Gold lacked enough strength to maintain the momentum that it gained yesterday and slipped from its intraday top to $1,793.

Despite managing to regain more than half of Friday’s sell off, the yellow metal failed to stretch further, owing to traders’ cautious approach ahead of central bank’s policy verdicts.

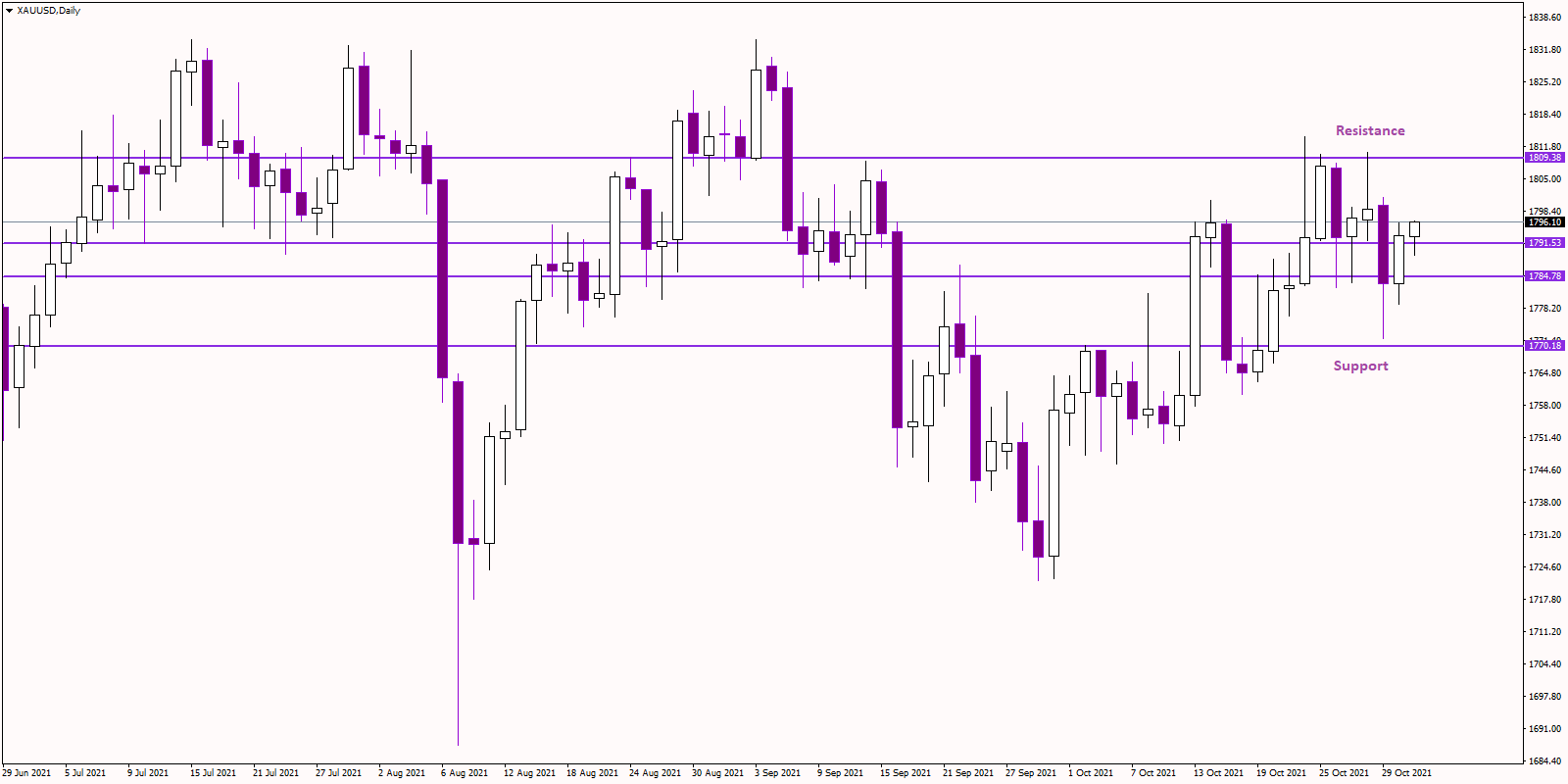

Looking from a technical angle, gold prices may go up towards weekly resistance line of $1,800, given the fact that it remains supported by 200-EMA and the ascending trend line over the past 2 days.

In addition to that, as per World Gold Council’s report, demand for gold could rise up in the fourth quarter, considering Reserve Bank of India’s decision to stay away from implementing any stringent monetary policies.

Fed Reserve meeting on Wednesday may influence this precious metal in a significant way, as US dollar continues to stay below its recent high figures on account of the central bank meetings scheduled for the week. The scheduled meeting with Reserve Bank of Australia (RBA) also may prompt a rebound in USD, resulting in Gold prices moving further up.

Chances for bright metal bulls to recapture the psychologically important $1,809 mark are more, given the RSI’s slow but steady movement higher up the midline.