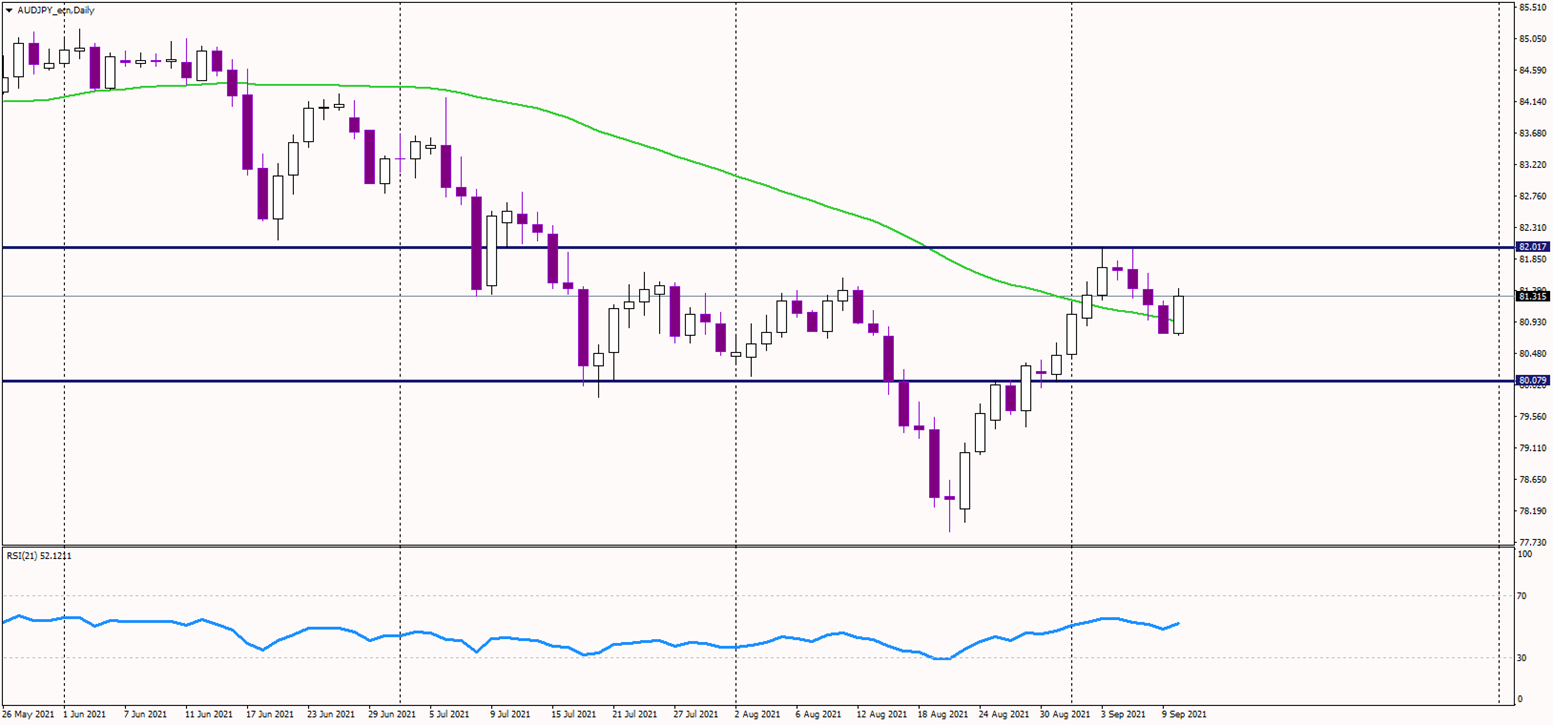

The AUDJPY cross underwent a small correction this week, but the medium-term uptrend remains intact. Today, the Aussie was up 0.7% ahead of the US session, jumping from its 50-day moving average and trading at 81.35.

The short-term outlook seems bullish as long as the cross trades above the 50-day average (currently at 80.95). The next target for bulls should be at this week's highs near 82.00. Bulls need to push the Aussie above that level to confirm the medium-term uptrend.

Additionally, the price managed to jump above the bearish trendline, which had been limiting the AUDJPY cross since June, reinforcing the bullish bias.

Alternatively, if sentiment worsens and the Aussie starts to decline again, the first demand zone is expected near today's lows at 80.75, with the next important support at the psychological 80 level.

The AUDJPY cross is often tied to US equities. Since US equities continue in their neverending uptrend, we might also see some bullish pressure in commodity currencies. However, the SPX and Nasdaq indices need to push to new highs to confirm their uptrends, possibly sending the AUDJPY cross above the mentioned 82 resistance.