In the realm of base metals, zinc often occupies a quiet, overlooked position. It frequently gets overshadowed by the electrification narrative of copper or the lightweight allure of aluminum. Yet, zinc represents one of the most technically complex and potentially lucrative markets in commodities. It is the fourth most widely used metal globally, trailing only iron, aluminum, and copper.

Trading Zinc through Contracts for Difference

Before diving into the specifics of zinc, a solid understanding of how CFDs work and how they differ from buying futures contracts is required. These are some of the key features of trading through a CFD:

- A CFD is a cash-settled derivative. This means you never physically buy, sell, or take delivery of any goods. You are speculating on a contract that is made to track the prices of zinc futures in major markets. Using a CFD thus allows you to speculate on prices without ever having to worry about rolling over a futures contract or undertaking physical delivery.

- CFDs allow you to use leverage, enabling you to use your capital more effectively. Using leverage wisely allows you to hold multiple positions at a time without tying up all your capital in just one asset. It also allows you to size up positions and potentially make significant profit from intraday swings that would otherwise achieve only a small percentage gain. Leverage is a tool; when used wisely, it can amplify potential returns, but if used without understanding, it can also increase the size of losses.

- Unlike a physical investment, holding a CFD position past the daily market close typically incurs an overnight financing charge (or 'swap fee'). This cost makes holding positions for extended periods less profitable. Therefore, the strategies discussed below are suited more for short to medium-term trades instead of longer-term investments.

What is Zinc, and how is it mined?

Zinc itself is not a singular commodity. It exists in two distinct physical states: Zinc concentrate and Refined Zinc metal. However, trading prices are based on the latter form.

The production begins with the extraction of zinc ore, predominantly from underground mines (80% of global output), with the remaining 20% coming from open-pit operations. This ore is crushed and processed to create zinc sulfide concentrate. This concentrate is the "raw currency" of the miner, which is then sold to smelters who process it into a refined metal with 99.995% purity.

Zinc Supply Chain

Geographical Concentration

Global zinc production is dominated by China, which is responsible for 39% of the total output. Following China, Peru, Australia, and India produce 13%, 11%, and 8% of the global supply, respectively.

Despite China’s hegemony, the nation is a net importer of zinc concentrate because its smelting capacity vastly exceeds its domestic mine output. This structural imbalance makes Chinese import data a critical metric for traders to watch.

In recent years, governmental energy policies have periodically forced Chinese smelters to close, removing supply from the market overnight and causing spikes in prices.

For Peruvian production, the main risk consists of social unrest. Traders should monitor Peruvian political stability, as a blockade or a strike at a major mine could tighten the global supply within weeks.

