French CAC was the worst-performing major index on Thursday and was down nearly 3% during the London session. Traders are liquidating their long positions after yesterday's hawkish FOMC minutes.

The minutes showed that the central bank might be ready to start tapering its bond purchases, also known as the QE, later this year. The official announcement is expected at the next week's Jackson Hole symposium.

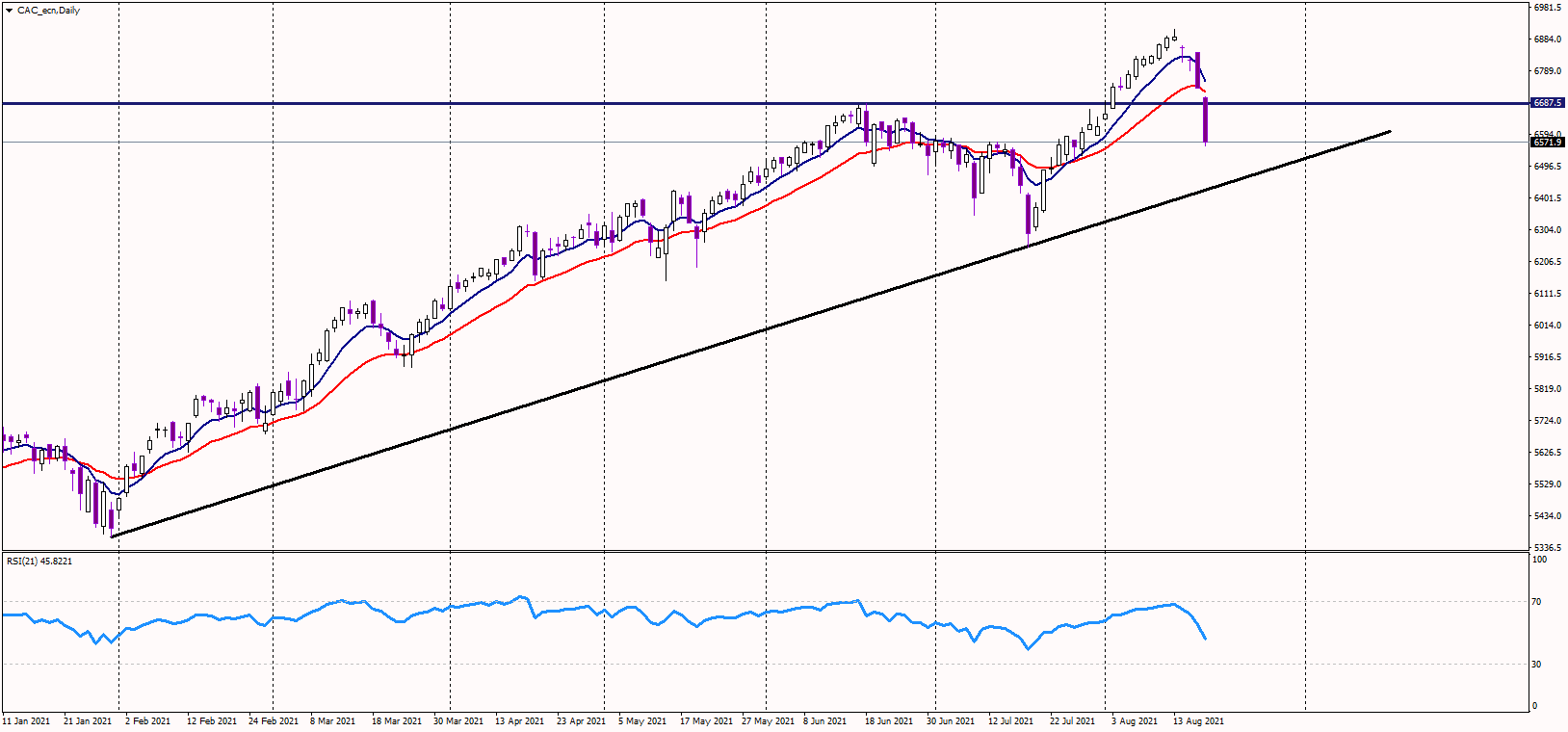

The key medium-term support at previous highs of 6,690 EUR was already broken to the downside, triggering stop losses and pushing the index further lower. The medium-term uptrend is now over. The next level to watch will be at the long-term bullish trend line, currently at 6,450 EUR.

If the price drops below that level, the outlook could change to bearish.

Alternatively, the resistance is at the mentioned broken support at 6,690 EUR, and the index needs to get back above it to revive the medium-term uptrend.

Volatility is expected to be elevated as markets need to digest the sudden hawkish tilt by the Fed. Still, the long-term bull market will most likely continue after this correction.