base metal prices. This relationship is particularly strong in copper, which shows a consistently high negative correlation with the DXY.

Supply Dynamics

Metals are impacted by unique supply dynamics. Since new metal supply can take years or even decades to materialize, producers simply cannot respond quickly to price changes. This often leads to significantly increased price volatility, as the usual self-balancing mechanism of supply increasing with prices is severely delayed.

What's more, ore grades continue to degrade, forcing companies to search longer and dig deeper to access them. This results in significantly higher production costs for miners, who naturally pass those costs onto the end customer. Add to that the fact that energy prices are also systemically increasing in inflation-adjusted terms, and you have a strong structural force.

This all contributes to a powerful long-term bullish bias for metal prices in general, and industrial metals specifically.

Conclusion

Metals are a unique asset class, and the subdivisions within this category, such as base and precious metals, each have distinct characteristics. Because they often move independently of other markets, they can offer interesting opportunities for traders who take the time to understand them.

This article has covered the basics of metals as an asset class, but each metal has its own trading nuances and setups that go beyond what we have discussed here. To explore further, you can check the Axiory website, where more educational articles will be shared. These resources aim to help you understand each metal's characteristics and approach them with informed strategies.

Dive into the world of metals trading with Axiory and discover new market possibilities.