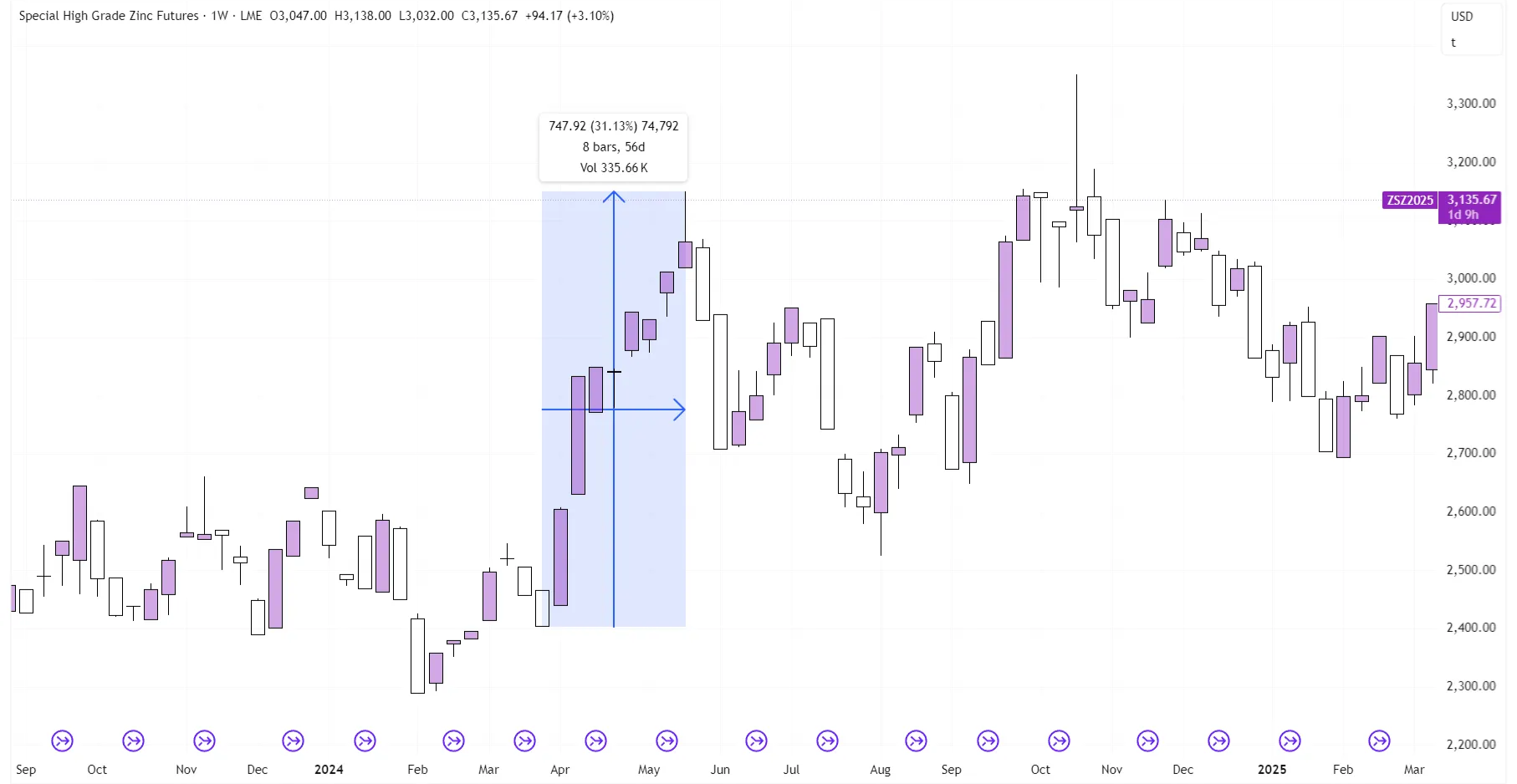

In Australia, the main risk remains extreme weather events. For example, March 2024 saw extreme rainfall, which led to a suspension of operations and was a primary catalyst for a 31% rally over the following two months.

Zinc prices on the Weekly Timeframe, indicating the 2024 spike following extreme rainfall in Northern Australia.

Key Projects

The central narrative for zinc prices moving forward is the arrival of new supply. Recent years have seen significant investments in new mines, which are expected to push the market into a supply surplus. Traders should track the schedules of these specific projects:

- Kipushi (DRC): This mine is expected to produce 278,000 tons of high-grade zinc (approx. 2.7% of 2024 global production). This additional injection of supply is expected to push the global market toward a surplus.

- Ozernoye (Russia): A major plant that has faced delays in the past but is expected to come online soon. While sanctions complicate the flow from Russia to the West, it is likely to be bought by China, which will indirectly loosen the global balance.

- Tara Deep (Ireland): Europe’s largest zinc mine, which will help alleviate geographical tightness in Europe and the U.S.

The Demand-Side

Galvanizing Steel

Approximately 50% of all zinc used globally is utilized for galvanizing steel—a coating process used to prevent rust. This strongly links zinc’s strength to the health of the steel industry. If steel demand softens, zinc can drop significantly as well. We can further subdivide the use of galvanized steel into the following industries:

- Construction: The primary use case is in rebar, roofing, and structural steel. The high-interest rate environment in the US and Europe throughout 2024 and early 2025 has depressed housing starts and commercial construction, acting as a persistent drag on prices.

- Automotive: Galvanized steel is the standard for car bodies. The auto sector has been a bright spot in 2025, with manufacturers engaging in "precautionary restocking" of raw materials amidst ongoing trade tensions.

- China: Real estate accounts for a massive portion of Chinese steel demand. Much like European and American real estate, construction in China has taken a significant hit.

The Green Transition

Just like many other metals, Zinc is also expected to take an important role in the upcoming energy transition.

Wind turbines require massive amounts of galvanized steel to withstand decades of exposure to the elements, particularly those placed offshore. Additionally, solar panel structures are heavily galvanized for the same reason.

Zinc-ion batteries are emerging as a contender for stationary grid storage for EVs. They are safer due to their non-flammable properties and are cheaper than lithium. While this sector is currently only a small fraction of demand, a technological breakthrough could lead to markets re-rating zinc prices.

Substitution Risks

A critical fundamental factor in zinc prices is the risk of substitution.

The steel industry is increasingly adopting Zinc-Aluminum-Magnesium coatings. These are technologically superior and offer better corrosion resistance with a thinner coating layer. While this results in a better end-product, it reduces the total zinc tonnage required per ton of steel and thus puts a significant damper on overall demand.

In the automotive sector, the focus on lighter vehicles favors aluminum and magnesium alloys over galvanized steel. Each percentage point of market share lost to aluminum body panels is a direct hit to zinc demand.

The SHFE/LME Arbitrage

Generally, the London Metal Exchange (LME) price for Zinc is the global benchmark, and is by extension the futures exchange that most CFDs track. However, because China is such a massive player in global production and demand, the Shanghai Futures Exchange (SHFE) is also a crucial venue for zinc trading.

If prices diverge too much between these two venues, it becomes profitable for companies to ship LME zinc and import it to China, or vice versa.

A good rule of thumb for watching this spread:

- Ratio > 8.5: If you divide the SHFE price by the LME price, a ratio above 8.5 typically shows that it is profitable for Chinese importers to buy LME zinc and import it.

- Ratio < 8.0: Inversely, a ratio below 8.0 often signals that it has become profitable for Chinese smelters to export metal to the LME.

Note: This calculation is a rough estimate. It doesn’t take into account exchange rates, VAT, transportation costs, import duties, or warehousing costs, so it cannot be 100% accurate.

However, this is where the edge lies for specialized traders. By researching estimates for these logistical costs, you can create your own pricing model to analyze the SHFE/LME spread. If your model predicts that Chinese import or export flows are likely to begin, it can create a potential setup to trade in the direction you anticipate the spread will close.

Future Outlook

The overwhelming consensus among analysts and the International Lead and Zinc Study Group (ILZSG) is that 2025 marks a critical transition year. According to the ILZSG’s forecasts:

- 2024: Market deficit of ~164,000 tons.

- 2025 Forecast: A confirmed surplus of 85,000 tons.

- 2026 Forecast: The surplus is projected to widen significantly to 271,000 tons.

This shift is driven by a projected 2.7% rise in global refined zinc metal production, elevating global output to roughly 13.8 million metric tons in 2025.

Conclusion

Zinc is shifting from a market deficit to a surplus, a fundamental change that traders must navigate carefully. While the influx of supply from projects like Kipushi suggests downward pressure, the green transition and the nuances of the SHFE/LME arbitrage provide ample opportunities for tactical setups. By keeping an eye on Chinese import data and global construction trends, traders can find volatility in this often-overlooked metal.

Ready to take your knowledge to the markets? Discover all the available Metal CFDs Axiory has to offer!